One of the first steps to achieving financial inclusion is to build a decentralized ecosystem. Cryptocurrencies allow you to access the world's financial markets without a centralized authority. These systems are also characterized by open markets and are more secure than traditional financial systems because there is no human intervention. In this way, anyone can use these services without any problems. A few key elements of a successful decentralized ecosystem are: For instance, the first pillar of the DeFi ecosystem is to create a decentralized financial service network. Its goal is to eliminate geographical, status, and wealth barriers. Refugees, for example, can register with their smartphones and then use the mobile network to access loans and other financial services. The digital profiles are secured by the blockchain and can be used for many purposes. They will be able to start a business or apply for a loan. In addition, the decentralized ecosystem eliminates the need for intermediaries. As a result, global payments are affordable and a single transaction fee of only 4% is predicted.

Website: https://payme.games/

Twitter: https://twitter.com/paymequiz

Telegram: https://t.me/paymetriviaquiz

Facebook: https://www.facebook.com/paymequiz

Whitepaper: https://payme.games/whitepaper

Instagram: https://www.instagram.com/paymequiz/

Forum Username: GraingerTainMian

Forum Profile Link: https://bitcointalk.org/index.php?

action=profile;u=2119363;sa=summary

Telegram Username:@GraingerTainMian635

BSC Wallet Address:0x1c53a6F71559A4307B2A088612EB921359E0FC90

The Technologies Behind Payme

As a result, the DeFi ecosystem is designed to eliminate location, status, and wealth barriers. By using a unique ID number, it makes it easier for refugees to access credit and financial services. By securely storing and securing digital profiles on the blockchain, refugees will be able to access loans and build their own businesses. Another benefit of the DeFi ecosystem is that it makes global payments affordable. With just a four percent fee, the cost of international payments will be very low.Another project is called Stellar. The nonprofit organization behind Stellar aims to provide financial services to those who don't have access to traditional financial services. This project uses its own virtual currency, lumens, to offer low-cost financial services. It initially focused on developing countries in Africa, but it has already proven its cost-effectiveness and efficiency. Its goal is to help the poorest people around the world access the benefits of modern finance.

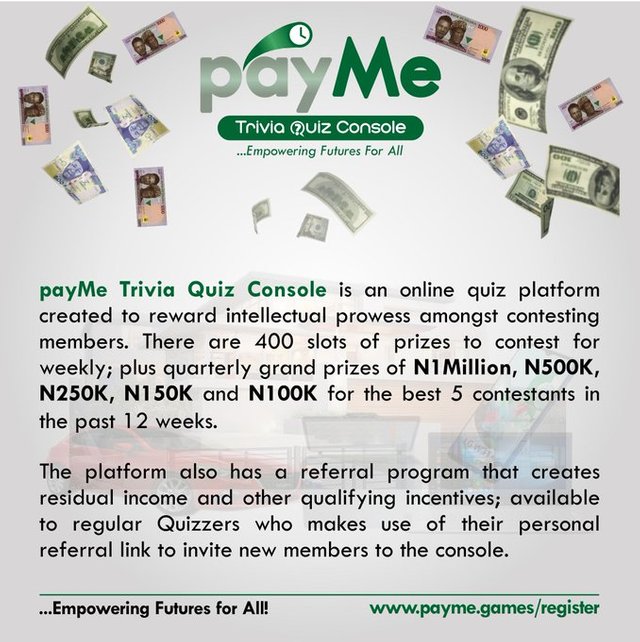

Payme allows users to spend their crypto with a single click

Although cryptocurrency is volatile, it is a great alternative for the conventional banking system. It offers a decentralized platform to lend and receive money from individuals. By facilitating these transactions, PayMe allows users to spend their crypto with a single click. There are numerous advantages to using a decentralized lending network. It enables a wide range of services and benefits for people from all over the world. Further, it allows people to transfer funds without requiring a bank account.The decentralized system uses stablecoins as a medium of exchange. It is perfect for retail and earning. It is widely used in Latin America as a way to protect their savings from inflation. Its decentralized providers offer loans in two main ways: peer-to-peer lending, in which a borrower will borrow directly from a lender; and pool-based lending, which means the borrower will borrow from a pool of lenders.Payme is a better alternative than the traditional banking system in many ways.

Its system is highly secure, making it easy to transfer money to and from people in different countries. It also facilitates peer-to-peer lending. In addition to reducing the costs of a loan, payME is faster and more efficient than any traditional lender.With its decentralized platform, users can send and receive cryptocurrency funds from over 400 million locations worldwide. It is possible to send and receive a large amount of money using only one coin. The process is fast and convenient. The user can transfer and receive funds in just a few minutes. The platform also offers attractive interest rates, which is a huge draw for many users. The main goal of payME is to make financial inclusion as widespread as possible.

To reach financial inclusion, payME must offer competitive interest rates

As a result, businesses should look for ways to increase their customer base. The aim of the decentralized network is to reduce the amount of fraud and increase profits. While the company does not want to become a central bank, it will be a global payment hub. The network should offer competitive interest rates and be a safe haven for consumers.✓ Hashtags: #payme #payME #Gaming #gaming #P2E #p2e #Trivia #trivia

✓ Website Link

Website: https://payme.games/

Twitter: https://twitter.com/paymequiz

Telegram: https://t.me/paymetriviaquiz

Facebook: https://www.facebook.com/paymequiz

Whitepaper: https://payme.games/whitepaper

Instagram: https://www.instagram.com/paymequiz/

✓ Proof of Authentication Post

Forum Username: GraingerTainMian

Forum Profile Link: https://bitcointalk.org/index.php?

action=profile;u=2119363;sa=summary

Telegram Username:@GraingerTainMian635

BSC Wallet Address:0x1c53a6F71559A4307B2A088612EB921359E0FC90