Creation Of Instant Payment Method:

The U.S. banking industry is about to launch its answer to the popular mobile payments app Venmo, in what is likely to be the biggest change in years in how individuals exchange funds digitally. Unlike Venmo, this method, dubbed Zelle, will enable instant transfers of money between users.

Over the next week, five of the largest U.S. banks will light up their segments of a new payments network, executives said in interviews. They plan to announce details of the launch on Monday, and expect another two dozen banks and credit unions to join over the next year.

Zelle Explained:

The long-awaited network will allow tens of millions of bank customers to send money to each other instantly - known as person-to-person payments - with a few taps on their smartphones. That is an improvement over Venmo, which immediately alerts users that a money transfer is in progress, but takes time to shift funds between bank accounts.

Customers who use existing bank payment apps may not notice much of a change beyond marketing. Transfers will simply happen faster because the banks are finally linking to each other, executives said.

"By coming together to offer Zelle, we are providing a large majority of Americans with a safe, fast and easy way to move money," said Bill Wallace, head of digital at JPMorgan Chase & Co., the biggest U.S. bank by assets.

JPMorgan, Bank of America Corp, Wells Fargo & Co, U.S. Bancorp, and Capital One Financial Corp will be the first to plug into Zelle. The network is the product of an industry consortium called Early Warning Services LLC, whose seven owners have more than 86 million U.S. mobile banking customers.

Business Is Competition:

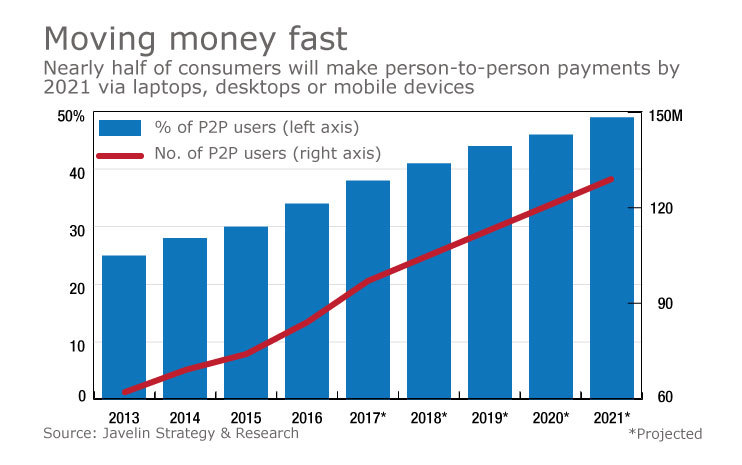

Zelle took years to establish because fierce rivals had to come together to make it work. In the interim, Silicon Valley has made inroads into digital payments, particularly with the young customers coveted by banks. Despite losing some ground to technology companies, banks still have a big advantage: No matter what network is used to transfer money, banks hold the vast majority of funds. And that is exactly what they are 'banking' on for their new network success.

http://www.reuters.com/article/us-usa-banks-payments-zelle-idUSKBN1931C2

thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://ca.reuters.com/article/businessNews/idCAKBN1931C2-OCABS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello to all! Texas National Bank has become a top choice for those who prioritize exceptional banking service, consistently putting customers first. Whether you need a specific banking product or service, they tailor their offerings to your needs, ensuring an optimal experience. The bank is committed to helping customers solve any financial problem, and anyone who contacts texas national bank customer service can count on professional advice and support from their team.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit