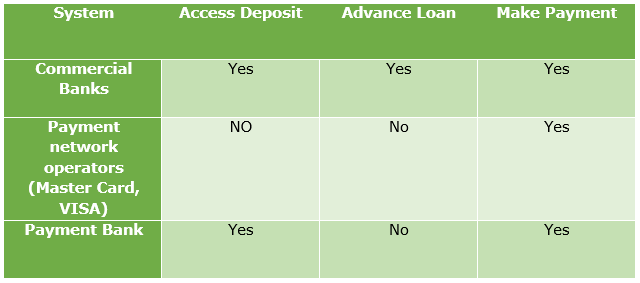

Payments bank is like any other bank conceptualized by the Reserve Bank of India (RBI). Payment bank operates on a smaller scale without involving any credit risk. Payment bank is not allowed to advance loans or issue credit cards like other banks but it can carry out most banking operations.

Payment Bank is allowed to accept demand deposits up to Rs. 1 lakh, offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking, and third-party fund transfers. In September 2013 RBI constituted a committee for the purpose of achieving financial inclusion and increased access to financial services. There is a requirement of minimum paid up capital of 100 crores.

The main objective of the payment bank is concerned with the financial services to small business, low-income households, migrant labor workforce in the secured technology-driven environment.

RBI seeks to increase the penetration level of financial services to the remote areas of the country with the payment banks.

Due to the demonetization drive in November 2016, mobile wallets gained mainstream acceptance from being seen as a niche player. It is considered as one of the key drivers of payment banks in India.

A payments bank is set up under the payments banks guidelines issued by the Reserve Bank of India (“RBI”) and it is a differentiated micro-bank with limited banking functions.

Through a smartphone, these banks are allowed to provide basic financial services as it is not economical for conventional banks to have branches in remote areas.

In India with the reach and proliferation of mobile phone penetration, payments banks can use this network to bring such remote areas into the banking system, without incurring significant expenses.

Payments bank has low deposit limit which is a comfortable amount even for persons belonging to lower income groups. It will help in transitioning the users to a less-cash dependent lifestyle since the transactions are cashless.

Requirements to Setup Payment Bank

As per the Guidelines issued by the RBI, the RBI undertakes a preliminary assessment of the applicants and grants principle approval to the applicant to set up a payments bank.

Principle approval will be valid for a period of 18 months, during this period of time applicants have to comply with the other requirements and conditions specified under guidelines stipulated by RBI.

These include the following:

· The minimum capital requirement is INR 1 billion.

· For the first five years from the commencement of its business, restriction on dilution of promoter shareholding in the payments bank company below 40%.

· In Payment Bank, voting rights of stakeholders will be regulated as per the Banking Regulation Act, 1949, which in the first instance caps voting rights of a shareholder in a private sector bank at 10%. This limit can be increased by RBI up to a maximum of 26% in a phased manner.

· Prior approval of the RBI will be required in case of acquisition of more than 5% of stake in the payments bank company by any party.

· Availability of fully networked and technology-driven infrastructure right from the outset.

· In Payment Bank, foreign shareholding will be as per the prevalent Foreign Direct Investment (“FDI”) policy for private sector banks.

· Have at least 25% physical access points, including business correspondents in rural areas.

Acts Covered Under Payment Bank

· Companies Act, 2013.

· Banking Regulation Act, 1949.

· Reserve Bank of India Act, 1934.

· Foreign Exchange Management Act, 1999.

· Payment and settlement systems Act, 2007.

· Deposit Insurance and credit Guarantee Corporation Act, 1961.

· Other applicable rules and regulations that may come from time to time.

Payment Bank Operations

Here are the following activities permitted to undertake by a Payment Bank:

· Operate savings and current account both.

· Accept deposits per customer up to INR 100,000 and pay interest on these balances like that of a savings bank account of conventional banks.

· Through mobile phone, enable transfers and remittances.

· Through mobile phone, offer services such as automatic payment of utility bills and cashless purchases.

· Set up branches and ATMs (automated teller machines) and issue debit cards and ATM cards usable on ATM networks of all banks.

· Transfer money directly to bank accounts at nearly no cost being part of the gateway that connects banks.

· Provide forex cards to travelers, usable again as a debit or ATM card all over India.

· Offer forex services at charges lower than banks.

· Offer card acceptance mechanisms to third parties such as Billdesk and Paypal.

· Sell third-party non-risk sharing simple financial products like mutual fund units and insurance products through its mobile apps and outlets.

Payments Bank License holder is prohibited from issuing credit cards and undertaking any kind of lending activities. For payment banks, setting up subsidiaries to undertake non-banking financial services activities is also prohibited.

In addition to the cash reserve ratio, it is also required to invest a minimum of 75% of their “demand deposit balances” in Statutory Liquidity Ratio (SLR) eligible government securities/treasury bills with maturity of up to one year and to hold maximum 25% in current and time/fixed deposits with other scheduled commercial banks for operational purposes and liquidity management.

Eligible Players

· Existing non-bank prepaid payment instrument under the Payment and settlement systems Act, 2007. (They can opt for conversion to payment bank)

· Individuals/professionals.

· NBFC’s (non-banking finance companies).

· Business correspondents.

· Mobile telephone companies.

· Supermarket chains.

· Companies (public companies).

· Real sector cooperatives.

· Public sector entities.

Business Model

As far as financial inclusion and safeguarding depositor interest is concerned, stringent norms prescribed under the Guidelines for payments banks may appear to be on the right track.

· Major revenue generator for conventional banks is interesting/charges on lending services and in the absence of the same, as the main source of income payments banks are essentially dependent on transactional charges for their banking services. The biggest drawback for payments banks is a blanket prohibition on lending activities.

· Another sore point for payments banks is investment prohibition.

As mentioned above, Guidelines require payment banks to invest minimum 75% of its “demand deposit balances” in SLR eligible government securities/treasury bills and maximum 25% in current and time/fixed deposits with other scheduled commercial banks.

This restriction will obstruct a payments bank from optimally augmenting its resources through diversified funds management.

For payment banks, the direct revenue stream is transactional charges for banking services such as transfer, depositing or withdrawing funds. They can also generate revenue by means of advertisements, cross-selling permitted third-party financial services/products to its customer base and providing other data-led assisted services.

The main objective of the payments banks is the financial inclusion of the population which is not within the scope of the traditional banking network. They are not intended to replace the conventional banking system. These banks can function at best as auxiliaries to the conventional banking system of the country given the strict licensing norms and restricted scope of activities.

Areas where there are hardly any ATMs or banks, payment banks have the potential to bridge this gap with their telecom assisted banking services. For payments banks, this is a major advantage over their traditional counterparts, which can also be a game changer for the banking sector in India.