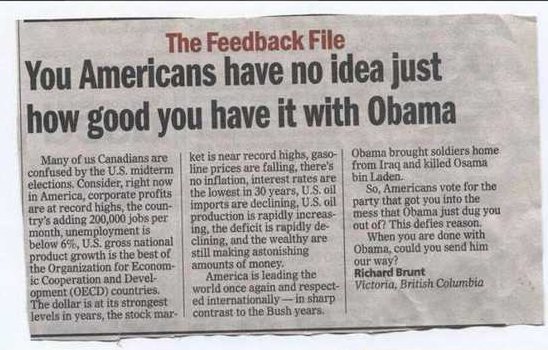

I am writing this as a rebuttal to the article “You Americans have no idea just how good you have it with Obama” by Richard Brunt because I have recently seen it show up in social media.

I don’t normally go out of my way to refute every piece of political propaganda I see; however, this article needs to be addressed because its key points are a highlight reel of platitudes, for the Obama administration, that look favorable on the surface but are truly disingenuous and misleading when put into proper context.

My intent is to clear up some of the misrepresentations by Mr. Brunt and to shed some additional light on the points that he brings up in his article. This will be a step by step approach to address many, but not all, talking points brought forward by Mr. Brunt.

In America Corporate Profits Are at Record Highs:

First: The increase in corporate profit is a measure of the business practices of the corporation and not the result of government intervention from the Obama administration. Increased revenue and profits have come about in spite of the government, not because of it.

Second: The strength in corporate profits can be directly tied to the weakness in hourly wages resulting in lower labor costs. This weakness in wages, with resulting strength of profits, is an indicator the US labor market is far from full employment (high unemployment is the driver that keeps labor costs in check). Companies have been able increase profits because they are employing as few workers as possible at as low a rate as possible.

Finally: Many companies have been able to further reduce labor costs and increase profits by moving their business outside of the United States to countries that are able to provide super cheap labor. This fact alone has changed the US economy from a manufacturing based economy to a service based economy which is a discussion best left for another time due to its broad implications.

The Country’s Adding Two Hundred Thousand Jobs per Month:

It may be true that the Bureau of Labor Statistics (BLS) is reporting job gains of over two hundred thousand per month for 8 out of the 12 months in 2015; however, alone these numbers can not paint a full picture of US job creation. What is being neglected is the fact that the majority of jobs being created are part time jobs, temporary jobs, and government jobs that pay less than the full time jobs that Americans are loosing. Not to mention that the BLS is implementing some pretty shady accounting practices in order to report higher jobs numbers. One practice is to show an increase of 3 full time jobs created as the result of a single person who has 3 part time jobs.

The true story is that Americans are loosing their full time jobs (as US multinational corporations are laying off workers domestically and are hiring oversees) and are replacing them with part time jobs at a decreased hourly wage. This fact is indicated by the Year-over-year change in nominal hourly earnings which has decreased form 3.7% in 2007 to 2.2% in 2015. To put is simply; no matter what the jobs report indicates Americans are making less money.

(U3) Unemployment Rate is Below 6%:

There is no other way to put this than to say that an unemployment rate below 6% is misleading at best. The Department of Labor under the Obama administration has been misrepresenting its job data to make the unemployment rates look much lower than they really are and this is how:

If a person is unemployed and has given up finding a job, or if a person is so hopelessly out of work that they have stopped looking, over the past four weeks then the Department of Labor does not count that person as unemployed.

If you are out of work; however, you perform a minimum of 1 hour of work in a week and are paid at least $20 then you are not officially counted as unemployed.

The unemployment rate does not take into account those discouraged workers who are working part-time but wanting full-time work; meaning if you are professional but can not find work in your profession and opt to take a lower paying part-time or temporary job (in other words, you are severely underemployed) you do no officially get counted as unemployed.

The U3 unemployment rate, or the official unemployment rate, only takes a narrow approach to interpreting unemployment/underemployment and can paint a rosier picture of where the nation stands; whereas, the U5 and U6 rates take a broader approach and can give a more accurate representation of US unemployment/underemployment.

The U5 rate includes discouraged workers and all other marginally attached workers and the U6 rate adds on those workers who are part-time purely for economic reasons. BLS data (at the time the disputed article was written) indicates that in November of 2014 U3 unemployment is 5.8%, U5 unemployment is 7.0%, and U6 unemployment is 11.4%.

One last thing to note is that the government and corporate media rarely talk about the Labor Force Participation Rate which is a measure of the active portion of an economy’s labor force (the participation rate refers to the number of people who are either employed or are actively looking for work). As of December 2015 the labor force is at its lowest it has been since 1977 with year over year declines. BLS stats: Dec 1977 = 62.7, Dec 2015 = 62.6.

Gross National Product Growth is The Best of OECD Countries:

This is true; however, it does not point out the manipulation that has taken place in order to get such favorable results. First let me explain what the Gross National Product (GNP) is before I point out where the misrepresentation comes from. The GNP is an economic statistic that includes the Gross Domestic Product (GDP), plus any income earned by residents form overseas investments, minus income earned within the domestic economy by overseas residents.

My point of contention will focus on the manipulation in the US GDP report. The GDP is a broad quantitative measure of a nation’s total economic activity. More specifically, GDP represents the monetary value of all goods and services produced within a nation’s geographic borders over a specific time.

