You have probably already heard about NFTs in general and play-to-earn games in particular. Therefore, in this article, we will not chew what it is. We only denote that these are games on the blockchain, where the player can earn real cryptocurrency right during the game.

In this article, we will try to explain as clearly as possible how this game economy works: how the financial flows inside the game work, where the money that players earn comes from, and whether the game economy can collapse.

Often, the play-to-earn element (play to earn) is implemented using non-fungible tokens (NFT) or using a native game token (usually a cryptocurrency on the Ethereum blockchain, or BNB Chain). We will take the Cryptosnake game as an example since both elements are fully implemented there.

Where does the money come from in the game?

Game tokens and game NFTs, like regular cryptocurrencies and regular NFTs, have their value through demand. As long as there is demand, there is value. If suddenly the token turns out to be useless to anyone, the price will collapse.

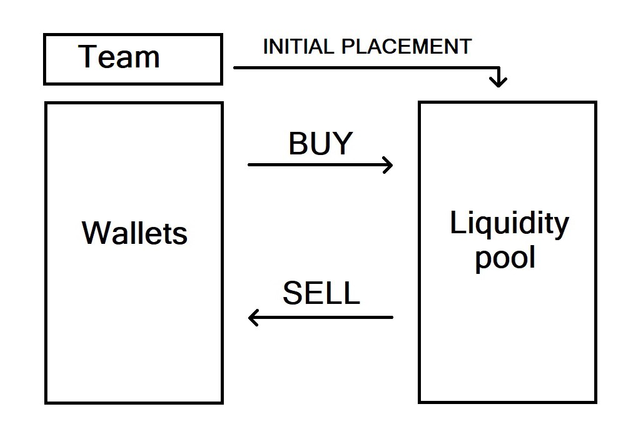

To form the starting price of the token at the start of the game, it is required to provide demand in the form of players ready to buy the game token and liquidity in the form of popular cryptocurrencies added to the liquidity pool for easy quick conversion between the game token and mainstream tokens (for example, BTC, ETH, BNB, USDT etc).

There were about 80 thousand people in the Cryptosnake community at the time of the start of the token sale, of which 20-30 thousand were active participants. The price of the token at the start was 0.01 BUSD. A total of several hundred thousand BUSD were irrevocably sent to the liquidity pool - this can be seen in the blockchain records and in the video evidence uploaded by the Cryptosnake team directly to the official channels on Twitter and Telegram.

As a result, demand exceeded expectations, and in the end, it turned out that the starting price of the token was greatly underestimated. The SNK token rose from 0.01 BUSD to 0.30-40 BUSD in the first minutes of sales. This provided the initial capitalization of the project. So, even before the start of the game, Cryptosnake had valuable tokens backed by demand.

Since the start of sales, the token has been living its own life. Its rate is not regulated. This is a general rule for all self-respecting play-to-earn projects. The inability of game developers to influence the course of the game token is an element of decentralization that is valued in any crypto project.

Even if the rate falls, it is pointless to artificially fuel it with infusions from the team. In the long run, this will result in even bigger problems. The course of a freely traded cryptocurrency always follows a sinusoid, and you need to be prepared for this.

Like any cryptocurrency like bitcoin, the gaming token can rise in moments of increased demand or fall when holders sell the token en masse. So, for example, SNK grew on the background of the news about the listing on Coinmarketcap, but fell at the moments when the assets of early investors were sold.

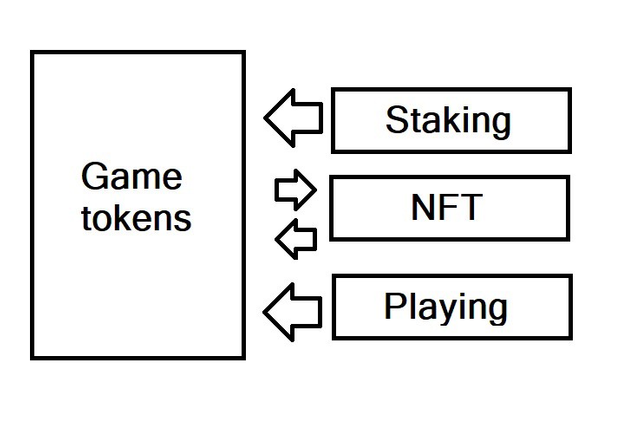

When a player earns in a play-to-earn game, they usually generate new tokens. This is a kind of mining or, more correctly, staking. An increase in the number of tokens in circulation leads to gradual inflation, but this can be compensated by buying back and burning tokens or by a steady influx of new players.

It is also important that previously generated tokens circulate in the game, and not new ones are constantly created. This keeps inflation down. Often this is implemented through the marketplace. The player buys new objects not from the conditional blockchain, but directly from another owner. There is such a marketplace in Cryptosnake.

Another way to get in-game currency to circulate in the game is through pools. The pool can be replenished with tokens lost in the game and distributed among those who earned in the game. Thus, the emission does not increase - equilibrium is maintained.

Ways to earn money in play-to-earn games

Here, too, it is convenient to analyze the mechanics using the example of Cryptosnake, since five earning mechanisms are introduced in the game at once:

- Staking. This is the receipt of passive income by accruing annual interest on staking (APR). In Cryptosnake, staking yields range from 15% to 115% per annum.

- Earning tokens while playing. In the case of Cryptosnake, this is a classic snake game where a 2D snake runs around the playing field after pixels, avoiding obstacles and its own body. In other games, it can be any other gameplay, because most games (even non-blockchain ones) have in-game currency in one form or another. The only difference is that in a play-to-earn game it can be withdrawn.

- Participation in tournaments with a prize fund. In top games, the prize fund can reach tens and hundreds of thousands of dollars. Competitions are regularly held in the Discord Cryptosnake community, where everyone can take part and, if they win, earn themselves prize SNK or BUSD tokens.

- NFT trading. This is the most common earning mechanic in these games. There are examples of games where there is neither staking nor earning tokens directly in the game, but there is NFT monetization. Every in-game item in NFT games has value in the secondary market. Such items can be characters, equipment, skins, and so on. In the case of Cryptosnake, these are snakes with different characteristics and game artifacts.

- Earnings on fluctuations in the token rate. If you buy tokens at the bottom and sell them at the peak, then in addition to net earnings directly in the game, you can also get a bonus in the form of a difference in the rate at the entrance and at the exit.

Circulation of money in a game economy

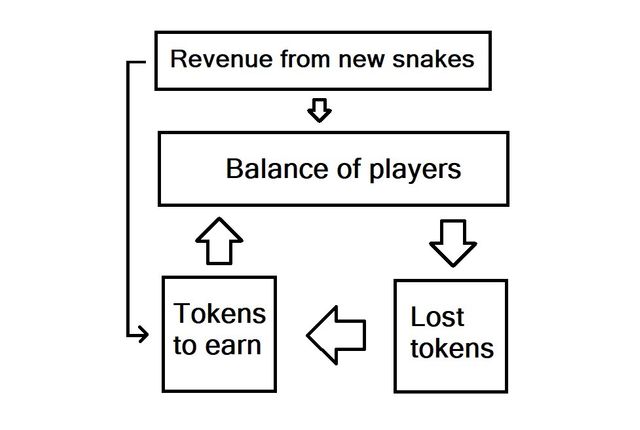

As you already understood, the gaming economy is based on supply and demand. Then it turns out that it's just a pyramid? After all, new players cannot come and come indefinitely, once the marketing resource is exhausted, and then what?

If demand were the only factor, it would most likely be so. Therefore, games aimed at the long term, and not at the momentary earnings of developers, build a system of checks and balances. It is necessary to maintain a balance in the universe: if someone has earned money, then someone must have lost it. That's pretty much how it's all set up. In many blockchain games, a player can lose cryptocurrency if they play poorly.

So, for example, in Cryptosnake, the player loses 1%+ of the snake's balance if it hits an obstacle. Unlike the classic snake on Nokia, the game can be completed without collisions, then you will be in the black. Thus, more dexterous players earn more than others, and weaker players lose tokens.

Are play-to-earn games pyramids

Whether a particular game is a pyramid scheme depends on its economic balance. If the earnings of old players are provided only by a continuous influx of new ones, then, of course, this is a pyramid scheme. If the game has an economic balance and the cryptocurrency circulates within the ecosystem, then this is a completely healthy viable economic model.

As new players arrive, the winners earn more, and the losers lose less. If the flow of new players stops, then it will not be the end of a viable game. It will just become a little riskier for weak players.

Of the signs of a financial pyramid for play-to-earn games, the only relevant thing is that early players earn more than others. This can be implemented, for example, through halving.

Learn more about play-to-earn game economy in the White Paper.

Disclaimer

Play-to-earn games are an opportunity to earn money. Often this is an opportunity to earn good money. And yet, this is the cryptos sphere, and the risks associated with it do not go away. You must understand and accept the laws of the market because playing blockchain games is also a kind of investment. Just more exciting. Indeed, in the vast majority of games, including Cryptosnake, in order to earn something, you must first invest something. So do not invest more in cryptocurrency than you are willing to lose. In particular, this also applies to play-to-earn games.