Foreword

With the rise and development of DeFi, open financial insurance, especially DeFi contract insurance, is becoming more and more important. Insurance is an indispensable part of the DeFi puzzle. At present, the development of DeFi insurance is still in the early stage, and insurance products are not yet mature. In addition to Nexus Mutual, there are more open financial insurance projects on the way. Only the Nexus Mutual family is not enough.

Compared with some DeFi insurance projects, the Nsure team has many years of deep cultivation background in the insurance field, which is conducive to its construction of open financial insurance projects that can be implemented. This time, Blue Fox Notes AMA invited the two co-founders of Nsure, Jeff Ren and Alex Peng. Jeff has a management and research role in the Nsure team. He has a double master's degree in engineering and business. He has written storm surge models for the National Oceanic Administration of the United States. Jeff has done a lot of research on blockchain protocols and ecology since 2017, and served as the investment and research director of the ChainFunder fund. Alex is responsible for actuarial and insurance model design in the Nsure team. Alex is a master of financial engineering and has more than 10 years of working experience in insurance companies. He has worked in Aon America and Hong Kong, and has extensive experience in insurance product design, actuarial analysis and market development.

The following is the record of this AMA:

Briefly introduce what is Nsure?

Jeff: Nsure Network is an open insurance platform for open finance. It is a decentralized "Lloyd's" and provides a trading platform for people who want to transfer risks and capital willing to take on risks.

Nsure will launch the Alpha version at the end of this year. By then, you can insure the Defi projects and smart contracts you want to protect on the platform.

At the same time, you can also invest ether and some stable coins into the capital pool to mine Nsure Token. When you become a Nsure Token Holder, you can participate in the project Staking to help the platform underwrite and get the benefits of premiums. At the same time, you can also participate in governance through Nsure DAO.

Why did the Nsure team choose to open up the financial and insurance field?

Jeff: The explosive development of DeFi this year is obvious to all. However, in recent years, many incidents such as hacker intrusions or contract bugs have caused losses to Defi users and gradually exposed the risks of smart contracts. Participants of the DeFi project will naturally seek insurance products to manage their risks, but the corresponding insurance products are actually very lacking in the traditional insurance industry. The main challenge that traditional insurance companies face is that DeFi is too new and there is not enough data to allow insurance companies to do traditional actuarial pricing.

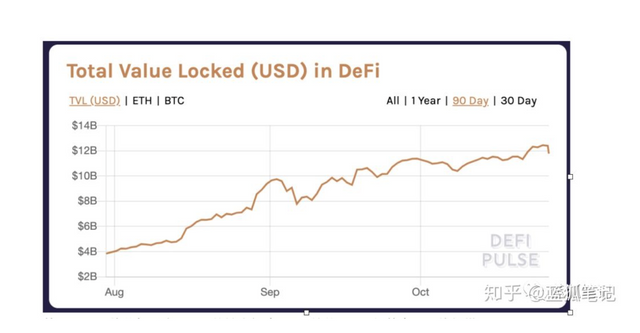

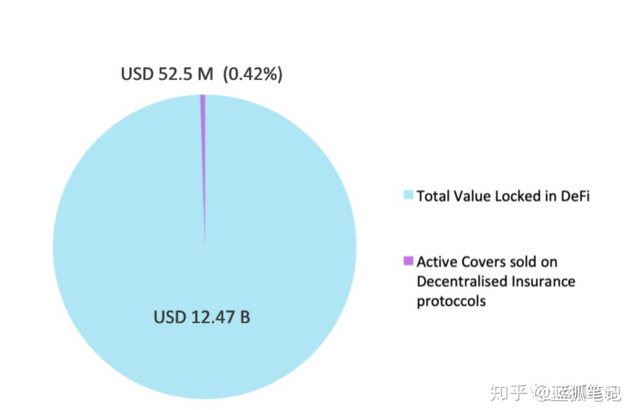

Estimated based on the insurance penetration rate of 5-10%, the current DeFi market needs at least 500 million US dollars of insurance, but the current DeFi insurance is only one-tenth of this amount, so we think this is a market with huge potential.

Smart contracts are just the beginning. When we built the Nsure platform, we hoped to apply to a wider range of insurance needs, including the capital risk of traditional exchanges, or catastrophe insurance that is still relatively missing in the traditional insurance industry. As with traditional insurance products, demand and supply can be matched on the Nsure platform. By introducing more low-relevant products, Nsure holders can achieve higher and more stable returns on the platform. For the insurance of smart contracts alone, we estimate that the premium market demand is US$50-200 million, which is equivalent to the existing property and casualty insurance market with annual premiums of US$2 trillion. We believe that there is a lot of room for growth.

Nsure is an agreement to open up financial insurance, and it is also an insurance market. What is the motivation for users to purchase insurance on Nsure? And why is the insurer willing to provide underwriting? How does Nsure provide the best support for both supply and demand?

Alex: At home and abroad, everyone's pursuit of wealth growth and high returns on capital has remained the same. For example, in the 16-17th century, the trade between the European and American continents created huge wealth and attracted a large amount of capital and manpower. But at the same time, high returns are often accompanied by high risks, such as shipwrecks, pirates, and fires.

For individuals, although the probability of these events is not particularly high, if they occur, it is a catastrophic blow, and the capital has a strong need to transfer risks. The Crypto market also has strong demand, but the existing market cannot be well satisfied.

The initial form of insurance was that all shipholders gathered to share risks. Slowly, high yields attracted more capital and professionals to enter. At the same time, professional service platforms and institutions were established. Lloyd’s has since the 16th century cafe Developed to the largest insurance platform today. To some extent, insurance has also promoted the development of modern economy.

Nsure draws on the operating model of Lloyd’s of the United Kingdom to provide a place for transactions between insurance demanders and capital suppliers. The dynamic pricing model can effectively mine the price corresponding to the risk according to demand and supply; capital mining can flexibly provide corresponding capital demand; at the same time, the three-stage claims settlement process protects the interests of policy holders; finally Nsure will provide a large amount of Materials and information help everyone earn enough risk premium.

How is the price of insurance on Nsure calculated? How to calculate the insurer's income?

Alex: Compared with traditional insurance, the insurance company will provide a quotation, and consumers can choose to buy it or not. Nsure's premiums are determined by a dynamic pricing model. The dynamic pricing model takes capital demand (total insurance purchasing power) and capital supply (total number of pledged Nsure tokens) as parameters, and jointly determines the final premium in the model. The advantage of this pricing model is that premiums are sensitive enough to both supply and demand. When supply increases, premiums will become lower, and when demand increases, premiums will become higher, and the ratio of supply and demand together determines the magnitude of premium growth, which is consistent with Market rules.

The insurer's income comes from three sources. The first is that the insurer who pledged tokens can earn 50% of the premium, and the insurer can obtain higher leverage by pledged non-related items to get higher premiums. If no loss is reported, the insurer’s profit is the 50% of the premium. If the project has a loss, the pledge token equivalent to 50% of the claimed amount will be destroyed. The value of this part of the token is the insurer. Loss. Therefore, the first part of the income of the insurer is the premium minus the claims, that is, the contracting income.

In addition, the insurer can also obtain voting rights in the claims process by pledge tokens, and participation in this process will also have corresponding benefits. Finally, as the holder of the Nsure token, the insurer also enjoys the right to co-governance in the DAO, and at the same time allocates the newly generated tokens to enjoy the profits obtained from the appreciation of the tokens.

In the near future, we will gradually publish information on Insurance Knowledge 101, how to become a good insurer and other information on the official website, and there will be Becoming Nsure Underwriters activities in the future. Welcome everyone to pay attention. While familiarizing with the concepts, we will study how to obtain higher returns.

From the public information, Nsure has a "capital mining" plan. So, what is "capital mining"? Why start the "capital mining" plan?

Alex: The insurance industry is a capital-heavy industry. How to obtain the corresponding capital to expand the business is the first consideration. Traditionally, there are two ways: the first is the form of mutual insurance (Mutual), which collects funds from policy holders, and Nexus Mutual borrows from this form; the other is a joint-stock company that uses stock to finance, such as large insurance companies PICC, Ping An, etc.

Joint-stock insurance companies now occupy about 80% of the market. The main reason is that they have more flexible ways of obtaining capital and can expand the market more quickly; and due to the pressure of shareholder returns, they are more sensitive to customer grasp, new products, and industry changes.

Since the beginning of the year, the DeFi industry represented by liquid mining has ushered in a spurt of development, and everyone has become more and more aware of this form. We also believe that this form can be very flexible to solve the capital needs of decentralized insurance, so the Nsure team was established.

The number of mining is fixed, the income depends on the price of Nsure tokens, and the price depends on the development of the business.

In the event of a claim, how to guarantee the rights and interests of insurance users? How to guarantee reimbursement?

Jeff: First of all, we will try to clearly define the specific incident of the claim. Nsure's definition of DeFi insurance is the loss caused by the failure of the smart contract. Other risks such as: systemic risk (the collapse of the Ethereum network), because the loss caused by personal operation is not within the scope of protection, and we will publish it on the official website later Examples of historical events are analyzed and defined.

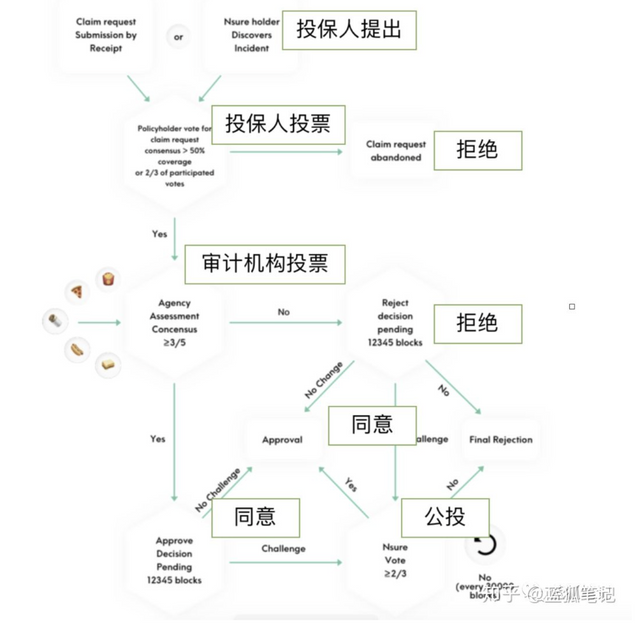

After we define the claim event, there will be a three-stage voting process to make a specific claim decision, as shown in the following figure:

The first round is the voting round of policyholders. We believe that the risk of smart contracts is an event. All insured persons are victims. In rare cases, there will be personal damage. Therefore, the first round of voting is decided by all policyholders. Whether to file a claim collectively.

In the second round, professional audit institutions were introduced. We believe that the judgment of smart contracts is a judgment that requires professional institutions to participate in judgment. Ordinary people's judgments about events often come from news, forums, etc.

The third round is a referendum. Whether it is the claim settlement party or the Nsure Holder party, if they believe that the audit agency’s judgment is wrong, they can pledge Nsure token to challenge. The conclusion of the referendum is the final conclusion.

What can Nsure tokens be used for? What supports the value of Nsure tokens?

Alex: First of all, Nsure tokens can be used as mortgages to collect premium income, because the income of different mortgage strategies will be different, and there may be a difference of 10% to 80% or even higher, which requires certain research. We will gradually provide more materials, and in the follow-up activities to let everyone gradually become familiar with it. For token holders who do not have the energy to research, they can authorize a specific Syndicate, some professional personnel or team, to manage it, and they charge a certain fee.

Secondly, Nsure tokens can participate in community operation and governance, and will receive corresponding returns, such as claims voting, parameter research settings and other activities. Finally, Surplus Pool is all the assets of Nsure tokens. As the business develops, it will continue to accumulate for a long time, and the corresponding Nsure token value will also increase.

How does Nsure's governance work?

Jeff: Nsure DAO is a platform where Nsure token participates in governance, and its functions are currently being gradually improved. Governance has always been the most important part of each project's ability to obtain community support. The upgrade of the main agreement, whether to stop mining when the reserve pool is sufficiently funded, the correlation coefficient setting of each project, the proposal and listing of new projects, and the decision on the cooperation of the audit agency will all be determined by NsureDAO. The current governance process of NsureDAO is similar to that of Compound, and the proposal will be based on executable code.

Currently Nexus Mutual is one of the main players in DeFi insurance. What is the difference between Nsure and Nexus Mutual? What are the problems that Nexus Mutual has not solved, but Nsure can solve it?

Alex: First of all, we think Nexus Mutual is very innovative and very successful. We share many common ideals with them, and we may explore more cooperation with them in the future.

Our main difference lies in the following 4 points:

Different sources of funds. We have adopted a more flexible shareholding system, and they are a co-insurance method; we use capital mining to attract funds to conduct business. Token price is a market decision. Higher prices attract more funds to conduct business, and more business Generate higher returns and further support the Token price. The price of NXM is determined in the form of a bonding curve. The price theoretically fluctuates in a range. When more funds are needed, the price drops, and when there is excess funds, the price rises.

Due to the needs of physical companies, they need to fill in KYC before buying the insurance policy. We think this block prevents a lot of demand. For example, we cannot participate in the needs of KYC countries. We are not in the first stage of the development stage-Crypto products. Need KYC.

Different pricing methods. Our price is determined by both demand and supply, while the price of NXM is only determined by supply. This also caused the embarrassing situation that their prices were too low before, but there was no insurance policy to buy. With the interaction of supply and demand, the entire market will develop more benignly.

The claim settlement process is also a big improvement, Jeff gave a detailed introduction before.

What is the current stage of opening up the financial and insurance field? What do you want to stand out in the end?

As you can observe, the insured amount is only 0.42%. As mentioned earlier, compared with the standards of traditional industries, generally speaking, more than 5% of the funds will be insured, and there is at least 10 times the room for growth in open financial insurance.

At present, we have seen many insurance projects rise due to the development of DeFi, and Nsure's unique token economic model guarantees its scalability.

To give a specific example: when the demand for compound insurance increases, Nsure's quotation model will increase the premium of compound insurance → the increase in premium will increase the income of underwriting → the price of Nsuretoken will be positively affected and the value of the secondary market will appreciate → dig Increase in mine output → attract more funds to take risks for larger insurance coverage → meet the insurance needs of compound.

Nsure's unique risk assessment model also ensures that the risk of everyone involved in Nsure's mining and underwriting is controllable. There are correlation evaluation coefficients between each project to prevent excessive capital leverage and cause huge losses.