In July of 2013 the Bureau of Economic Analysis (BEA) change the way in which the US GDP is measured making America appear wealthier on paper. Some very important changes included:

Research and development is now counted as a capital investment instead of a cost of making goods.

Investments in artistic originals like books, TV shows and movies are counted as fixed investments.

Money promised to retirees from pension plans are now counted as wages.

The biggest manipulation came in 2014 when Q3 GDP jumped up to 4.96%, from 1.51%, when Obamacare was factored into GDP growth as part of healthcare spending. When American GDP was manipulated higher the GNP naturally increased with it.

The Dollar is At its Strongest Level in Years:

Yes the US dollar is stronger than other currencies; however, in many ways this is not a benefit for Americans or emerging markets. Here are a few problems with the stronger dollar:

The higher dollar is raising crop prices and making US farm products less competitive on the global marker consequently causing farmland prices to fall.

The strong US dollar makes products manufactured in the USA more expensive in offshore markets and therefore less competitive. This in turn results in a drag on US exports and declines in the US stock that are traded internationally.

The stronger US dollar has the potential to cause a large scale currency crisis in emerging markets. When smaller economies hold debts in US dollars they will struggle to service those debts as the value of the dollar increases.

I have listed only a few problems related to a strong US dollar (USD); however, it needs to be said that the increased strength in the USD has been driven by quantitative easing (QE) from the European Central Bank (ECB) and not by US government intervention to increase the strength of the dollar. The result of bold stimulus from the ECB, and other central banks around the world, has put substantial downward pressure on the euro, the yen, and other currencies, while boosting the USD.

Some may argue that the increase strength in the dollar can be attributed to a number of factors including: relatively strong US economy, improving trade balances, and improving budget deficits; however, I contend that none of those scenarios are actually true and it is truly because the USD is the least bad currency in a basket of bad currencies. China’s economy is sharply slowing and the Eurozone seams to be having debt crisis after debt crisis. Because the USD is the world’s reserve currency, money naturally flows to the USD as a flight to safety from depreciating international currencies. This is why the USD is gaining strength.

Record High Stock Market:

Yes; the stock market reached record highs in 2015, but this is directly related market manipulation; by the Federal Reserve (FED), and not by natural market forces. Former Dallas FED Head “Richard Fisher” summed it up when he disclosed the FED had front-loaded an enormous market rally, in 2009, in order to create a wealth effect. In addition to the front-loading, the FED continued to manipulate the market through the use of the Plunge Protection Team, the exchange stabilization fund, high frequency trading, and 0% interest rates from December 2008 to December 2015. These mechanisms for manipulating markets are detrimental to a free market economy.

We may have had record highs in the equities market, due to manipulation, but when the FED no longer has the ability to keep the market artificially high there is going to be a severe market correction that is going to wipe out an enormous amount of wealth with huge losses coming to 401K’s and pension funds.

Gasoline prices are falling:

Falling gasoline prices are not the result of American government policies; however, is the result of Saudi Arabia refusing to cut oil production in order to maintain its market share from encroaching American and Russian oil production. Saudi Arabia is pushing to bankrupt US and Russian oil producers who can not produce oil at a profit with such low prices. With oil prices around $30 a barrel, many US oil producers are going under; especially shale oil producers who can not turn a profit with oil under $70 a barrel.

There Is No Inflation:

To say that there is no inflation is not true. Cumulative inflation from 2010-2015 is 10.12% and average annual inflation form 2010-2015 is 1.86%.

The Deficit is Rapidly Declining:

The US deficit, as of October 2015, came in at $439 billion according to the numbers released by the Treasury Department. That is the lowest deficit since 2007 when the annual deficit was $161 Billion.

It is true the deficit has decreased; however, it is still a deficit none the less. It would be much more impressive if the US government could balance the budget and not run deficits. Also, let’s not overlook the fact that the US debt has been run up to $18.9 trillion under the current administration. The US national debt is well worth mentioning as it poses a greater threat to America and its national security than the deficit; however, Mr. Brunt chose not to address this fact in his letter to the editor.

Final Thoughts:

I could continue to shed light on the rest of the claims from Mr. Brunt; however, I feel I have addressed some of the most important claims that he has made. My intent is not to disavow or promote any political party, as I have no party affiliation; however, it is to address information that is being spun to fit a political agenda.

It is obvious that Mr. Brunt had a political agenda when he wrote his letter to the editor; however, in doing so he came off as condescending, and insulted the intelligence the American people with his misrepresentations and half truths. But I’m sure that was his point.

Hi! I am a content-detection robot. This post is to help manual curators; I have NOT flagged you.

Here is similar content:

http://cachevalleypi.com/4/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am the owner of Cache Valley PI.com. This is an article i wrote, and posted, back in January of this year on my site as a rebuttal of the letter to the editor post " You Americans have no idea just how good you have it with Obama". I am new to steemit and wanted to make a quick post to test how the process of posting worked; therefore, I used an article I had previously written for the sake of expediency. I chose this article because I feel that the points I made are still relevant today.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That whole article is full of nonsense. Thank you for a concise and complete refutation of this hack's points.

I suppose in his mind, so long as our wise, benevolent overlords are pulling the economic levers, everything will be juuuuust fiiiiine. Personally, I'm dreading the market correction that's inevitably going to follow all of this quantitative easing and extended 0% interest rate period the Fed has engaged in.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I couldn’t agree with you more. I also dread the inevitable market correction; however, I now worry about the possibility for negative interest rates in our future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit