In the course of the most recent decade, an age of fintech’s has developed to challenge conventional monetary fund specialist benefactor and, similarly, prod them into new advancement. Innovation has served to decrease the expense of creating monetary fund items and administrations. Reduction in the use of intermediaries between producers and consumers, for example by investing directly in the securities market rather than through a bank and the process or state of breaking or being broken into small or separate parts have placed power in the hands of the end-users, giving consumers more decisions than any time in recent memory.

Also, everything from worldwide grimness to the information-driven attitude of the millennial age has kept individual account high on the client motivation. The universe of banking as we probably are aware for a long time is in a key change process, activated by new advances. The most significant is a blockchain that is said to be on a very basic level, change how money related exchanges are taken care of today.

It is anticipated that this innovation will have noteworthy outcomes on how customary banks work together, later on, empowering new plans of action, convey new offers and settle longstanding difficulties, with the well-required straightforwardness and security in exchanges that these days include various gatherings and a lot of information.

By means of the coming of blockchain innovation, the ascent in web-based loaning has made it simpler for entrepreneurs to get subsidizing. Be that as it may, the scene of the independent company or business loaning has changed definitely as of late. PNGME is a worldwide FinTech web-based loaning network, coordinating moneylenders and borrowers instantaneously.

Pngme is another loaning commercial center fabricated utilizing blockchain innovation, decentralized rate-setting algorithms, and advanced credit scoring. #Pngme network is a non-bank monetary fund platform that pairs borrowers with moneylenders. They influence innovation to assess and process advance solicitations empowering efficient loan endorsements and foundation. Dissimilar to customary commercial center loaning and capital markets wherein trade rates are set midway or by a little gathering of people, Pngme utilizes unconventional barters and coordinating calculations to precisely value coupon rates on another class of advanced securities made up of high return loans.

The PNGME platform vision is to shut down the $5.2 trillion account hole influencing 200 million MSMEs all-inclusive by bringing down the expense of credit while expanding its openness, consequently driving maintainable monetary development from the base of the monetary fund hierarchy. Difficulties looked by the upcoming Business individuals or companies are the new business thought, regardless of whatever it may be, requires one crucial state of affairs; which is funds.

ABOUT PNGME

Pngme is a global alternative lending platform that provides established investors access to an alternative lending asset class. Using tokenized digital bonds, decentralized rate-setting algorithms, and digital-footprint-based credit scoring Pngme creates an open and transparent lending platform where borrowers can obtain low-cost capital and investors can access alpha.

PROBLEMS IDENTIFIED BY PNGME

- Limited access to decentralized loan marketplaces that provide MFIs, MSMEs, digital asset hedge funds, and mobile money services.

- Most marketplace lenders place their loan rates utilizing inadequate credit models

- Increase in high-interest rate to MFIs customers due to an increasing rate of administrative cost which is a big challenge to MFIs.

- Borrowers have no choice when sourcing for lenders due to a lack of formal credit history leading to high APRs.

SOLUTION PROFFERED BY PNGME

Loans contained inside digital bonds can be collateralized utilizing conventional, liquid cryptocurrencies, and phone locking development, bringing down borrower risk just as exposure to borrower default

Lending rates are set in a decentralized commercial center utilizing reverse Dutch auctions where lenders and market members purchase loans from borrowers at agonistic rates dependent on transparent digital bond risk metadata.

PNGME's hybrid credit score permits borrowers without a proper credit score to access reduced credit through a system of MFIs and Mobile money systems who influence PNGME's mobile application and loaning commercial center to oversee tasks and serve clients

Quantitative hedge funds and authorize financial specialists will have the option to decide their level risk vulnerability and buy bonds including sway centered digital bonds that gives desire returns in an elective resources class while producing alpha and yield

PNGME PLATFORM FEATURES

- CREDIT SCORING

- PIGGY BANK

- REWARDS

- MOBILE PAYMENTS

- EVERYDAY ACCOUNTS

- LOAN MARKETPLACE

WHY IS PNGME PREFERRED TO OTHER LENDING PLATFORM?

PNGME has indirect competitors that target their downstream clienteles – MFIs and mobile money networks. These competitors raise debt capital to finance their loan books and place rates in a series of 50 – 250 % APR utilizing mobile phone digital scoring credit scoring and entails no collateral to protected the loan.

The PNGME lending network marketplace is incorporated with a hybrid blockchain technology stack that uses the Proof-of-Authority Ethereum sidechain, ERC-721 non-fugible tokens, IPFS, USD-c stable coins for settlement and Smart contracts.

The network, on the other hand, utilizes a centralized backend that serves as an administration to PNGME website, banking infrastructure, mobile application, Know Your Customer (KYC) or Anti-money laundry (AML) compliance backend.

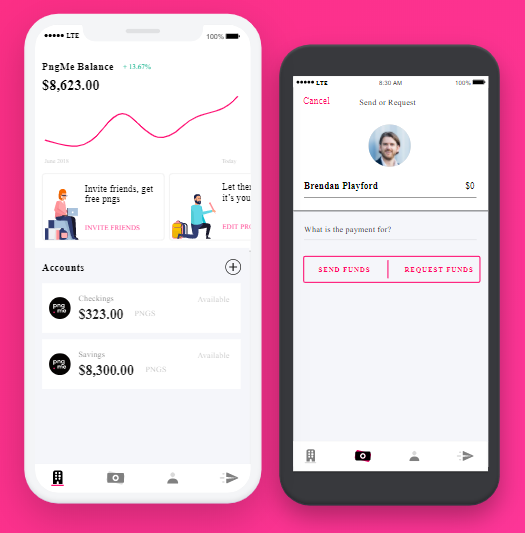

PNGME MOBILE APPLICATION

Users will be able to earn rewards, lend money, and create an unlimited credit score. They will be able to make instantaneous payments and also allow them to save their traditional currency.

Users who download the application and sign up will receive free Pngcoin straight int their pngme wallet. Get easy access here

THE PNGME TOKEN

PNGME platform has created their traditional currency on the Ethereum network known as the PNGcoin. The tPNGcoin will serve as the fuel of the platform, which will be used as a means of a transaction on the marketplace, web and mobile app across the platform. It is designed to be utilized by two primary stakeholders, the application users, and the network validators.

Users can acquire PNGcoin when they sign up to PNGME mobile app, staking PNGcoin in their personal savings account, buy pngcoin from exchanges, and by referring friends and family.

TOKEN NAME: PNGCOIN

PLATFORM: ETHEREUM

SYMBOL: PNG

TOTAL PNGCOIN SUPPLY: 1,192,258,185 PNG

CONCLUSION

PNGME has created a hybrid blockchain platform that is transparent, secure, and a serene marketplace for both small and big business sectors to access loans without risk. The PNGME API is open for all lending platform for integrating with giving its business platform serenity for their clients.

FOR MORE NEWS AND INFORMATION, VISIT PNGME NETWORK USING THE LINKS PROVIDED

WEBSITE

BITCOINTALK ANN

FACEBOOK

TWITTER

REDDIT

TELEGRAM

MEDIUM

YOUTUBE

INSTAGRAM

LINKEDIN

PUBLISHED BY MICKEY OBERABOR

BTT Profile Link

ETH Address: 0x77F684b6E0359210527046cC592A24D60cBD8f5a

Congratulations @mickeyberry! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit