( )

)

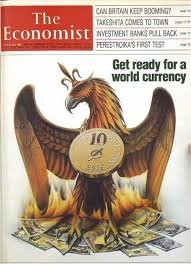

THIRTY years from now, Americans, Japanese,

Europeans, and people in many other rich countries, and

some relatively poor ones will probably be paying for

their shopping with the same currency. Prices will be

quoted not in dollars, yen or D-marks but in, let's say, the

phoenix. Te phoenix will be favoured by companies and

shoppers because it will be more convenient than today's

national currencies, which by then will seem a quaint

cause of much disruption to economic life in the last

twentieth century.

At the beginning of 1988 this appears an

outlandish prediction. Proposals for eventual monetary union proliferated fve and ten

years ago, but they hardly envisaged the setbacks of 1987. Te governments of the big

economies tried to move an inch or two towards a more managed system of exchange

rates - a logical preliminary, it might seem, to radical monetary reform. For lack of cooperation

in their underlying economic policies they bungled it horribly, and provoked

the rise in interest rates that brought on the stock market crash of October. Tese

events have chastened exchange-rate reformers. Te market crash taught them that the

pretence of policy co-operation can be worse than nothing, and that until real cooperation

is feasible (i.e., until governments surrender some economic sovereignty)

further atempts to peg currencies will founder.

But in spite of all the trouble governments have in reaching and (harder still)

sticking to international agreements about macroeconomic policy, the conviction is

growing that exchange rates cannot be lef to themselves. Remember that the Louvre

accord and its predecessor, the Plaza agreement of September 1985, were emergency

measures to deal with a crisis of currency instability. Between 1983 and 1985 the dollar

rose by 34% against the currencies of America's trading partners; since then it has fallen

by 42%. Such changes have skewed the patern of international comparative advantage

more drastically in four years than underlying economic forces might do in a whole

generation.

In the past few days the world's main central banks, fearing another dollar

collapse, have again jointly intervened in the currency markets (see page 62). Marketloving

ministers such as Britain's Mr. Nigel Lawson have been converted to the cause of

exchange-rate stability. Japanese ofcials take seriously he idea of EMS-like schemes

for the main industrial economies. Regardless of the Louvre's embarrassing failure, the

conviction remains that something must be done about exchange rates.

Something will be, almost certainly in the course of 1988. And not long afer the

next currency agreement is signed it will go the same way as the last one. It will

collapse. Governments are far from ready to subordinate their domestic objectives to

the goal of international stability. Several more big exchange-rate upsets, a few more

stockmarket crashes and probably a slump or two will be needed before politicians are

willing to face squarely up to that choice. Tis points to a muddled sequence of

emergency followed by a patch-up followed by emergency, stretching out far beyond

2018 - except for two things. As time passes, the damage caused by currency instability

is gradually going to mount; and the very tends that will make it mount are making the

utopia of monetary union feasible.

Te new world economy

Te biggest change in the world economy since the early 1970's is that fows of money

have replaced trade in goods as the force that drives exchange rates. as a result of the

relentless integration of the world's fnancial markets, diferences in national economic

policies can disturb interest rates (or expectations of future interest rates) only slightly,

yet still call forth huge transfers of fnancial assets from one country to another. Tese

transfers swamp the fow of trade revenues in their efect on the demand and supply for

diferent currencies, and hence in their efect on exchange rates. As

telecommunications technology continues to advance, these transactions will be

cheaper and faster still. With unco-ordinated economic policies, currencies can get

only more volatile.

Alongside that trend is another - of ever-expanding opportunities for

international trade. Tis too is the gif of advancing technology. Falling transport

costs will make it easier for countries thousands of miles apart to compete in each

others' markets. Te law of one price (that a good should cost the same everywhere,

once prices are converted into a single currency) will increasingly assert itself.

Politicians permiting, national economies will follow their fnancial markets -

becoming ever more open to the outside world. Tis will apply to labour as much as to

goods, partly thorough migration but also through technology's ability to separate the

worker form the point at which he delivers his labour. Indian computer operators will

be processing New Yorkers' paychecks.

In all these ways national economic boundaries are slowly dissolving. As the

trend continues, the appeal of a currency union across at least the main industrial

countries will seem irresistible to everybody except foreign-exchange traders and

governments. In the phoenix zone, economic adjustment to shifs in relative prices

would happen smoothly and automatically, rather as it does today between diferent

regions within large economies (a brief on pages 74-75 explains how.) Te absence of

all currency risk would spur trade, investment and employment.

Te phoenix zone would impose tight constraints on national governments.

Tere would be no such thing, for instance, as a national monetary policy. Te world

phoenix supply would be fxed by a new central bank, descended perhaps from the IMF.

Te world infation rate - and hence, within narrow margins, each national infation

rate- would be in its charge. Each country could use taxes and public spending to ofset

temporary falls in demand, but it would have to borrow rather than print money to

fnance its budget defcit. With no recourse to the infation tax, governments and their

creditors would be forced to judge their borrowing and lending plans more carefully

than they do today. Tis means a big loss of economic sovereignty, but the trends that

make the phoenix so appealing are taking that sovereignty away in any case. Even in a

world of more-or-less foating exchange rates, individual governments have seen their

policy independence checked by an unfriendly outside world.

As the next century approaches, the natural forces that are pushing the world

towards economic integration will ofer governments a broad choice. Tey can go with

the fow, or they can build barricades. Preparing the way for the phoenix will mean

fewer pretended agreements on policy and more real ones. It will mean allowing and

then actively promoting the private-sector use of an international money alongside

existing national monies. Tat would let people vote with their wallets for the eventual

move to full currency union. Te phoenix would probably start as a cocktail of national

currencies, just as the Special Drawing Right is today. In time, though, its value against

national currencies would cease to mater, because people would choose it for its

convenience and the stability of its purchasing power.

Te alternative - to preserve policymaking autonomy- would involve a new

proliferation of truly draconian controls on trade and capital fows. Tis course ofers

governments a splendid time. Tey could manage exchange-rate movements, deploy

monetary and fscal policy without inhibition, and tackle the resulting bursts of

infation with prices and incomes polices. It is a growth-crippling prospect. Pencil in

the phoenix for around 2018, and welcome it when it comes.

Congratulations @scoopthisgames! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit