Ladies & Gents,

I've been thinking alot about the value of NEX and it's current price compared to the value they are actually offering investors. I find it difficult to value this as a utility token, like the binance coin, because the business model of NEX is so much different.

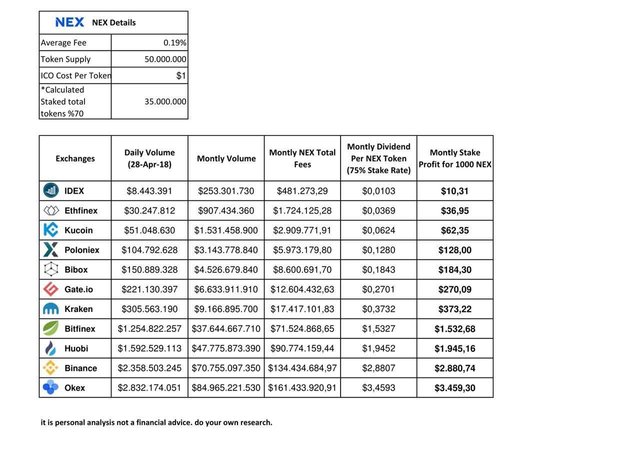

Let me explain why, lets use that infamous volume table that everyone has been quoting to saying that NEX reaches Binance levels and produces around $3,600 USD per month in passive income (there's another post on this, refer to the calculations on that - see diagram below).

Now the current market cap of Binance coin is around $900m, so if we value NEX to that, it gives us a token price of $36 per token ($18 if all 50 million are in circulation). Therefore what is being proposed is that 1000 tokens, valued at $36 per token (at Binance levels) will give you a worth of $36000 USD (simple maths), is producing an income of $3600 per month (based on volume) which equates to $43200 per year.

You're producing more income in a year than the price of your tokens? Makes no sense, either our approach at valuing NEX according to other utility tokens is flawed or the calculations to get to $3.6k is flawed.

My take on the matter is if the volume calculation is correct the NEX token price will be much much higher, generally a 10% ROI is acceptable for highly profitable assets, so for $3.6k per month with 1000 tokens you would need a token price of a whopping $430 per NEX token. It would create a barrier to entry and a fair price for valuation.

I'm sure there are asset valuation experts here, or stock valuation experts, keen to hear your thoughts based on the projected cash flows with the unique business model NEX has.