Hi,

Im paintninja from youtube. I'll be posting on steem from now on i've recently began to be involved in the crypto space.

Who am I? I have run a semi-successful painting business between the gold coast, bris and down as far as byron bay for most of my adult life. During that time I have enjoyed both massive success and failure on the business front.

Along the way I have been investing in property, shares, and now cryptocurrencies. I passively invest every single week without fail, dollar cost averaging which of course compounds, pays dividends which are re-invested and then in the long run will provide and exponential return.

I encourage everybody to consistently take money off the table by paying themselves first, i.e. Put away 10-20% of your earnings BEFORE you pay all expenses. Do this habitually, every week, fortnight, month. I realise small business has quite a lot of cashflow problems and this can sometimes be difficult, but it is important to invest and save along the way so if you do have business failure (which i have had plenty of) you still will have the economic energy you have generated boiling away in the background growing and further producing income.

My favourite investing app presently is acorns, the returns so far have been quite reasonable hovering around 6% pa for me. I find it easier and by far less time consuming than researching, and investing in individual stocks etc. I outsource that to acorns, and its working so far.

If you would like to know more about painting, property or anything I post on here please comment and i will try to respond as quickly as possible.

My current favourite crypto's are:

Ripple, Antshares, Steem, Golem, Stratis & Ethereum.

My recommended readings would be:

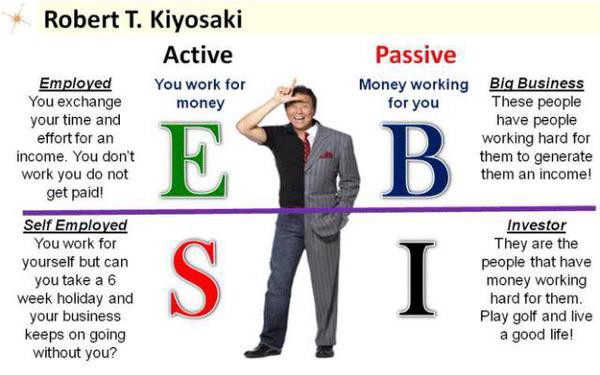

Rich Dad Poor Dad, Rich Dad's guide to investing, Conspiracy of the rich < All by the same author, Robert Kiyosaki, i have not yet to find better quality material in such a concise and easy to read guide for the layman.

If you read these books, and you have children, i encourage you to force them to read the books even by paying them to do so if you have to. The information pertained in these books is life changing, and can lead to you leaving a legacy for your children, and grandchildren.

Great advice Paintninja. What are your thoughts on EOS? My favorite are coins are Ethereum and Iota.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ok... EOS has only recently popped up on my radar in the last week or so, and i know next to nothing about it, so I cannot really comment on it.

My rationale i am using to buy crypto's is similar to that i would use for individual stock investing, that being majority blue chip, with some medium sized companies as well. I will not even look at the penny dreadfuls of the cryptocurrency world, although i realise there are number of people who have made money specifically in this space, it is not going to be the most reliable way to get into crypto's IMO.

The things I am looking for in crypto's are horizontal / vertical integration, and a monopoly style business. That is a business that owns the entire supply chain (wholesale / retain / transport / manufacture etc) and has emerged as one of the top 15 or so blockchains with a scarcity of coinage.

The scarcity rule i have not applied to ripple however as the major banks seem to be deciding between ripple, and ether. In Australia here 2 of our top 4, NAB & WBC (National Australia Bank 80bn/mcap and Westpac Bank 100bn/mcap) have involvement in the ripple space, and i believe this is the case in a lot of developed economies. Therefore I have broken the rule on that occasion for this very specific reason.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

EOS and Burst coin are excellent technologies that have real world applications.

My radar is beeping and I cast a wide net.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

had a very good day today i see, I'm not even sure it was in the top 50 and now its no. 9 by market cap at 700bn. I don't think i'll chase it at this point. What price did you get in at? Cant access their website i think too much traffic.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit