Mounting concern over the future of the British housing market sent shares in Taylor Wimpey lower yesterday despite the company announcing bullish trading figures.

The housebuilder fell 4.2 per cent, or 8.7p, to 200.2p amid anxiety over falling house prices, weak wage growth and the impact of Brexit on the economy.

The slide came even after the company said the UK property market has remained resilient in the face of uncertainty.

In its full-year update Taylor Wimpey announced that it had built 5 per cent more homes in 2017, while overall average prices increased 4 per cent to £264,000.

Demand for new homes was helped by the Government’s Help To Buy scheme.

Taylor Wimpey fell 4.2 per cent, or 8.7p, to 200.2p amid anxiety over falling house prices, weak wage growth and the impact of Brexit on the economy

And low interest rates and strong mortgage availability played their part.

But shares in the group fell as it disappointed investors hoping for a repeat of Persimmon’s profit upgrade on Tuesday.

The firm’s rivals were also down with Persimmon slipping 1.6 per cent, or 42p, to 2673p.

Barratt Developments was down 1.4 per cent, or 9.2p, to 634.2p and Berkeley Group dropped by 0.6 per cent, or 25p, to 4215p.

The FTSE 100 hit a another fresh high, finishing up 0.2 per cent, or 17.49 points, at 7748.51 points, which beat the record of 7731.02 that was set on Tuesday.

Royal Bank of Scotland was the biggest gainer on the blue-chip index, thanks to an upgrade by Morgan Stanley.

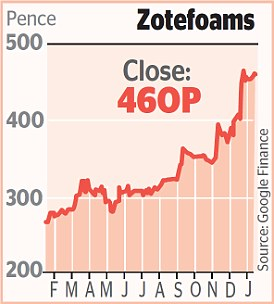

STOCK WATCH – ZOTEFOAMS

A bullish update ahead of full-year results lifted shares in manufacturer Zotefoams.

The company jumped 1.4 per cent, or 6.5p, to 460p after revealing profits and sales for 2017 would be higher than hoped.

Zotefoams makes foams for the sports and aerospace industries and is working with Nike to develop training shoes with its materials.

It said it was entering 2018 with strong orders and is committed to growing further, investing £12million to boost manufacturing in Croydon.

The investment bank said RBS is in better shape than its peers Lloyds and Barclays ahead of Brexit, given the strength of its mortgage business, and upgraded it to overweight.

The comments were welcomed and sent shares up 4.6 per cent, or 12.9p, to 293.4p.

Barclays, which the bank downgraded to equal-weight from overweight, fell 0.3 per cent, or 0.6p, to 201.2p, while Lloyds, which was also downgraded to equal-weight, rose 0.9 per cent, or 0.58p, to 68.98p.

Recruitment firm Page Group rocketed towards the top of the FTSE 250 after toasting record full-year profits.

The company said that a strong showing in its international business had helped to offset a weaker performance in the UK, where it said the conditions were slightly more challenging.

Profit jumped 13.8 per cent to £182.4million in its fourth quarter, up from the 8.8 per cent increase it experienced in the third quarter.

For the full-year, profit surged 9.9 per cent to £711.6million.

It said this was thanks to strong trading figures across Europe, Asia and the Americas. The company’s shares rose 9.6 per cent, or 45.2p, to 516p.

Construction company Interserve jumped 19.5 per cent, or 19.45p, to 119p after announcing savings of around £40million-£50million by 2020.

Also up was Footasylum, which climbed 2.6 per cent, or 6.5p, to 253p after analysts at Liberum gave it a buy rating.

It said the fashion retailer, which makes footwear and clothing for people aged between 16 and 24, has an attractive digital model and a new wholesale business.

Elsewhere, the advertising firm WPP dropped 1 per cent, or 13p, to 1327p after announcing a deal to acquire creative agency Bomtempo, Anahory & Ralha (BAR) in Portugal.

It’s the latest acquisition by the company, which is placing a greater emphasis on growth in western Continental Europe – which includes Germany, France, Italy and Spain – following the Brexit vote.

BAR, founded in Lisbon in 2009, has a number of key clients including Nespresso.

please vote have me https://steemit.com/bitcoin/@ridhaaden/menambang-bitcoin-di-freebitco-in

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post received a free Upvote. Get your free Upvote NOW! Just follow @freeupvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.thisismoney.co.uk/money/markets/article-5256119/MARKET-REPORT-Builders-fall-amid-fears-boom-days-over.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit