By Ken Schortgen Jr.

.jpg)

There has been an interesting dichotomy taking place in China over the past three months, and understandably it has most Wall Street economists confounded. And what we are referring to here is the fact that President Xi Jinping appears to no longer be worried about, or even talking about, China's massive debt load.

There has been an interesting dichotomy taking place in China over the past three months, and understandably it has most Wall Street economists confounded. And what we are referring to here is the fact that President Xi Jinping appears to no longer be worried about, or even talking about, China's massive debt load.

“It’s Xi Jinping’s economy now, and he isn’t too worried about debt.

China signaled its economic priorities on Wednesday at the end of a meeting of top Communist Party economic leaders with a statement indicating that President Xi is fully in charge. Labeled “Xi Jinping Thought on Socialist Economy With Chinese Characteristics,” the statement called for trimming industrial overcapacity, controlling the supply of money and other moves that have been staples of China’s other recent declarations.

Barely mentioned: China’s surging debt. Despite downgrades this year by two international credit rating firms and warnings from institutions like the International Monetary Fund, the statement issued at the conclusion of the Central Economic Work Conference called for controlling borrowing by local governments, but it otherwise glossed over a vast borrowing splurge in recent years, driven in large part by Chinese companies.”

— New York Times

And a story from one month later from Davos...

“A reclusive and influential senior adviser to President Xi Jinping of China emerged here on Wednesday with a public message that many in the financial world have been eager to hear: The country has a timetable for curbing its vast appetite for debt.

Speaking to attendees at the World Economic Forum, the adviser, Liu He, said that the Chinese government planned to bring its debt under control within three years. Mr. Liu said Beijing intended to focus on reining in the growth of debt among local governments and companies.

“We have full confidence and a clear plan to get the job done,” he said.”

— New York Times

So the question to ask is, what changed in the course of China's fiscal policies that suddenly makes them believe they are immune to the pitfalls of extraordinary debt and credit expansion? One reason of course is due to their growing economy which underlies an economic law that implies that a nation can handle rising inflation if their growth outpaces these rising costs. But even this truism may not be the real catalyst behind China's willingness to ignore their debt as Xi Jinping has been doing since December of last year.

Perhaps what really is taking place is a monetary policy that has worked for economies for thousands of years, but has been absent throughout the world since the U.S. took the global system off of it 47 years ago.

That's right... a gold standard.

Next month China is implementing a new Yuan-denominated oil futures contract that will compete directly with the U.S.'s Petrodollar system. And mixed into this program is the capability for nations who invest in their oil markets to swap their Yuan currency at the Shanghai Gold Exchange for physical gold.

Yuan for gold. But wait... could China have already been tying their currency to gold now even before this contract is initiated?

Economist Stephen Leeb seems to think so.

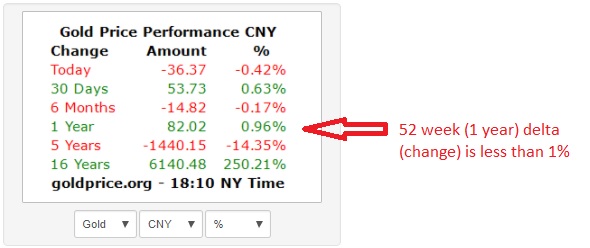

““One of the big clues for me has been the behavior of the Yuan relative to gold. Over the past eight to twelve months, if you look at an average of the gold price in Yuan, you’ll see almost no change.”

”I mean basically the 52 week moving average of gold price in Yuan, you will see almost no deviation. It is as if they are really linked.”

”The biggest deviation is maybe 1% when it comes to that moving average.”

”By comparison if you look at the dollar price... ie.. gold price in the dollar, you have about 4 and 5% deviations.”

”What this suggests to me, is that the Chinese are deliberately, or to some extent, setting their currency to follow gold.””

— King World News Interview - February 10, 2018

Indubitably, some analysts will quickly comment that only a 1% change in the price of gold over a year's time when the rest of the world has seen much larger increases in relation to their own currencies screams of manipulation, but that of course would reflect severely on the Shanghai Gold Exchange which is accepted as the world's largest physical gold market. And it wouldn't answer the question of why China and Xi Jinping no longer feel their debt levels are of any significant consequence.

Perhaps the real answer lies in China preparing itself for a full scale internationalization of the RMB when this new oil contract comes online, and by tying their currency to the gold price, it will assure investors and sovereigns who purchase Yuan-denominated oil futures that they do not need to necessarily transfer their RMB proceeds into gold as the currency will already be backed by the gold price in a pseudo form of a new gold standard.

If this becomes the case, and our assertions are correct, then once a critical mass is reached where a large portion of the world moves away from the London (Brent) and U.S. (WTI) markets to purchase their oil through China, then it will result in two things. A much higher gold price, and a in that higher gold price, a way for China's debtload to be backstopped by their reserves of the precious metal.

This is a WONDERFUL article - thank you so much!

GREAT NEWS!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit