I don't like to sell naked puts. Bull put spreads are a better way to limit margins and downside risk. The margin for selling bull put spreads should never be more than 5% of your trading portfolio, so the risk is controlled. If there was EVER a time to understand why 5% MAX ALLOCATION PER POSITION should be adhered to, the crash of feb 2018 is a perfect case study.

Use the 5-10-20 rule to find high probability trade setups with a solid ROI and limited risk.

- No more than 5% of portfolio should be allocated to any single trade

- The difference between current stock price and short put strike must be at least 10%.

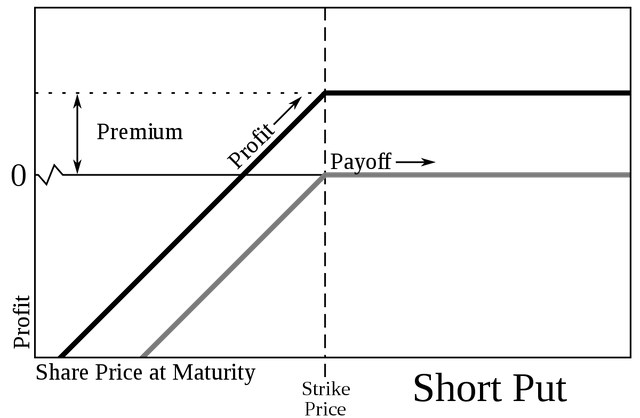

- The return on selling either naked puts or preferably bull put spreads should be at least 20% on full margin requirement otherwise it is not worth it.

Always after heavy pull backs occur we see put sellers come in first. Then as implied volatility subsides, we start to see leap call buyers. Generally you should sell options when implied volatility is priced expensive. And buy options when iv is too low.

When i buy options i try to get at least 0.3 delta and 45 days to expiration. With selling it's the opposite, look for options with less than 0.3 delta and an expiration date max 1 month far.

Don't sell options or calendar/diagonal spreads when earnings are coming out. Stocks usually make the biggest moves on earnings and it makes the implied volatility go up. Try to avoid any type of binary events, volatility is not good when you are just trying to collect the premium.

Options are now getting more mainstream in the crypto market aswell. With Deribit you can trade options on bitcoin (and soon also ethereum). Check it out here: https://steemit.com/bitcoin/@niel96/how-to-trade-bitcoin-futures-and-options-with-deribit