The essential elements of DeFi, namely stablecoin, lending, and a decentralized exchange, became the trifecta that underpinned minimal viability, unleashing innovation and growth while driving the value of assets in the space past $200 billion. Today, DeFi's meteoric rise has somewhat leveled off, and further catalysts for growth, such as institutional engagement and regulatory clarity, no longer seem out of reach.

At the same time, new innovations have sprung up, and the NFT and "meta-universe" debates have not only become a major industry issue, but have also permeated the after-dinner chatter. Thoughts on DAO have made headlines in the New York Times and Time Magazine, raising both doubts and curiosity. As a venture capital firm, it's clear that these new phenomena will be the basis for the next phase of building Web3. But how exactly will it evolve?

Every day we are in the midst of a wave of Web3 experimentation, and we are torn between being bold and being cautious. But we need to choose our own position after all.

Make NFT more useful

NFTs have the potential to dwarf even tokens, as they naturally better reflect the value of an asset without feeling like "printing your own currency". It's no wonder that NFTs have been able to set records at auctions and attract mainstream attention with their cute, or not-so-cute, image.

However, the only use for most NFTs today is speculation. The market is valuing future uses or values. Even with the current high-performing lead project, Bored Ape Yacht Club, which raised $450 million, acquired Larva Labs (the company behind CryptoPunks and Meebits), and launched ApeCoin, its primary value still comes from bullishness about its potential. We should be more sensitive to real value creation - both intrinsic value and practical value.

Intrinsic value

NFT itself can be art, music, video, 3D environments or blueprints, just like privately owned public goods. Everyone can enjoy the artwork being exhibited for free, but the items themselves have a clear record of ownership. Tokenizing these valuable assets (rather than simply generative art) helps to help creators connect with their thousands of real fans. In the case of music NFTs, some investors have already expressed similar views (e.g. Delphi Digital and Coopahtroopa), and there are already cases like Audius and Royal. Given the mainstream familiarity and extensive experimentation with NFT, the time to adopt it may be close. We are looking for infrastructure, such as platforms and DAOs, that have a clear advantage in their target markets and can attract a sufficient number of creators and collectors to join.

Utility value

Utility NFTs are more akin to privately owned private goods - games, communities, events or any crypto product/service that require access. Ownership and access to these NFTs allows people to build an immediate loyalty relationship with a brand or business, or they can be transferred as the user base or community grows. As a basic start, almost every PFP NFT project has created a Discord server with tokens as access, which only verified holders can join. We have invested in infrastructure that enables various use cases, such as the Smart Token Lab, Grape Protocol and Lit Protocol. These projects are positioned to serve any project that issues NFT.

NFT Outlook

As these practical NFTs proliferate, datasets emerge naturally through ownership and access, and user and collector purchases and interactions can be substantiated. This social graph will be invaluable for derived use cases such as evaluation, reputation, and personalization of experiences.

On empowering more creators in the game/meta-universe

By now, the big bang of Axie Infinity has made one thing clear: Web3 games have taken root. Returning ownership to the players and allowing them to enjoy the profits from the development of the game creates a powerful feedback loop that can drive value creation and enhance user stickiness. Of course, to ensure long-term sustainability, the project still needs to improve the token mechanism, such as realizing participation cash and using the free model to lower the participation threshold. At the same time, the influx of players, developers and capital into the space over the past few years will also usher in rich results as many highly anticipated games are scheduled to launch in 2022, such as Ember Sword, Illuvium, and Guild of Guardians.

However, Web3 Games is currently overemphasizing the importance of big 3A titles. These titles tend to take longer, cost more money, and therefore carry higher risk. Instead, we want to find alternatives with faster iteration cycles.

Casual games

Casual games are easier to deliver, appeal to a broader demographic, and have generated significant profits in web2. Handheld games, in particular, are way ahead in terms of revenue and growth. web3 games will continue to be dominated by browser-based page-based games, which are the smallest segment of the game. This is due in part to the official censorship of the console and handheld markets, while Web3 games are blocked, sometimes across the board, due to some bad actors (see Steam). This provides opportunities for new platforms and markets to capture the long tail of Web3 casual games. We are looking for platforms that have extensive networks and experience in the gaming and Web3 space. One example in our portfolio is OPGames, which offers an SDK and aggregator. Existing game projects and publishers can also be expanded into a broader ecosystem, such as Gala Games.

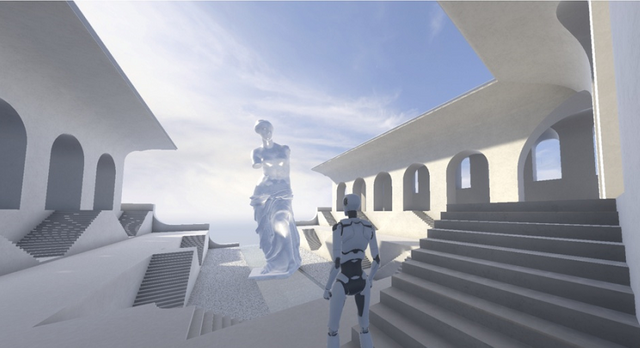

Meta Universe Games

Meta-universes use communities to drive large-scale innovation. In Web2, sandbox games like My World and Roblox are hugely popular because they unleash creativity. Similarly, open-world or MMO games with active modding or role-playing communities attracted a large and loyal audience, such as GTA V, The Elder Scrolls, and World of Warcraft. In Web3, these games are referred to as metaverse - an always present virtual reality in which assets can be truly owned, creating a real economy with real commerce through open integration. These worlds rely heavily on strong initial momentum, often driven by the founding developers, and then explicitly transition to community-led content creation. We have seen some initial success with Decentraland, Sandbox, Cryptovoxels, and Somnium Space. We will continue to invest in teams with clear strengths in their target markets, such as Realy within the Solana ecosystem, Mona Gallery within the Filecoin ecosystem, and Bitcountry within the Polkadot ecosystem.

Meta-universe Outlook

As Web3 games mature, a so-called meta-universe native economy has also emerged. Players organized guilds, developers gathered to build DAOs, and tools developed for Web3 features came into being. Coupled with hardware innovations that bring immersive digital experiences such as VR, AR, and mixed reality, the world is moving toward a tipping point that will lead us to a metaverse-based social and work life.

On empowering DAO goals and scaling

With digital assets in the form of NFT and digital experiences in the metaverse, it is natural to derive digital ways of organizing and working. the concept of DAO can be traced back to the ethereum white paper and has evolved in recent years into more contemporary forms, including regulated investment DAOs like The Lao, product-focused DAOs like MakerDAO, or ConstitutionDAO - which raised $47 million to bid on the U.S. Constitution. It's no coincidence that the rise of DAOs coincides with the rise of the freelance economy and the Big Quit, where people are looking for more flexible, fair and personalized work opportunities. Clearly, the disruption of work forms is well underway.

DAOs tend to work well when there is a clear purpose and mission, as in the few examples of investment, product development, or crowdfunding mentioned above. However, none of these DAOs have reached the global scale that is the true potential of a DAO's orchestration capabilities. There are a few DAOs that have a more ambitious vision, such as GitcoinDAO, which aims to build and fund public goods, but we still need mechanisms to recognize large-scale contributions and contributors.

"Proof of Contribution" Infrastructure

We need to be able to standardize and gamify DAO activity, and in the process create new prototypes for a new economy. At the individual and project level, implementations already exist in the form of liquidity mining with DeFi, or social tokens that incentivize participation and consumption of products/services - such as Roll. in terms of infrastructure, there are also some powerful examples. For example, Bitcoin's proof-of-work mechanism, despite the trade-offs, is a fair measure of contributions to security. filecoin's proof-of-storage has amassed an incredible 15 million TB of storage space. A newer experiment is the move-to-earn model, adopted by Genopets and Stepn, which attracts governments, employers and insurance companies to sponsor health improvements through exercise. Think of experiments like the "carbon capture proof" or "research replication proof". Each of these could spawn a huge industry. From this perspective, the attention economy that still powers Internet giants today is largely based on the discovery of a simple underlying principle - that of "proof of clicks". "proof of clicks".

Governance Mechanisms

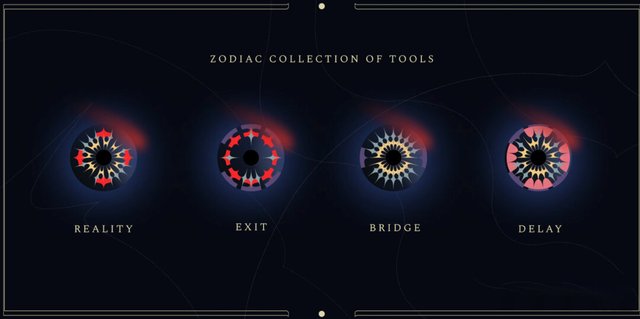

On the other hand, targeted governance fills the gap of unstandardized interactions or strategic contributions. In Web3, the tamper-evident nature of the blockchain often leaves little room for legal recourse, which means that governance mechanisms related to code execution become a critical piece of infrastructure. An early example in our portfolio is Snapshot X, which ties voting to on-chain execution. Also, as DAOs evolve and decentralization efforts are made, the need for governance will evolve over time. Here, scalable, modular tools like Zodiac provide a seamless experience for all phases of the DAO lifecycle. We need to fund more targeted infrastructure to improve the setup and operation of DAOs to achieve the ultimate goal.

DAO Outlook

As we increasingly embed ourselves into digital tribes through DAO clusters, digital nation-states divided by culture are slowly starting to take shape around the security provided by the underlying blockchain. Arguably, rights, benefits, and taxation (voluntary or mandatory) mechanisms tailored to each nation-state are not impossible.

Conclusion

As is the case with venture capital, and even more so with Web3, our understanding and outlook will continue to adapt as new pieces of the puzzle are put in place. In the meantime, we must collaborate in our respective roles to consciously map out what Web3 should achieve - challenging and enhancing the existing order toward a more open, transparent and inclusive world.