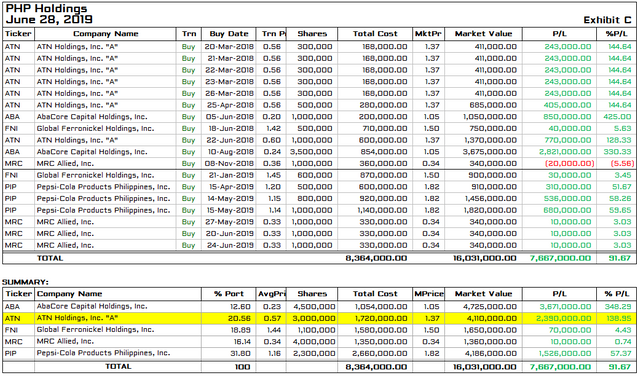

As I rebuilding my non-real properties portfolio, ATN now comprise 20% of my most recent holdings. To view my previous stock list here.

Why ATN?

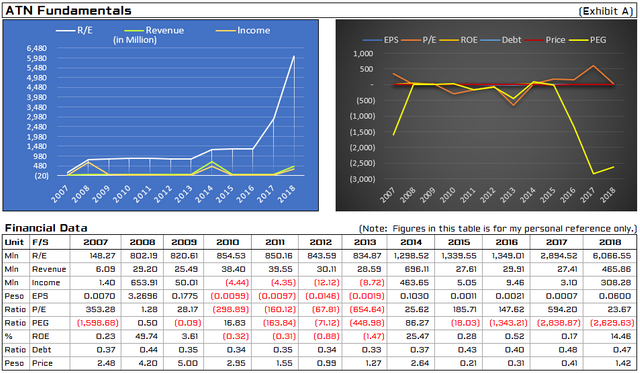

I closely monitored this stock since 2016 and saw the vast increased in company's fundamentals last quarter of 2017. When I examined this security using my investment strategy and valuation, the potential future growth is immeasurable even though the ratios are not impressive at all as shown in my Exhibit A above.

On 29th March 2018, just a few weeks after I cashed-out my previous holdings, I started accumulating this ticker as I believed the intrinsic value of ATN is so remarkable.

Based on my Exhibit A, the revenue, income and retained earnings skyrocketed in fiscal year 2018 and the said unrestricted retained earnings have given the investor an edged for a consistent periodic dividend in the years ahead.

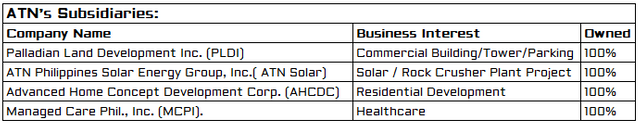

Lately, ATN has partnered with AlphaRock Mining Corporation to double the volume of rock aggregates it produces and potentially generating P12 billion in revenues in the future.

On the technical side, my indicator confirmed the major support level at the price of 0.17 centavos on January 25, 2016 with swing low of 0.59 on June 22, 2018.

ATN is in a sideways territory since its resistance of 1.69 on August 9, 2018. I am expecting a major correction in the mid-term but will not easily wipeout 0.17 unless triggered by major stock market panic worldwide. My recent buy indicator crossed EMA21 and MA34 on June 20, 2019 which for me indicates that the resistance of 1.69 maybe broken in the remaining half of 2019. If this happen, the new resistance of 3.40 on December 1, 2014 will soon be re-tested.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of this security.