Braintree

PayPal purchased Braintree in 2013. One of the main problems with PayPal was in a redirection of the user from the seller's website to the PayPal server, and it required the user to be a registered service user. It was a reason for discontent from both parties, so the purchase of Braintree solved the problem.

Online payment platform Braintree provides developers with SDKs and adjusted API interfaces in six programming languages as well as with ready-made solutions for baskets. PayPal's Commerce feature, that was launched recently, means that dealers can integrate Purchase buttons into such apps like Pinterest or Facebook Messenger. Stripe's Relay feature may look similar to it. Braintree also has a phone support that is available for all customers.

Online payment processing comparison

Braintree doesn't charge a monthly payment for processing payments either. It charges a commission for a transaction at the rate of 2.9% from transaction amount plus 30 cents per transaction. Braintree provides users with a special offer where your commission will be covered starting from $50.000 you processed.

If the amount you process exceeds $80,000 per month, you can get a discount.

If you receive PayPal via Braintree, you have no Braintree charges, but you will get PayPal payments.

If you receive Bitcoin via Braintree Coinbase option, your first processing in Coinbase with an amount of $1 million is free. After this, you will pay 1% of commission for conversion and 0.15% of the fee.

Some of famous clients of Braintree online payment gateway are Airbnb, Dropbox, Uber, Casper, Yelp, and others.

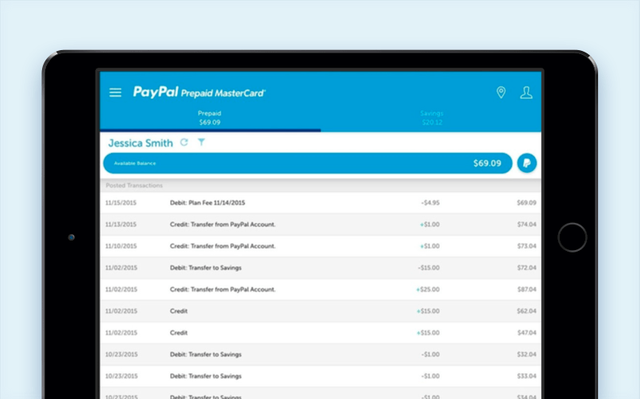

PayPal

PayPal can become a good alternative to other integrated payment systems in your web or mobile app. Of course, it can be integrated as the main solution, however, a lot of brands consider it as an alternative since some users don't want their credit card data to be stored on each trading platform where they made an order. PayPal is supported by all platforms. Since PayPal makes redirections to its website, you don't need a payment gateway integration. In case you want to add PayPal Express, redirection will be skipped, and Express API will submit all required information.

Also, there is no necessity to pay a subscription fee. A standard rate is 3.4% plus 30 cents for a transaction. If the amount you receive monthly exceeds $3.000, you will be able to apply for PayPal Merchant Rate that reduces your fees when you increase sales. Thus, you can pay 2.4% of the standard rate depending on sales for the previous month. So, this is how payment gateway works.

Famous PayPal clients are Walmart, eBay, Adobe, and others.

Stripe

Processing payments in Stripe is conducted via its own servers. Therefore, there is no necessity to store confidential data and think about its compatibility with the PCI. Stripe's system verifies fraud on its own. Stripe offers libraries to developers in six programming languages from Java to Go as well as many community libraries.

It is worth noting that Stripe has many third-party integrations that don't require development skills, hosting or complicated adjustment from your side, like Shopify does it, for example.

But you may require a developer for the integration of this payment system into the app. Besides, if you need to add payment system into the website, there are ready-made JavaScript libraries, and also iOS and Android SDKs for mobile apps that support Apple Pay and Android Pay respectively. Stripe supports more than 100 currencies and it offers a few methods of online payment. Apart from debit and credit cards, Apple Pay, and Android Pay, Stripe support Bitcoin and Amex Express Checkout.

There won't be redirection for customers from your website. Verification will be conducted on the computer and optimized for mobile devices. In 2015, Stripe added a Relay product that allows developers to create a Purchase button in the third-party apps like Facebook, Pinterest, and Twitter. Also, only Stripe allows users to receive payment via AliPay.

Stripe offers a standard fee to all users - 2.9% from each transaction plus 30 cents per transaction. It also provides discounts for enterprises that receive more than $80.000 per month. Also, Stripe allows users to make Bitcoin payments up to 5 bitcoins per day that equal to $625. This service also charges 0.8% from the transaction amount.

Famous clients of Stripe are Lyft, Instacart, Postmates, KhahAcademy, and Grab etc.

Full article link - https://www.cleveroad.com/blog/paypal-vs-stripe-vs-braintree-online-payment-gateway-comparison

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cleveroad.com/blog/paypal-vs-stripe-vs-braintree-online-payment-gateway-comparison

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit