i’m currently overwhelmed by the progress of blockchain technology and the extent to which blockchain technology is reaching in every aspects of human lives. Today’s platform which i’ll be discussing is based on management of pension funds with lots of benefit. AUCTUS

Over years, it has been discovered that a lot of people do not have any plan for their retirement; i mean financial wise, Only a few save up for retirement needs. All this is simply based on Pension. What is pension? A pension fund is an investment product into which, members pay contributions to build up a lump sum for the purpose of providing an income during retirement. The government reimburses income tax deducted from these contributions. In many cases, this is topped up with contributions from the member’s employer. We also have different pension schemes. i’ll be explaining this briefly in relation to the platform to be discussed.

Defined contribution plan in which the employer’s control over what is being set aside as savings for his own benefit is restricted.

Defined benefit pension plan in which an employer/sponsor promises a specified pension benefit on retirement

Lets see the problems pension is facing causing the need for effective management.

Poor Governance: Although the pension industry and lawmakers tried to improve the situation since the financial crisis, there are still numerous cases of poor performance due to poor governance practices. The use of a system that provides total transparency would facilitate control by regulators and participants, as well as increasing participant influence in the investment decision process, in order to seek good profitability within acceptable levels of risk.

Contribution Collection: There are also problems with contribution collection processes. There are no standardized processes, this frequently leads to operational issues. Record keeping of transfers can be challenging for smaller pension funds. Larger pension funds usually have no issue with this, but have to maintain expensive systems to manage this.

Hidden cost : Sometimes pension fund participants are not fully aware of all the costs involved. Asset management fees represent only part of overall costs, but there are a lot of other costs involved; minimizing these costs can lead to a transparency problem as described by Gail Moss and the IPE. Pension fund costs are comprised of transaction, trading and asset custody fees, but they also include regulation, administration and reporting costs. All these costs are often hidden and not transparent enough. Hidden costs reduce net investment returns and can significantly lower funds accumulated for retirement income.

Fraud: In the past two years, almost 20% of pension schemes have reported fraudulent activity. It’s common to have situations of fraud related to the provision of pension payments or benefits, as well as fraud aimed at stealing pension fund assets. Misrepresentation, ghost accounts, and fraud around processing and transfer of funds are also regular occurrences

Data Management The Pension Fund Dilemma Data management in pension schemes is another challenge. To achieve good performance in pension funds, data accuracy is required. Current systems for data management make it difficult for managers and trustees to have confidence in the data available to them. Especially smaller pension funds often rely on paper documents, or a variety of systems that are outdated. Data errors may occur as a result of omissions with historic paper trails, corporate mergers, replacing systems and human mistakes, among other factors associated with current solutions.

INTRODUCING THE UNIFIED PLATFORM FOR PENSION FUNDS

The adoption of a unified platform that pension funds could use to manage their operation with more transparency, lower costs and easier auditing and control would be of great advantage for employers, employees, managers and regulators. However, it would be necessary to create a transparency mechanism to prevent this platform to be controlled by an entity or group of people that was able to corrupt the system according to individual interests. This difficulty could be circumvented with the use of Blockchain technology.

Auctus Project , which was created with the mission of improving the pension market by increasing transparency and eliminating common problems such as governance, corruption, fraud, bribery and bureaucracy, as well as reducing own operational costs of the administration of this type of matters. Auctus is building a platform that will allow pension funds around the world to dramatically improve their operations and significantly reduce operating costs.

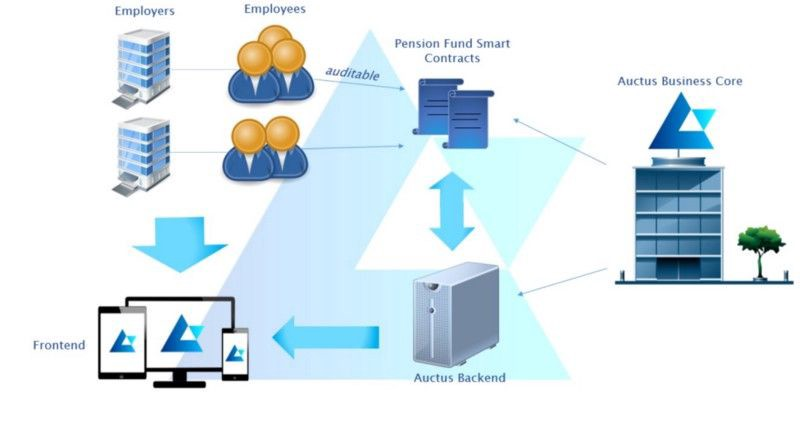

HOW AUCTUS WILL WORK

The users will have in that platform with characteristics to track their savings, to see the assets, to make active decisions and to be in control of their pension. The processes will be fully automated by Ethereum Smart Contrats, eliminating the potential for maladministration while at the same time saving operating costs, thus increasing pension yields. Pensioners will not only be able to reach their pension targets more quickly, they will have the peace of mind that their pension will always be transparent and secure.

With the platform developed within the Auctus project, it will be possible to define all the rules of retirement funds in smart contracts. Managing pension funds on the platform will make rules transparent and accessible to participants and regulators, and it is not possible to change terms or assumptions without creating a new contract. Smart contracts are dynamically generated and registered in the Ethereum blockchain at the time of registration of the fund, eliminating problems of hidden fees, fraud and altering rules in a way detrimental to the participant.

WHY YOU SHOULD CONSIDER AUCTUS

Firstly considering pension market analysis, Total United States retirement fund assets in 2016 was USD 19.1 trillion, of which roughly 35% were defined contribution and 65% were defined benefit schemes. Worldwide, total pension assets were estimated at USD 36 trillion at the end of 2016. The US accounts for 62% of global pensions assets, followed by the UK (7.9%%) and Japan (7.7%). Also considering the features of auctus and what it has to offer makes the paltform top-notch. The auctus team also, are a group of blockchain enthusiasts with backgrounds in pension funds, investments and software engineering. The majority of team members have more than 10 years experience in their respective fields and have held senior positions with reputable companies, as well as successfully started and grown their own companies.

ABOUT SALE AND DISTRIBUTION

Token Presale Phase

Amount: 1,600,000 AUC (ICO Token Price will be 2000 AUC / 1 ETH)

Period: before and during ICO (Pre-sale: 3–10 October , ICO: 14–28 November)

Distribution: 1w after ICO ending (5 December)

Presale participants will be able to convert Pre-ICO tokens with the ICO smart contract corresponding function as soon as the ICO period ends.

The smart contract will be revealed a few days before the ICO allowing auditing of the locking rule. This is intended to make a responsible ICO and prevent ETH offloading and, also, revealing the contract early will help to avoid funds being sent to an incorrect address.

All funds raised will be locked during the ICO period. After the ICO period end, the contract will allow transferring at most 20% in the first month and 5% in the following, and this values are estimated considering minimum cap reached. If more than minimum is raised, it is likely that expenses will demand less than the allowed value each month, making the resources last longer.

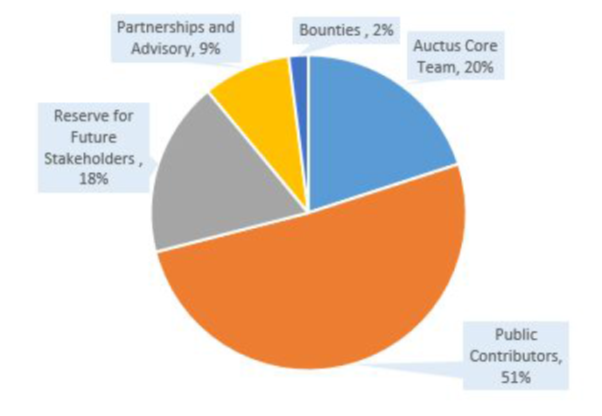

Token allocation summary

Below are the links to auctus

official webpage: http://auctus.org/

facebook:https://www.facebook.com/AuctusProject

twitter: https://twitter.com/AuctusProject

slack: http://slack.auctus.org/

ANN thread: https://bitcointalk.org/index.php?topic=2059117.0

telegram: http://t.me/auctusproject

My bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1048662

My Youtube channel: https://www.youtube.com/channel/UCoKb8l6T6TN3dk9_9CvTnvw