Customers could face a fresh squeeze on their energy bills after two energy giants confirmed plans for a mega-merger worth around £7billion.

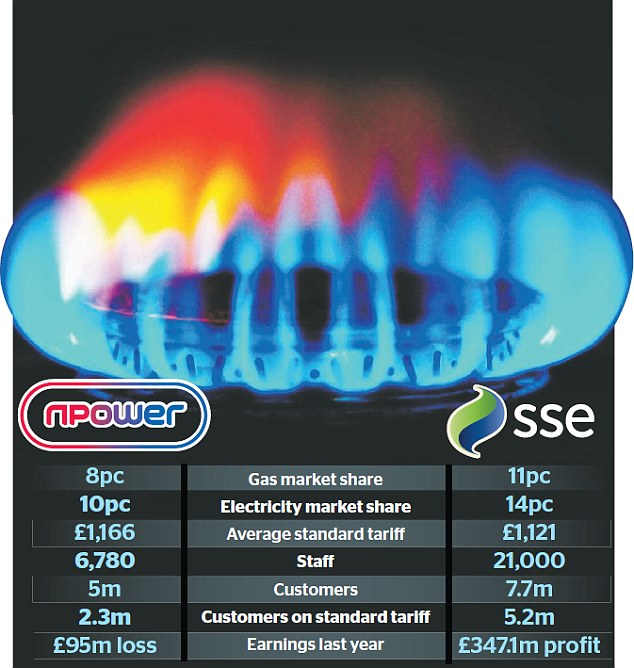

SSE and Npower have agreed a tie-up that would create a business with a 24 per cent share of the electricity markets and 19 per cent share of gas.

It will mean the so-called Big Six, which control more than 80 per cent of British energy, become the Big Five.

The plans follow a public outcry over rip-off tariffs faced by loyal customers who do not switch their supplier every year.

SSE and Npower are discussing a tie-up that would create a business with a 24 per cent share of the electricity markets and 19 per cent share of gas

They would allow the two companies to save cash by axing admin jobs, and potentially mean they could cut their rates.

However, there would also be a major impact on competition.

Greg Jackson of smaller rival Octopus Energy said: ‘Both of these companies are ones with questionable customer records.

‘They intend to carry on exploiting customer disengagement, and this move will simply create an enormous list of such customers.’

Claire Osborne of price comparison site Uswitch said: ‘The question for consumers will be whether this new supplier leads to improvements in pricing or customer service.

‘The regulatory authorities will need to be satisfied that this deal works in the best interest of consumers.’

SSE and Npower last night said they were in advanced talks, although no agreement has yet been reached.

Neither firm would be drawn on the detail of the discussions.

However, it is thought that the merged company would take in all of their combined retail customers.

This would leave Npower’s German parent Innogy SE free to focus on its renewable power activities and its businesses on the Continent.

Meanwhile, SSE – which is listed on the London Stock Exchange – would be left with its power generation business. Existing SSE shareholders are likely to be offered stock in the new business as part of the deal.

An SSE spokesman said: ‘The board of SSE has been in discussions with Innogy SE about creating a new independent energy supply company.

‘The discussions are continuing and are well-advanced but no final decisions have been taken,’ said the spokesman, adding the firm would reveal the outcome of the talks as soon as possible.

An Innogy spokesman said: ‘The combined business would be listed and SSE would demerge its shares to its shareholders.’

The biggest energy firms have been haemorrhaging customers to smaller rivals over the past few years. Their typical tactic is to lure customers in with low initial fixed-rate tariffs lasting a year or two, then ratchet up prices after this period ends.

The firms hope that most consumers don’t bother to switch supplier despite their rising costs.

Npower was fined £26million by watchdog Ofgem in 2015 for poor customer service and issuing inaccurate bills.

This February it enraged campaigners by hiking gas and electricity prices by an inflation-busting 9.8 per cent.

And Ofgem fined SSE a then-record £10.5million in 2013, for mis-selling energy deals.

Hargreaves Lansdown analyst George Salmon said there were still several hurdles to clear before the deal was done.

‘The planned tie-up increases scale and takes out costs – both things which, all else being equal, would give the new entity some advantages over where the groups are now,’ he said.

SSE shares rose 2.6 per cent, or 36p, to 1410p yesterday.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.thisismoney.co.uk/money/markets/article-5060289/Npower-SSE-plot-7bn-merger.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit