.jpg)

The Introduction

Decentralized finance has made a tremendous impact on the cryptocurrency market. Since its beginning in the crypto sector, it has shown to be an effective financial technology. DeFi has made financial inclusion available to both low and middle-income earners. In this essay, I will share with my readers a game-changing Decentralized financial ecosystem that will provide a Decentralized Investment Loan Protocol, a trustless and permission-less undercollaterized DeFi lending platform, and other benefits. This is going to be massive. I'm talking about the PAXO platform. Paxo is a next-generation DeFi network designed to promote financial inclusion and provide frictionless Decentralized financial services to the global masses. Paxo will provide a smooth deFi solution that will provide a highly appealing, hospitable, and cheap transaction cost decentralized financial system.

About the Paxo Finance

PAXO is a ground-breaking DeFi ecosystem designed to provide large-scale DeFi services. It would provide a decentralized money market system with investment loan options, allowing users to participate in digital assets through multi pool borrowing. PAXO's incredible features include low transaction costs, a non-custodial and totally decentralized service, a perpetual contract, and a very attractive interest rate for ecosystem lenders. Furthermore, there will be choices for large loans with cheaper interest rates. Traders can take out loans and repay them in accordance with the ecosystem's stipulations. All of these services are provided through a decentralized system, so no complicated paperwork or identification is required.

PAXO will provide a flexible Loan Repayment plan that will allow consumers to return their loans over a period of 3-6-12 months. On the site, users can also choose their payback time frame.

PAXO offers an open system to everyone. As previously stated, PAXO is a completely decentralized protocol that is accessible to anybody through the usage of bitcoin. Based on the protocol conditions, anybody can borrow and lend on the site. Lending on PAXO is only possible using bitcoin. There are no KYC or credit checks required. There is no complicated paperwork required before receiving loans. The ecosystem's purpose is to encourage financial inclusion among the global masses while also providing the greatest DeFi services to the global masses.

PAXO Ecosystem Characteristics

Highly Secured Platform

The Paxo Finance ecosystem is highly secure and compliant. PAXO smart contracts have been thoroughly examined by a recognized blockchain audit company. Because of this functionality, users should feel safe when utilizing the PAXO Finance protocol. The entire system is automated and distributed. The smart contracts are bug-free and have no security flaws.High Yield Platform with Low Transaction Fees

PAXO will enable multichain, allowing users to choose their preferred network. As collateral, isolated pools and a diverse variety of digital assets such as Wrapped BTC (WBTC, BTC, and Matic are supported.Simple User Interface

The Paxo Finance UI is a user-friendly kind that is created for everyone's convenience. It is a user-friendly and simple platform.Completely Decentralized Platform

As a fully decentralized platform, it provides for worldwide access. As long as they have their crypto assets, anyone from anywhere in the globe can utilize the site. There are no restrictions on using the site, lending and borrowing do not require credit checks or KYC.

The Objective of the Paxo Finance

Paxo will most likely activate the following million wallets in the DeFi 2.0 biological system. The platform will allow ordinary investors to approach help to participate in crypto-resources with minimum risk. PAXO is working with other DeFi conferences to empower marking and cultivation using donated resources.

Using the Paxo convention, clients may obtain and deposit resources into a variety of computerized resources. The purchased resources are kept locked within the convention; clients can use the purchased resources for marking/yield cultivation, and so on within the PAXO convention. Paxo's financing costs are quite aggressive and among the best in the industry, allowing banks to obtain significant, long haul profits while granting borrowers unexpected loans, allowing them to participate in the cryptographic money market.

Paxo Finance's Outstanding Features for DeFi Lending and Borrowing

Paxo introduces uncollateralized borrowing options in the DeFi space, allowing users to trade long/short positions.

To facilitate loan service, Paxo employs a smart contract-based trustless protocol that does not reliant on credit rating or any centralized enforcement.

Paxo Finance Lenders benefit from excellent, long-term rates of return while providing cryptocurrency borrowers with predictable loans that enhance their capacity to invest in the cryptocurrency market.

Paxo's smart contracts will be open to the public and absolutely free for computers, dApps, and people to use.

Paxo addresses these challenges by providing the community with instant, permissionless, insurance-free credit at affordable lending rates. Such a feat is possible because of our decent, uncomplicated, and adaptable gamble reward sharing framework, which is capable of delivering credits of up to multiple times the value of guarantee while supplying enticing and manageable re-visits to moneylenders who invest resources into the convention.

There have been several stages giving such administrations in the crypto loaning market. These stages can be structured in two ways: brought together and decentralized. The main distinction is whether or not a company substance or a brilliant agreement convention is in charge of the exchange cycle.

PAXO is a decentralized currency market convention that opens new speculative credit options in the DeFi sector, allowing clients to invest in computerized resources through multi pool getting. The clever agreement of Paxo Finance does not rely on loan scores from concentrated substances, for example, banks to direct loaning administrations. The agreement was created with both moneylenders and borrowers in mind, and it provides financiers with enticing and economical rates of return while providing borrowers with under-collateralized credits.

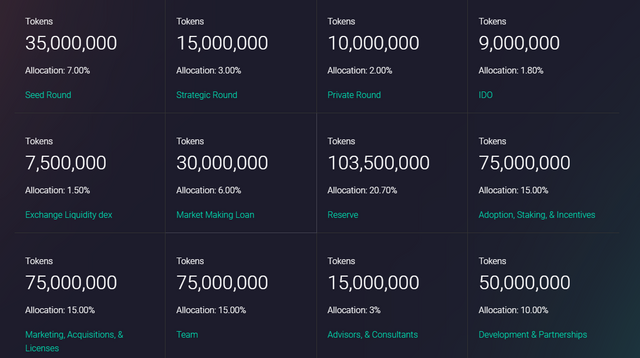

Tokenomics

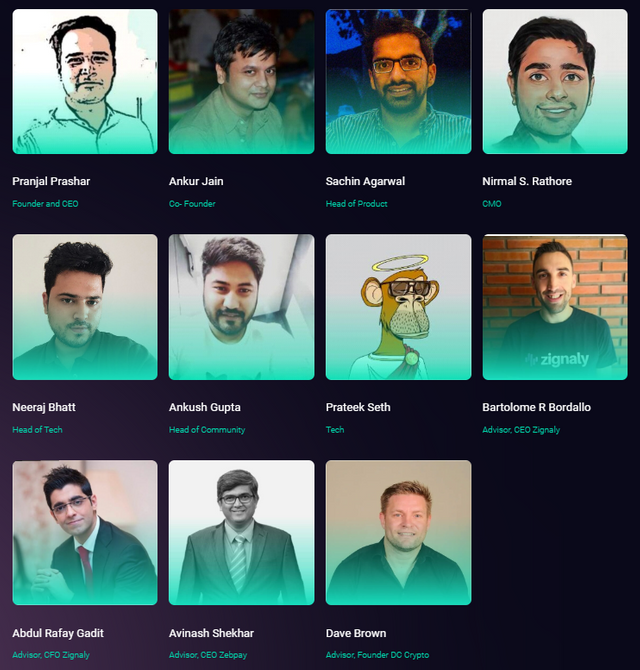

The Team

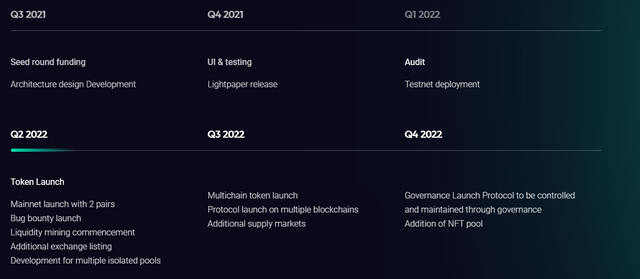

The Roadmap

The Summary

If you imagine you are among those who can rise to the challenge of boosting DeFi adoption among the larger ones, Paxo Avengers seeks to play various roles in the ecosystem in order to achieve Paxo's objective of fair money and prosperity. They will connect the Paxo blockchain system to the bitcoin community. This is a unique role that will allow them to work directly with the architects of Paxo Finance on the future of DeFi while also increasing public awareness of its greatness. Join us right away and contribute to our project's success in the crypto market!

For more info :

Website : https://paxo.finance/

Medium : https://medium.com/@paxofinance

Telegram : https://t.me/paxofinance

Twitter : https://twitter.com/paxofinance

Author Details:

Forum Username: Kavindu123

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3374029;sa=summary

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well written

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit