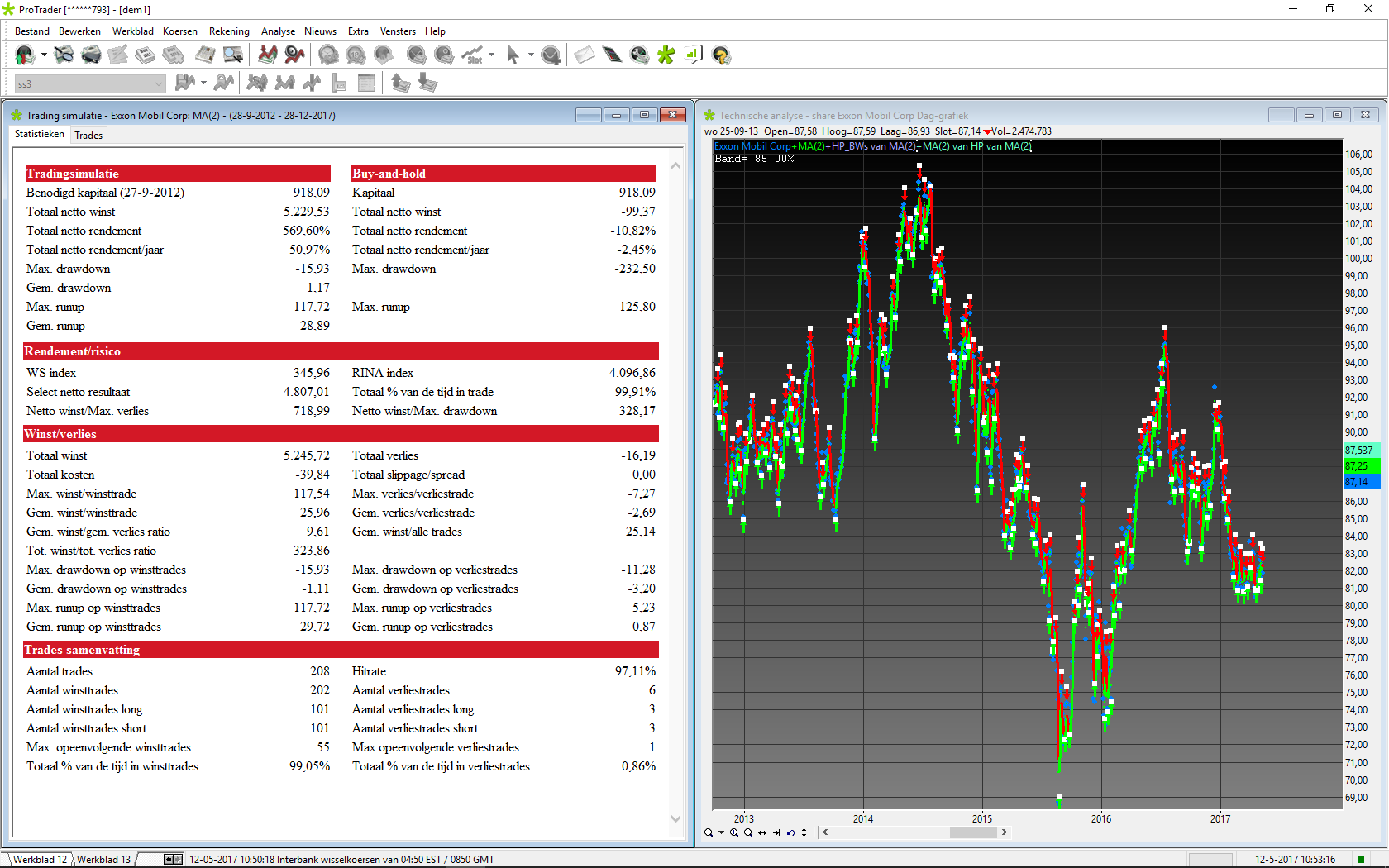

Backtesting results from 2013-2017 in Exxon using the Hodrick Prescott indicator (12-05-17)

First indicator is a 2 day moving average on the close price of Exxon.

attached to that is the Hodrick Prescott indicator with a lamba of 1

attached to that is a 2 day moving average to do the backtesting with:)

Starting amount in example = 1000 dollar

End result = 5200 dollar

Backtesting results from 2013-2017 in Seadrill using the Hodrick Prescott indicator (12-05-17)

First indicator is a 2 day moving average on the close price of Seadrill.

attached to that is the Hodrick Prescott indicator with a lamba of 1

attached to that is a 2 day moving average to do the backtesting with:)

Starting amount in example = 1000 dollar

End result = 20000 dollar

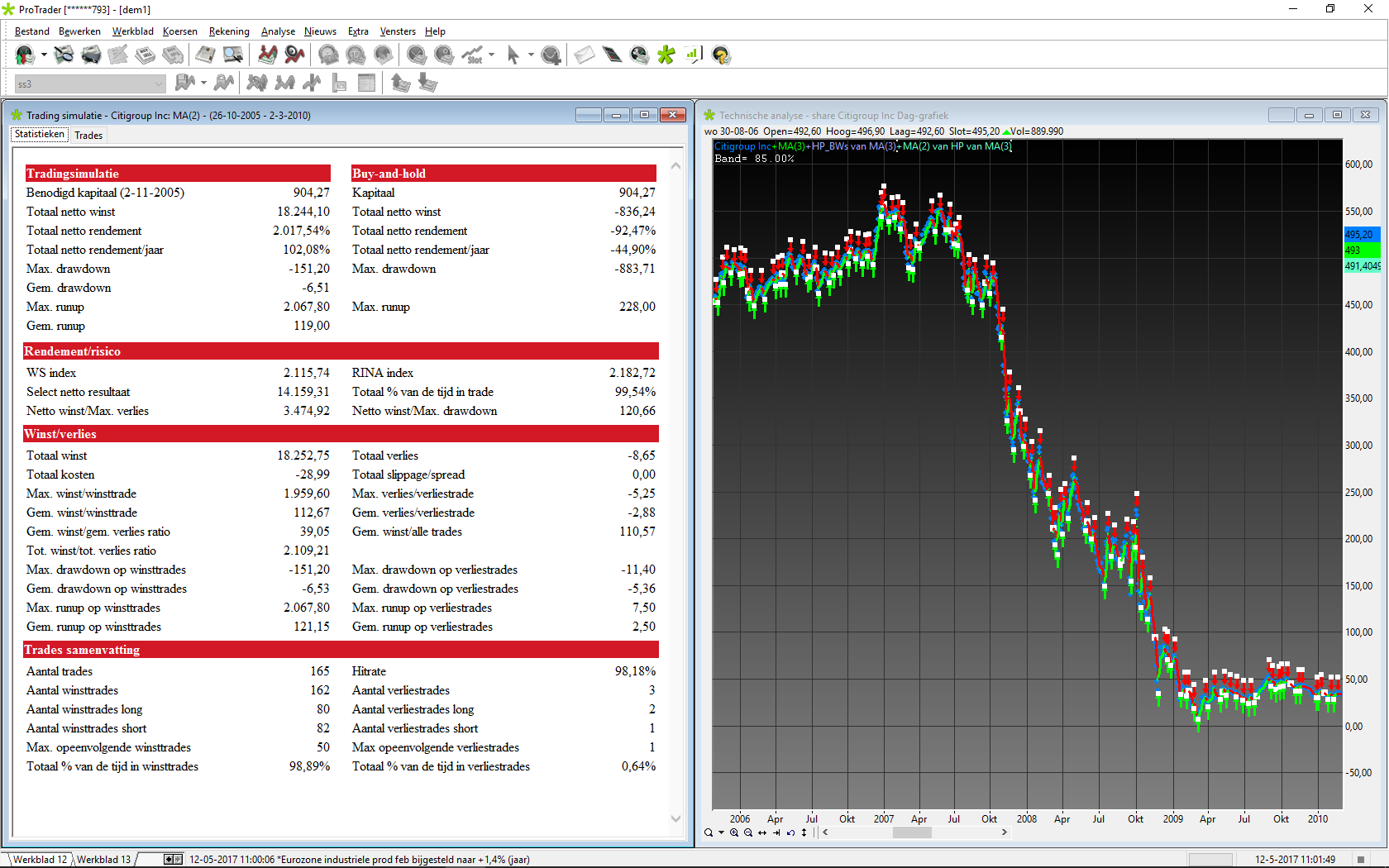

Backtesting results from 2006-2010 in Citigroup using the Hodrick Prescott indicator (12-05-17)

First indicator is a 3 day moving average on the close price of Citigroup.

attached to that is the Hodrick Prescott indicator with a lamba of 1

attached to that is a 2 day moving average to do the backtesting with:)

Starting amount in example = 1000 dollar

End result = 18000 dollar

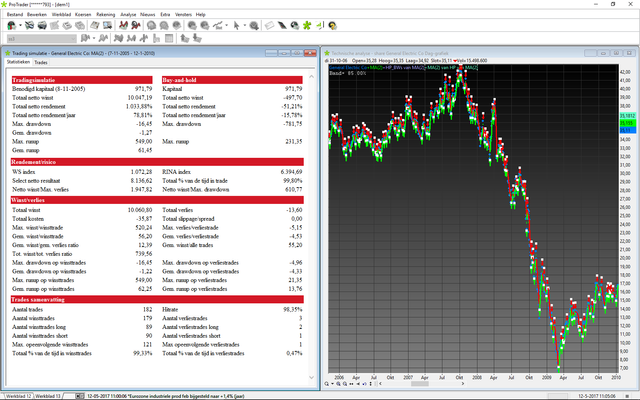

Backtesting results from 2006-2010 in General Electric using the Hodrick Prescott indicator (12-05-17)

First indicator is a 2 day moving average on the close price of General Electric.

attached to that is the Hodrick Prescott indicator with a lamba of 1

attached to that is a 2 day moving average to do the backtesting with:)

Starting amount in example = 1000 dollar

End result = 10000 dollar

Perfectly!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit