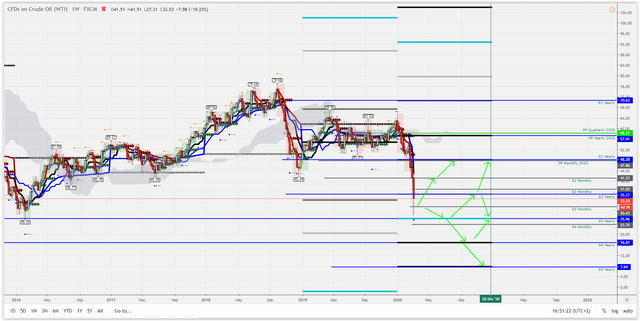

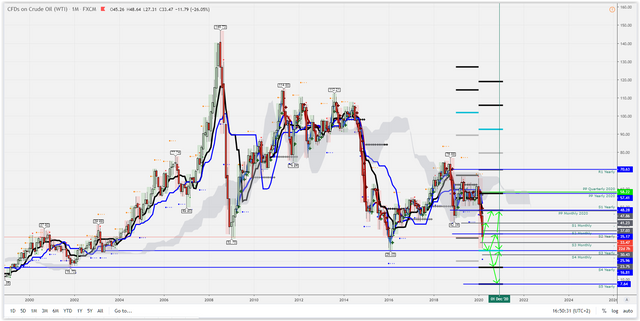

First, here are some views on oil:

All Images here: https://imgur.com/a/awLNUUP

Considering the images, it is entirely possible for Oil to touch 16$ considering the recent OPEC fallout. So, another 50% drop from current levels? Possible.

What the historical monthly graph for oil, tells that oil has a higher supply than demand, and the only reason oil was up, it was because production cuts. They know if they exploit it all, price could go under 10$/ barrel.

Oil is also one major reason for wars in the Middle East, and most importantly, too much competition could get the price down, thus hurting their profit margins. All these wars vs. Russia or Iran look to be "oil wars". Those in charge of oil production want a monopoly, so they could fix the price. The oil producers definitely want oil to be over 100$/barrel. But that doesn't work with the current demand for oil dropping and at the same time with more oil producers entering the market.

Oil's new trading range could be between 16$-25$ per barrel. Now it's at the 25$-35$ range.

One of the main reasons for this drop? The lack of demand for crude oil due to nCoV-2019 quarantine that affects tourism and as a result transport. The cascading effects of quarantine and business shutdowns lead to the price of oil going down so far.

It could go up above 35$, going to the price range of 35$-48$, but that is if OPEC members cooperate. Otherwise crude oil could continue to trade in a lower range.

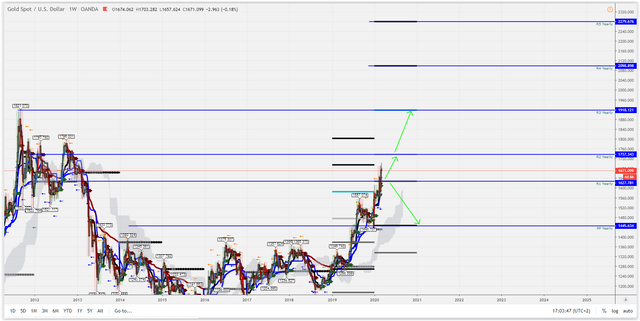

Gold can continue it's role as a safe haven and might reach the 2011 highs.

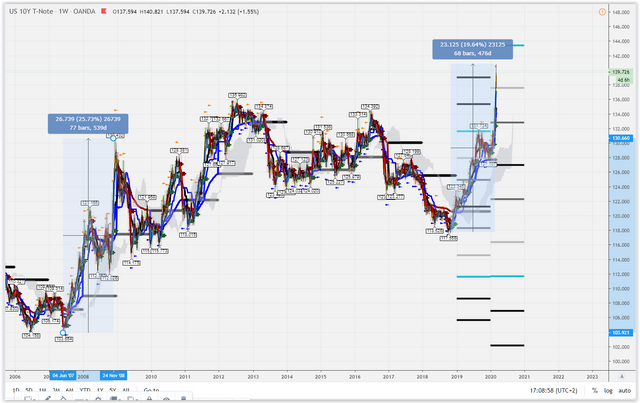

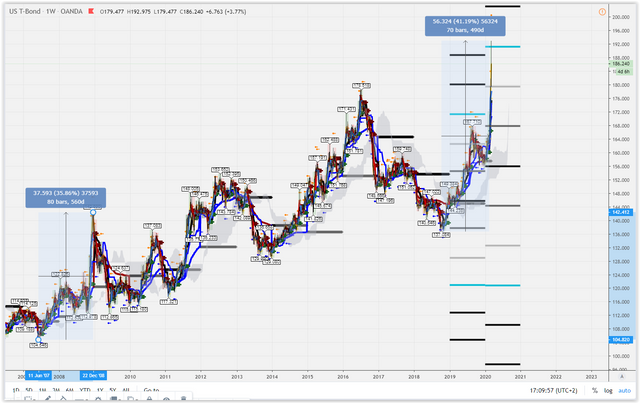

10 Year and 30 Year Bonds look to have similar price rise, similar to what happened in the financial crisis of 2007-2008.

S&P 500 below 3000 is a certain psychological level. But 3000 was reached, even 3300.

Considering the crisis, the stimulus might not be enough to help it. On this market crash, there is also a tremendous opportunity to "drain the swamp". And the blame for the crash, to be put both on the virus and on the corrupt people that build that corrupt "swamp".

Remains to be seen if this comes to fruition.

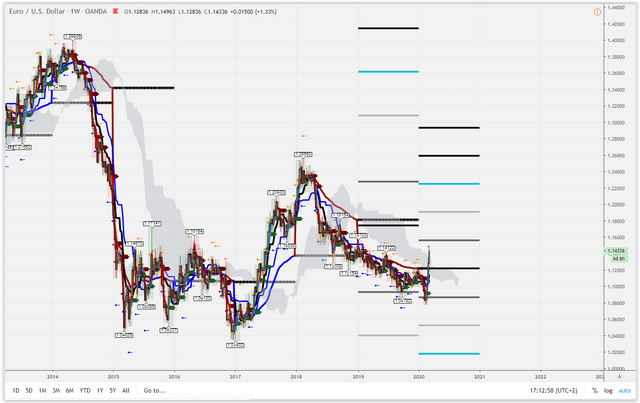

Euro goes up.

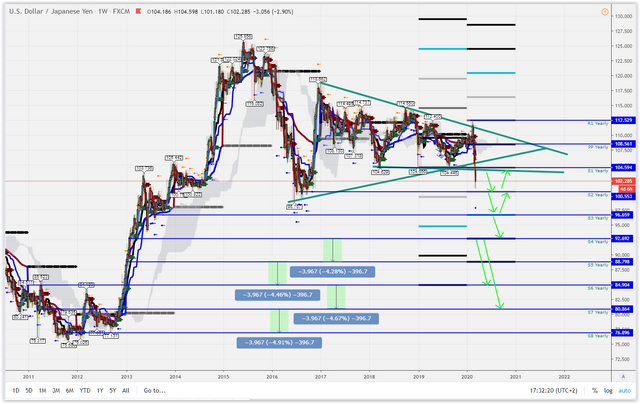

The Japanese Yen has the potential of appreciating a lot.

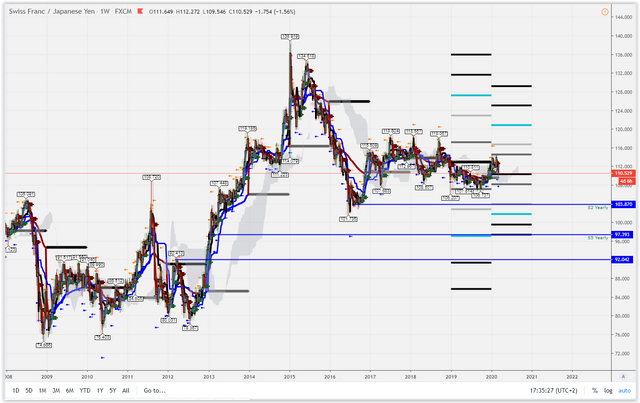

Swiss Franc started devaluing vs Japanese Yen.

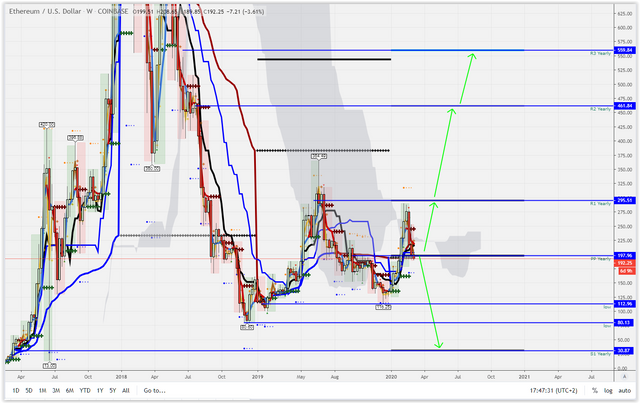

Ethereum, hard road ahead so far.

Same for Bitcoin.

Getting Bitcoin above 8000$ and Ethereum above 200$ is bullish for crypto. Otherwise... not so good.

There are other tokens, like Link, Tezos, Atom, that are likely to show strength. Remains to be seen.

Conclusions?

Japanese Yen, Gold and possibly Treasury Bonds, to be the winners for this year.

Ethereum and Bitcoin? They have a chance but it's small. Ethereum needs to be above 200$ and Bitcoin above 8000$, for this year. Just like S&P 500 needs to be above 3000.

The high quality screenshots here: https://imgur.com/a/awLNUUP