Whenever government banks fall short of the capital due to irregularities and corruption, the government has been fulfilling the taxes of the people. The budget for these banks will be allocated in the next budget.

Finance Department sources said the government has given Tk 15 billion in the last six years to fulfill the capital deficit of the state-owned banks. In the current fiscal year, the bank had allocated Tk 2,000 crore, although it has not yet been discontinued. After the budget announcement on June 7. And in the coming budget, the banks are getting the same amount of money.

It has been learned that the government has to pay the amount of money that has been embezzled from the state-owned banks. In between, between 2010 and 2014, the Hall-Mark scandal in Sonali Bank is worth Rs 2,600 crore, Basic Bank scam 4 thousand 500 crore, and the Bismillah Group scandal in the Janata Bank is a significant incident of siphoning Tk 1,200 crore.

Finance Minister Abul Maal Abdul Muhith told reporters in the Secretariat on Monday that, "Banks are also being allocated for the next fiscal year." He did not want to disclose the amount of allotment, even if asked for questioning. But regarding the irregularities of the criticized bank sector, the Finance Minister said that he will form a commission this month.

Experts and economists in the bank sector say, not only the government, the irregularities of the private sector banks and the burden of corruption are now going to the government. For example, the shares of Furmers bank, which were sinking in irregularities, were owned by state-owned gold, banks like the public. But these banks themselves are in the deficit of the capital.

Experts further say that since irregularities in the bank sector have become very common and corruption is going to be more common in the budget as the government knows that there will be more irregularities-corruption. As a result, there is such message in the bank sector that the government is beside the crisis or any crisis. That is why banks are increasingly dependent on the government, rather than improving the management and management.

Former caretaker government adviser AB Mirza Azizul Islam said in the first light, there is a good governance deficit in the banking sector. That is why irregularities are due to lending, not being able to recover the loan, debt is going down, and banks have to pay every year from the government treasury. He said there is a shortage of government's efforts for good governance in this sector.

The question about the allocation of money in the name of investment

The finance department data says that the budget allocation for the deficit of the government banks in the budget started from 2011-12 fiscal year. The government has given headlines of budget allocation in this sector every year to 'invest in capital restructuring'. The least amount of money is not coming back, whether it can be called investment or not.

Explanation of top officials of the finance department, however, is such that, the government will provide money to its own owned institution. It's actually investment. The question is whether it is good investment or bad investment.

In the report of the budget report, in the last six years, in the name of capital shortage or sometimes in the name of capital reconstruction, six banks, including several banks, have been given around Tk 15 billion. Funds have been given to anyone, funding and loan assistance, and for someone to increase the paid up capital.

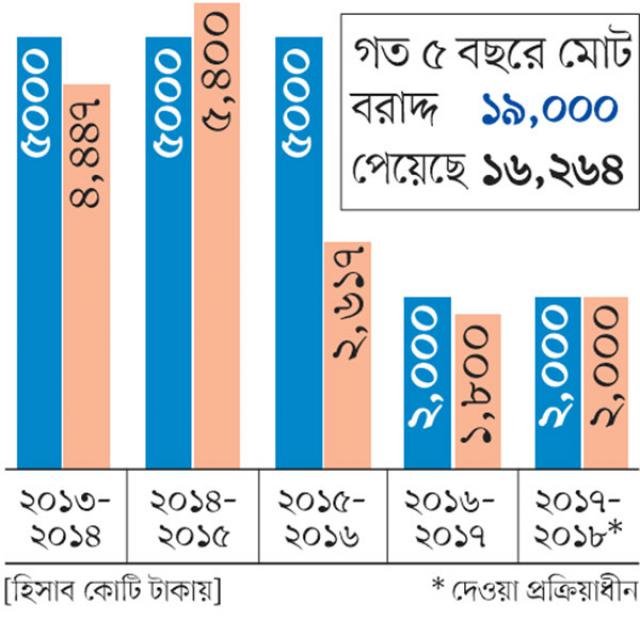

According to the Department of Finance, the allocation of Tk 341 crore in the fiscal year 2011-12 is not exempted. In the next year, the allocation of Tk 1,650 crore was given to 541 crore. In the fiscal year 2013-2014, the budget allocated Tk 420 million, but the banks gave five thousand crore taka.

The next year, the government itself allocated Tk 5000 crore in the financial year 2014-15, but not even the money. That year, banks have to pay Tk 5,300 billion From the year 2015-16, every year, including the current fiscal year, has been allocated Tk 2 billion.

Professor Moinul Islam of UGC University of Chittagong University said in the first light, 'The money should not be allocated in this way. Since the situation has worsened, the defaulting loan is increasing, and the domestic reality will have to keep the money in handling the bad situation. However, he believes that with the fulfillment of the condition, he should pay the money to the banks and strictly monitor it.

Capital deficit is increasing

According to the Bangladesh Bank's report till December last year, the deficit of gold, people, Rupali, Basic, Agriculture and Rajshahi Krishi Unnayan Bank (Rakab) stood at Tk 17440 crore. But in the last three months before that, ie, in September this deficit was 15, 909 crore taka. The capital deficit increased in three months to Tk 1,531 crore

The central bank's data analysis shows that due to the Sonali Bank, the total capital deficit of six banks has increased. In September last year, the deficit of Sonali Bank was Tk 3,440 crore, in December it increased to Tk 5,397 crore.

Sonali Bank Managing Director (MD) Obaid Ullah Al Masud said in the first light, "Capital deficit has increased due to the increase in default loan."

Financial institutions division has recently recommended to finance the allocation for the current fiscal year. According to a report of Financial Institution Division, it is said that the most desirable way to meet the capital shortage is by making net profits, instead of dividing it, rather than bonus shares. But the banks are not able to do it. According to the section, another good way is to reduce deficit by reducing deficit debt. But there is no success in this regard.

Financial Institution Division Secretary Yunusur Rahman said in the first light, "The banks have not yet waived the money department to meet the capital shortage. There is an alternative thinking about whether the budget should not be allocated.

The concerned people are concerned that nearly a decade will be marked as a scam of the bank. There is no punishment for anyone. Rather, the facilities are provided in many ways. The loan defaulters have been filled. The government has made the path of dynastic rule even in the private banks, not only the loan defaulters. The policy of changing the policy, not the central bank, the association of the bank owners, the Bangladesh Association of Banks (BAB).

In the face of widespread criticism, the finance minister is talking about the formation of bank commission. However, it is believed that this promise has come at the end of time to get the benefit of the next election, said former bankers.

Nice post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The policy of changing the policy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The budget for these banks will be allocated in the next budget.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

bryegf

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Apni notun kono Post koren ni @mesba02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @mesba02! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit