Are these the cheapest shares on the stock exchange?

When we say that there are a group of shares that score less than 20 years ago, they are more profitable than 20 years ago while the product they sell is about 4 times more expensive than 20 years ago. Would you be interested?

We are talking about 4 of the largest gold mine stocks. Forget about FANG, the next few years you can make the most money with BANG: (Barrick Gold, Agnico Eagle, Nemont Mining and Goldcorp), says analyst Jesse Felder of The Felder Report.

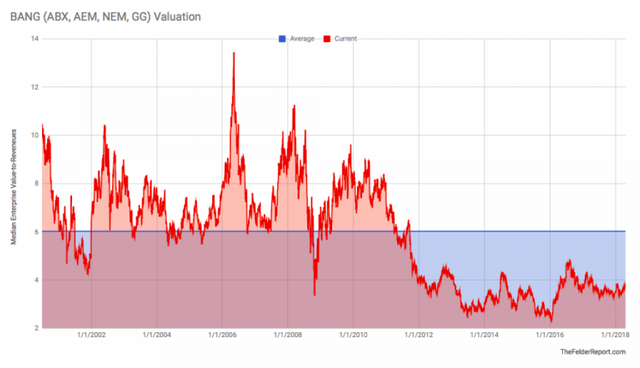

When we look at the enterprise value versus the turnover of these 4 gold mines, we see that these shares are cheaper than 20 years ago, the last time that gold mine shares began a long-term increase where investors made a profit of hundreds to thousands of percent.

You could say that a low valuation is justified because the gold price has lost about 1/3 of its value since the peak in 2011.

But nothing is less true.

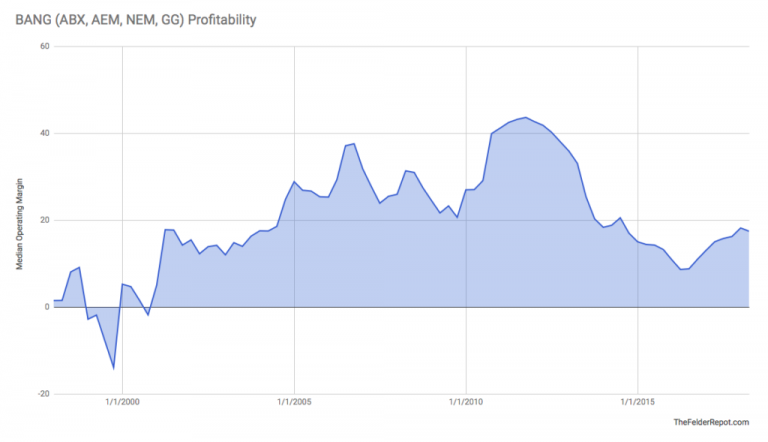

The profitability of BANG is higher than at the beginning of this century.

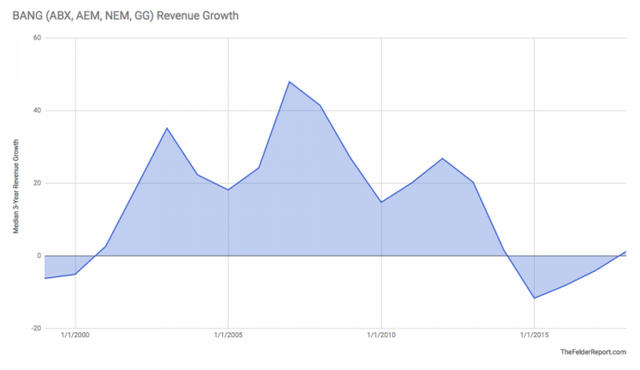

- And strikingly, the median of the turnover of the past 3 years for BANG is positive for the first time in many years.

The last time this parameter evolved from negative to positive was also at the beginning of this century. at the beginning of the last long-term bull market in gold mining stocks.

According to Jesse Felder, it means that the market is calculating a much worse situation for gold-mining stocks than the current situation.

These gold mining stocks could even rise 50% to return to their average valuation without the gold price rising.

He sees much more potential in BANG than in FANG.

Source: The Felder Report

Oh snap

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Got it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit