Good Morning,

Last week we’ve had a couple of trading events on the back of economic releases that have made their mark on the markets and major currency pairs.

FOMC cuts rate. Let’s discuss the impact on the markets.

On Wednesday 18th at 7 pm UK Time, the FOMC announced the results of its various votes around monetary policy. This includes their vote on interest rates and other policy measures, along with commentary about the economic conditions that influenced their votes. Most importantly, it discusses the economic outlook and offers clues on the outcome of future votes.

Jerome Powell and the Federal Open Market Committee made the following statement.

The U.S. Federal Reserve cut interest rates by a quarter of a percentage point for the second time this year on Wednesday in a widely expected move meant to sustain a decade-long economic expansion but gave mixed signals about what may happen next.

If you were looking at the trading event you would have seen pairs like the GBP/USD and the EUR/USD move over 50/60 pips each. We often see larger moves on the back of this kind of trading events. The results this week were pretty much priced in. At Platinum Trading Academy our Forex Trading Analysts monitor Central bank policies and monetary policies that impact currencies.

The technical analysis we provide on the forex market is in real-time for the trading events so that you can make the most of the trading opportunity.

Let's discuss the Bank of England Interest Rate Decision and Its Impact on the Forex Market.

On Thursday 19th at 12 noon UK Time, the Bank of England announced its interest rate decision, as well as other policy measures. This event is somewhat similar to the FOMC Statement which occurred the previous day.

Mark Carney and the Monetary policy Committee made the following statement.

The Monetary Policy Committee voted unanimously to maintain Bank Rate at 0.75%. The committee also voted unanimously to maintain the stock of corporate bond purchases and UK government bond purchases.

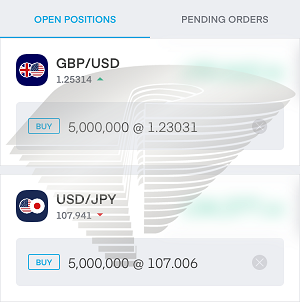

If you look on your charts around the time of this trading event the GBP/USD moved approximately 60 pips in the hours moving up to this event, as well as almost another 60 pips in the hours following. While the GBP/USD is extremely unpredictable due to the political turmoil, it’s not untradeable. Our Long-Term Swing Trade is now up 228 pips as you can see from the screenshot below:

RESERVE YOUR SEAT ON OUR NEXT TRADING EVENT!

If you missed our 2 new videos last week, don’t worry because you can watch them right here!

We have two trades, one on the EUR/USD, and the other on the USD/JPY!

These two videos exemplify what expert analysis can do for you, and how you too can take advantage of the market!

Learn To Trade Video 1. How To Trade the Euro

Learn To Trade Video 2. How To Trade the Yen

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.