Rich people are doing something right: If nothing else, they’re good at making (or, at least, having) money. If you aspire to join their ranks, you need to think and invest like the wealthiest people in the world.

Right now, according to a world wealth report by research firm Capgemini, there are more than 16.5 million “high-net worth individuals” worldwide. These are people who have investable assets of more than US$1 million (excluding primary residence and collectibles).

These people control a lot of the world’s wealth, approximately US$63.5 trillion according to Capgemini… and what they do with their money has a huge impact on asset prices.

So here are three things you should know about rich people, according to the 2017 World Wealth Report, recently published by global consulting firm Capgemini…

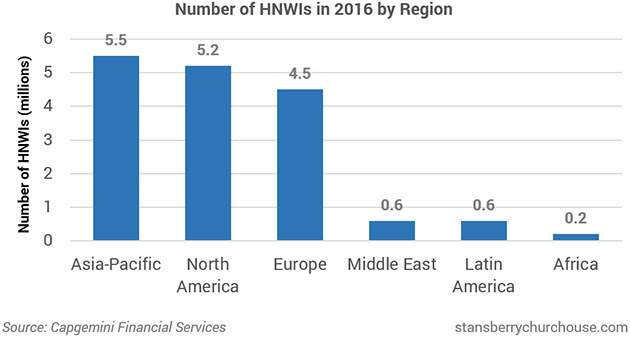

- Asia has the most

The Asia-Pacific region is home to more rich people than anywhere else. 5.5 million high-net worth individuals (HNWIs) call the Asia-Pacific region home.

By comparison, North American has 5.2 million HNWIs… and Europe has 4.5 million.

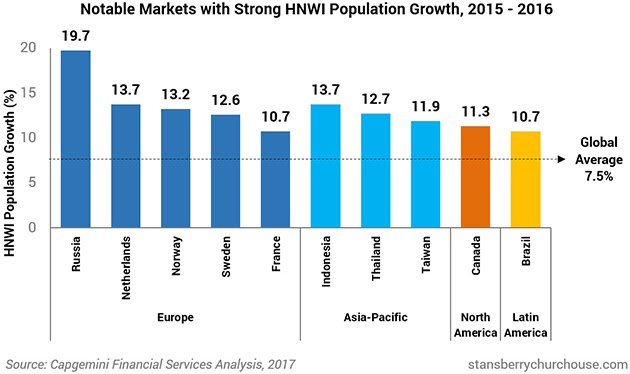

- Russia, the Netherlands and Indonesia are seeing some of the fastest growth

The global HNWI population grew by 7.5 percent in 2016. But the Russian HNWI population grew a massive 19.7 percent… the fastest of all the markets. This was a sharp reversal from a 1.8 percent decline in Russian HNWIs in 2015.

The Netherlands and Indonesia both saw their HNWI populations grow by 13.7 percent last year… followed closely by Norway and Thailand.

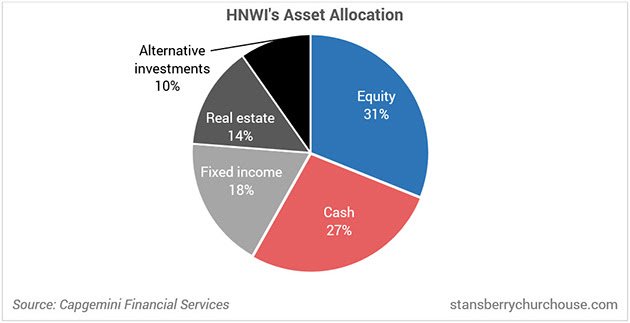

- They’re well-diversified

I’ve talked a lot about the importance of diversification. Keeping your money in different kinds of assets is one of the most important things you can do to build, and preserve, your wealth. And having too much in one asset class is a recipe for financial disaster.

The world’s richest people appear to know this, and have (on average) a broadly diversified portfolio, as shown below. Thirty one percent of their assets are in equities, 27 percent is in cash, 14 percent each in real estate, 18 percent in fixed income, and close to 10 percent in alternative investments (which include hedge funds, commodities and private equity).

But HNWIs take their diversification one step further by investing in different geographic markets.

I’ve talked about why it’s so important to invest in different markets before. While it might be comfortable to keep your money at home, from a portfolio diversification perspective, it’s like juggling live dynamite – especially in an increasingly uncertain economic and political environment.

To safeguard their wealth, HNWIs (ex. Asia-Pacific) hold 42 percent of their assets outside their home market.

And HNWIs in Asia-Pacific are even more diversified… in Hong Kong they hold about 68 percent of their wealth outside their home market… Chinese HNWIs hold 45.5 percent of their wealth outside China… and Singapore HNWIs hold 42.5 percent of their wealth outside their home. Altogether, Asia Pacific (ex. Japan) HNWIs hold 44.7 percent of assets outside their home market.

Hong Kong is the top destination for Asia-Pacific (ex-Japan) HNWIs to put their money outside of their home market… attracting 26.4 percent of offshore investments. Singapore attracts 17.3 percent of offshore Asia-Pacific (ex. Japan) investments… followed by New York at 15.8 percent and London at 13.7 percent.

As the number of HNWI grows, they will increasingly shape investing worldwide. Understanding how they think and what they do with their money is key, if you want to join their ranks.

Good content. To Keep up the good work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://stansberrychurchouse.com/education/investment-education/three-things-know-rich-people/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit