There is no business that can survive without good funding either for start up or maintenance of the business. If you have ever tried funding a start-up business before, then you will understand the challenges being faced by most start up organizations when setting up businesses.

This has created a whole big avenue of income generation for banks through loan programs, but have you ever for once sat down to imagine how banks get loans to offer for businesses? They make this possible by loaning out the deposits being made by their customers to borrowers which thereafter pay certain percentages back in returns, this gain that banks make on this loan programs is what they use in rewarding you and I for deposits over specific period of time which is very little compared to the gains they make loaning out your money to borrowers.

Of course this modus operandi comes with several risks and downsides such as centralization of loan interest by banks which is at the detriment of borrowers, and as such, Marketplace lending has risen up to these challenge by providing an avenue where they serve as brokerage firms that match lenders and borrowers together rather than taking deposits or lending their own capital.

Having said this, its worthy to note that marketplace lending platform have been experiencing an exponential growth pattern since the year 2008 and has also been predicted to appreciate more in the coming years.

However, this industry is still being faced with some threatening challenges which is proving lethal to its survival. The most challenging of these problems includes; Stress that borrowers passes through when they have no formal credit history hence having to face lending rates that exceeds 200% APR, limited access to decentralized loan marketplaces for businesses and other enterprises, high administrative cost being faced by MFIs which results in high interest rates and also setting of loans with inefficient credit models by current marketplace lenders.

Having known all these problems that are endemic to the marketplace lending industry, then its mandatory to get urgent solution to all of these problems in order to experience rapid growth of the industry. This is therefore the sole reason behind the advent of the Pngme platforms.

Introducing Pngme

You would agree with me that decentralization will go a long way in making this industry experience the rapid growth and advancement we all crave for, hence blockchain technology has been used to build a decentralized lending marketplace with integration with banking infrastructures that which facilitates assets settlement, transactions, and collaterization of loans via the use of digital and tokenized physical assets. Of this excellent and innovative solution is a product of Pngme platform.

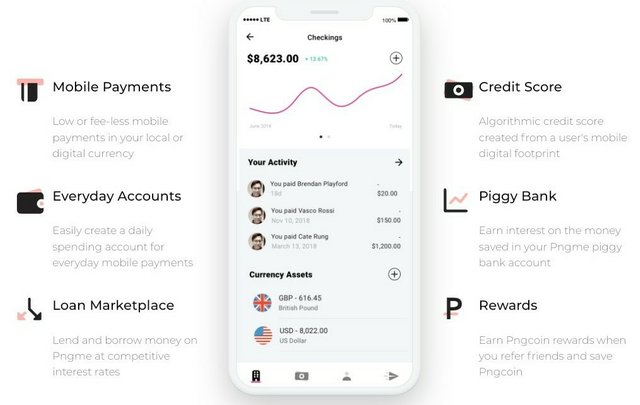

This platform will use its lending algorithm to match lenders with borrowers. This shall be solely based on the platform’s risk assessment and digital credit score, isn’t this awesome?

The Modus Operandi

- Here on Pngme platform, borrowers can list a bond which is comprised of one or several loans with each bond having a par value which is a fixed USD amount that is equal to the sum of all loans that originates within the bond

- Pngme digital credit score model shall be combined with the upper and lower coupon rate set by the borrower and also underwritten with a hybrid credit score model which shall all be included in the loan

- Whenever these loan bonds are being accessed by purchasers, they are being collaterized with liquid digital assets so as to protect against default by the borrower

- These digital bonds are being bided by lenders until the full par value of the digital bonds are being added up by a reverse dutch auction method

- Finally, Borrowers APR is set by the bidder that clears the auction for the digital bond.

The platform shall be accessed through their web and mobile apps with user management, analytics and portfolio tracking features embedded in it also with the availability of mobile wallet with excellent user interface both for borrowers and lenders.

What catches my attention most about this platform is the system architecture of the marketplace lending which is being implemented using a hybrid blockchain network technology stack in combination with Proof of Authority Ethereum side-chain, smart contracts, IPFS, ERC-721 non fungible tokens, USD-C stable coins and also centralized backend for the management of the sections of the platform, isn’t that fantastic?

Token Details

The native token of the platform is Pngcoin with the symbol PNG. This token shall serve as the fuel of the platform with several usecases such as use as transaction fees for P2P payments made within the platform, incentive bonus for referrals on the platforms among several others. The token is an ERC-20 based token with a total supply of 1,192,258,185 PNG.

Conclusively, the Pngme platform has proven beyond all doubts that it is capable of positively transforming the lending marketplace through the blockchain technology which will be totally decentralized and also offering several functionalities that includes mobile app, digital asset hedge funds, MFIs and several others. Judging by the professionalism and experience of the set of team behind this project, the excellent modus operandi and also the exquisite roadmap of the project, I can boldly say that Pngme is on its way to becoming one of the best blockchain projects in existence.

To get more information about Pngme, kindly check the links below;

Website

Whitepaper

Telegram group

Twitter account

Facebook page

Bitcointalk ANN thread

My Bitcointalk Username: amusanmikel2

Bitcointalk Link: https://bitcointalk.org/index.php?action=profile;u=2305577