With the popularity of smartphones and the continuous development of e-commerce, e- payment methods have begun to permeate to people’s daily lives. However, in Southeast Asian countries, the use of cash and bank transfers is still widespread in the region.

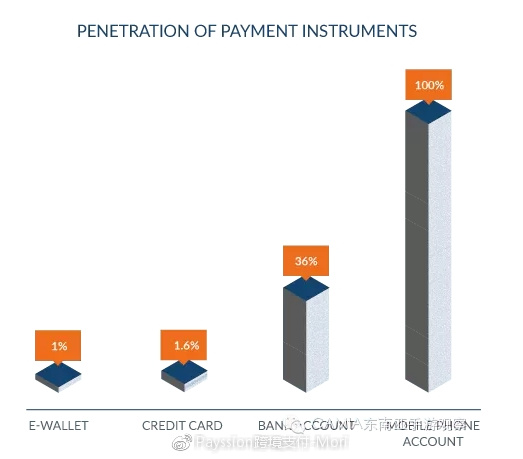

Payment methods in Southeast Asia have always varied across different markets: cash on delivery, bank/ATM transfers, credit cards, mobile wallets, etc. due to the nascent nature of e-payments. More than 73% of the region’s population is still unbanked — 438 million — and lack trust in sharing information through online channels.

Another big problem with online payments in Southeast Asia is that each market in the region has multiple digital wallet services from different players, making the payments sector highly fragmented and frustrating for consumers who wish to pay online.

Indonesia

As Southeast Asia’s largest economy, Indonesia is recognized for its resilient economic growth and low government debt. Indonesia’s online payment mainly includes online banking transfer, bank transfer, wallet and cash, accounting for 27% of online banking, 39% of bank transfer, 25% of cash and 5% of wallet respectively.

One-third of Indonesia’s population has bank accounts. Indonesia’s four major banks account for 90% of the market share, while the credit card market has only 2% coverage in Indonesia. Therefore, bank transfer, ATM transfer, online banking and cash payment are the most popular online shopping payment methods in Indonesia.

Thai

The potential to reach Thai consumers is further encouraged by the long hours they spend using mobile internet and social media. Thailand spends more time on the internet (including mobile internet) than any other nation. This sets the stage for further expansion of bank transfers as the most dominant payment method for e-commerce.

Like many markets around the world, Thai retailers and chain restaurants are facing a rapidly changing business environment. Technology has changed consumer behavior, and people are demanding more and more speed for online shopping and catering. Thailand’s e-wallet and cashless payment are booming, and e-payment is becoming more and more popular with the full support of the government.

Vietnam

Vietnam is currently one of the countries with the worst financial inclusion in Southeast Asia, with only 59% having bank accounts, behind 86% in Thailand and 92% in Malaysia.

In 2018, Vietnam had a total population of 96.96 million, of which 36% were urban. There are 143.3 million mobile phone users, accounting for 148% of the total population. There are 64 million Internet users, accounting for 66% of the total population.

Vietnam Becomes One of Southeast Asian Countries with Fastest Growth in Smartphone Use. The government is also working hard to make the country cashless by 2020. State Bank of Vietnam also continues to update its payment system to create and promote favorable conditions and encourage non-cash payments.

Singapore

In Singapore, cash is usually used only for small payments, while credit cards are widely accepted. Apart from major credit cards, Singapore also has several NETS-led cashless payment methods.

NETS aims to operate payment networks and promote the widespread use of electronic payments. In the past 20 years, Nets has been in Singapore’s vanguard position towards Cashless society. Today, there are 30,000 stores across Singapore that offer NETS payment services. Cash-free transactions are allowed from the smallest neighborhood stores to the largest supermarkets. Businesses all know that NETS system is very reliable and easy to pay.

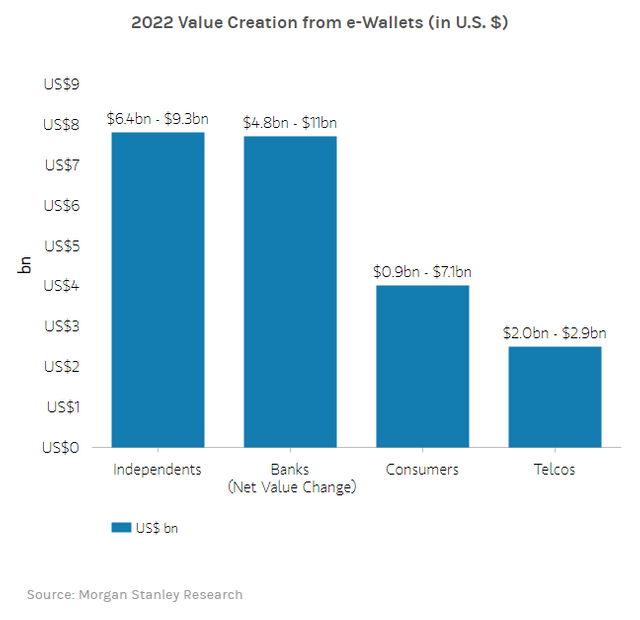

In these areas where consumers are heavily dependent on cash, the task of promoting the development of the electronic payment industry is arduous. For ASEAN countries as a whole, however, independent payment companies still have the most to gain from a widespread move from cash to digital payments. Morgan Stanley estimates that banks in the region could lose US$13-$15 billion in value across ASEAN to non-bank operators by 2022, with anywhere from $6.4 billion to $9.3 billion of that going to independents.