Barclays has been ordered by the competition watchdog to step up its customer communications as the lender was criticised for failings linked to payment protection insurance (PPI).

The Competition and Markets Authority (CMA) said on Monday that the lender breached an order requiring banks to provide customers with an annual reminder setting out how much they have paid in to a PPI scheme, and their right to cancel the policy.

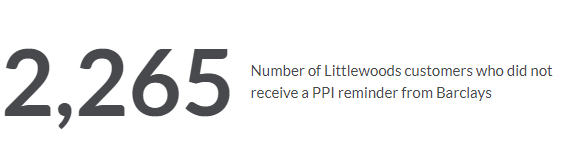

Between October 2016 and October 2017, Barclays failed to provide a reminder to 2,265 Littlewoods credit card PPI customers, the CMA said.

The bank attributed the breach to a technical problem in transferring the customers to its computer system.

As a result, the CMA has issued Barclays with “legal directions”, requiring it to put appropriate systems and procedures in place to prevent a similar incident happening again in the future.

Adam Land, the CMA’s senior director of remedies, said: “The annual reminder is an important measure so customers know they still have a PPI policy and how much it is costing them each year, as well as their right to cancel or switch.

We now require assurances from Barclays they have now put adequate systems in place to prevent a similar breach from occurring again.

This is Barclays’ second breach of the PPI order. As a result, we are issuing legal directions which can be enforced by a court, to ensure they comply with the order

This is the second time Barclays has failed to comply with the order, having reported several breaches to the CMA in 2015 for not providing annual reminders to almost 10,000 PPI customers.

“This is Barclays’ second breach of the PPI order. As a result, we are issuing legal directions which can be enforced by a court, to ensure they comply with the order,” Mr Land added.

Following the latest breach, Barclays wrote to all affected customers, providing a reminder of their right to cancel the policy and the offer of a refund.

It has so far paid out almost £336,000 in refunds to customers.

A Barclays spokeswoman said: This issue has now been resolved and all customers have received their missing statements. We have written to all affected customers to apologise unreservedly and to outline how we will recompense them where they would have otherwise cancelled their policy.

“We take this matter extremely seriously and have conducted an internal investigation to ensure all stringent controls and policies continue to be upheld.”

Last week Barclays saw half-year profits knocked by a third following a major US settlement and PPI provisions.

The high street lender reported a 29% fall in pre-tax profit to £1.7 billion for the six months to June 30, while total income for the period was flat at £10.9 billion.

Profits were knocked by a £400 million PPI charge and a £1.4 billion settlement with US authorities over its sale of mortgage-backed securities in the lead-up to the financial crisis – both of which were logged in the first quarter.