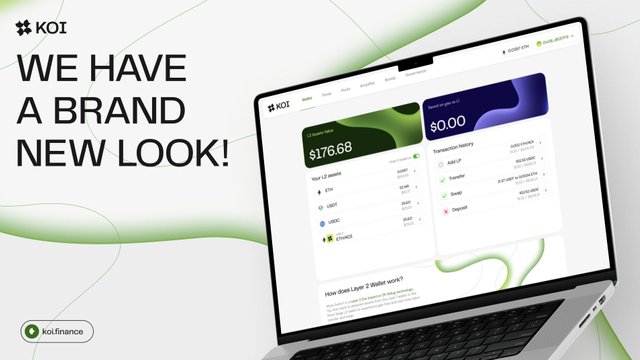

Koi Finance INTRODUCTION

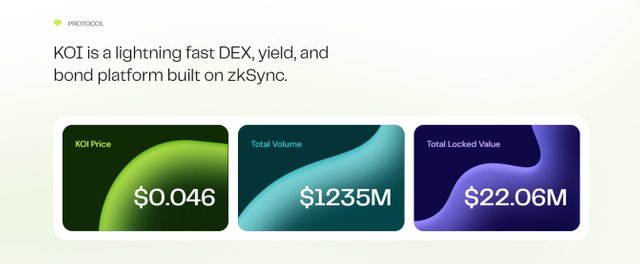

Koi Finance, formerly known as Mute, is a DeFi platform, serving as a liquidity hub for all projects on zkSync. Mute dynamic dApp features both a concentrated and standard pool AMM DEX,complete with limit orders,a farming platform. KOI is A next generation DAO governed. ZkRollup DeFi Platform. Trade, earn yields, and participate in Bonds all on one decentralized, community driven platform. Koi farming pools is a liquidity reward protocol that allows LPs to gain additional revenue APY & take part in the Koi ecosystem. Amplifier rewards are fueled by platform revenue and fees, which come directly from the buy back.

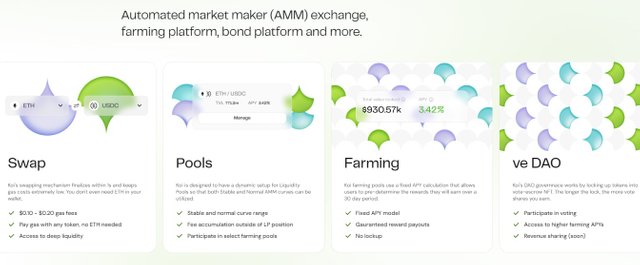

Koi finance FEATURES

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

- $0.10 - $0.20 gas fees

- Pay gas with any token, no ETH needed

- Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

- Stable and normal curve range

- Fee accumulation outside of LP position

- Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

- Fixed APY model

- Gauranteed reward payouts

- No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

- Participate in voting

- Access to higher farming APYs

- Revenue sharing (soon)

veKOI

DAO and Governance

The native Koi token, KOI, functions as a utility towards unlocking accessibility into the Koi DAO, which is a locked based vote system based on a ve NFT model, veKOI (Vote Escrow Locked Koi). This veNFT can be transferred, sold, and eventually burned for the underlying koi it owns once its lock period is expired.

This lock based system requires KOI holders to lock their KOI for a period of time (7- 728 days), and in return receive a new NFT, veKOI. This veKOI NFT is custom NFT for every user who locks their Koi in return of a veNFT. The NFT holds 3 important metadata variables:

- Underlying Koi Amount locked (for future redemptions)

- Total vote share weight

- Expiry date

After the lock period is expired, you are able to redeem and burn your veKOI NFT back to your original KOI balance, continue to hold your veKOI, or redeem & re-up a different time lock.

Specifications

- Minimum lock time: 7 days

- Maximum lock time: 728 days

- Increment of lock period: 7 days

veKOI vote utility:

- Dictates a users Amplifier Boost of a Amplifier Pool

- Modifications to the AMM protocol fee (0.1% currently, can be fixed or dynamic depending on pair)

- Creation of additional Amplifier pools and reward distributions

- Creation of additional Bond Offerings and distributions

- Ownership over the protocol treasury

All Koi DAO utility

- veKOI available custom functionality:

- Split veKOI into smaller veKOI NFTs

- Merge two veKOI NFTs into one

- Increase veKOI lock period to a greater one

Governor

Governor & Timelock specs

The Koi DAO uses a dual contract setup (Governor & Governor Timelock) that allows proposals to be created with an additional layer of security.

The Governor contract is responsible for the arbitrary logic that the governance mechanism works off of, and the Timelock contract is the core module that holds funds and owns other contracts. The Timelock contract also allows users to exit the system if they disagree with a decision before it is executed. This safety delay is 2 days after a proposal gets passed.

The Koi DAO UI can be accessed through Tally:

https://www.tally.xyz/gov/mute

Specifications

Minimum proposal threshold: 50,000 veKOI vote shares

Minimum Quorum: 10% of the total vote share supply with 50%+ in favor

- Vote delay: 1 day

- Vote period: 3 days

- Execution delay: 2 days

Koi Farming Pools

Koi farming pools is a liquidity reward protocol that allows LPs to gain additional revenue APY & take part in the Koi ecosystem. Amplifier rewards are fueled by platform revenue and fees, which come directly from the buy back and make system the Koite DAO has in place.

Do note, there are not amplifier pairs for every liquidity pair on the Switch. Rather, amplified pairs are decided up by the team and Koi DAO. There will be amplified pairs for important base liquidity pairs such as ETH/USDC, WBTC/USDC etc. These will be linked and updated on this page as those become available.

The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol, as well as its partners & users, to generate calculated revenue based on the rewards distributed to farmers.

The base APY in an amplifier is static. Additionally, if the pool has an extra amplifier APY set, the max apy is determined by a ratio of the users Ve vote share value to the lp value being deposited.

Rewards are allocated immediately upon deposit and disbursed gradually over the month based on user redemptions. If the user chooses to withdraw their funds prematurely, they forfeit the remaining unmatured rewards.

To own the max Amplified APY, you must have a vote share value of equal or greater to the value of lp being deposited.

Your veKOI votes/holdings carry over to all amplifiers. If you are providing your LP to two amplifiers, your veKOI vote share balance is not split among them. Taking the previous example, if you provided LP on two pairs using those same exact numbers as above, your APY on both would be 12.5%. This is to encourage participation in all pools.

KOI Tokenomics

Max Supply: 1,000,000,000 KOI

Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated.

Circulating (prev. Mute token swap): 50%

Ecosystem Incentives: 30%

Future Investors (reserved): 7%

DAO: 6%

Future Advisors (reserved): 4%

Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release

May, 2023.Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

- Mute -> Koi rebrand & token swap

- Rebranded ecosystem with overhauled tokenomics

- veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

- Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

Koi finance Social media link:

Website: https://koi.finance/

Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1

Twitter: https://twitter.com/koi_finance

Discord: https://discord.com/invite/muteio

Telegram Community: https://t.me/mute_iol

Author Details

Bitcointalk name : Silas Kai

Bitcointalk Profile link : https://bitcointalk.org/index.php?action=profile;u=3382086

Telegram username : @SilasKai

Wallet: 0x5ADCD956C149f463031896f2a2155527b78FDaC5