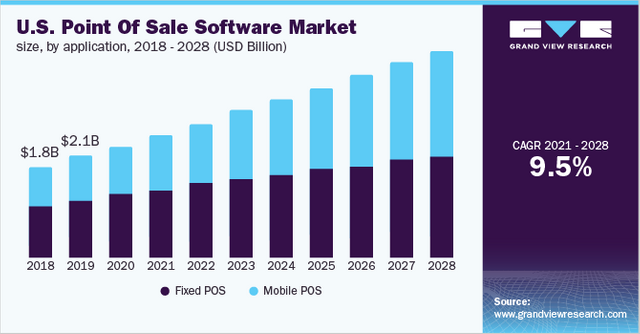

The global point of sale software market size is expected to reach USD 19.56 billion by 2028, registering a CAGR of 9.5% over the forecast period, according to a new report by Grand View Research, Inc. Over the last few years, the restaurant industry has witnessed an uptick, largely favored by improving economy. However, restauranteurs are still facing challenges that could potentially hamper their performance as well as revenue. Moreover, the pandemic has hit the business substantially as countries went into lockdowns and travel & tourism came to a sudden halt. This, in turn, impacted the point of sale (POS) software business for the short term.

In addition, restaurant operators also face challenges in terms of complexities associated with order management while delivering the food on time and ensuring outstanding customer service. To meet the changing customer requirements and decrease the food as well as operational costs, restaurant operators are relying heavily on innovative technologies like restaurant software solutions that range from an all-in-one business management system to standalone POS terminals. The need to offer rapid and high-quality service to the customers while enabling easy guest management at restaurants is creating a pool of opportunities for market incumbents.

Point Of Sale Software Market Segmentation

Grand View Research has segmented the global point of sale software market on the basis of application, deployment mode, organization size, end-user, and region:

Based on the Application Insights, the market is segmented into Fixed, Mobile.

- POS software finds applications in both mobile and fixed POS terminals. The fixed segment accounted for the highest revenue share of more than 55.0% in 2020 owing to the increased preference among FSRs and QSRs. Fixed systems are considered to be more secure in terms of data privacy, hence a popular choice among several end-users. The mobile POS segment is projected to register the fastest CAGR of more than 12.0% over the forecast period.

- The introduction of wireless technology evolved the payment method and business operations. The POS software integrated on tablets or smartphones provides a quick payment option via apps without the need to connect local networks with the system.

Based on the Deployment Mode Insights, the market is segmented into Cloud, On-premise.

- The on-premise deployment for POS software accounted for the largest revenue share of over 67% in 2020 primarily due to data security and greater control offered by this deployment model. The large enterprises contributed to the high demand for on-premise deployment of POS software as they need separate front-end and back-end solutions to limit access to critical financial and business information.

- The cloud deployment POS software is expected to exhibit the highest CAGR of more than 11.0% from 2021 to 2028. This growth is credited to the high demand due to low-cost deployment on the cloud, which enables the adaption of changing business landscape.

- The cloud-based deployment is ideal for small- and medium-sized businesses that require timely software up-gradation to support expanded business requirements. The cloud deployment offers remote access, affordable subscription-based pricing, endpoint security, sales management, and an all-in-one solution for inventory management.

Based on the Organization Size Insights, the market is segmented into Large Enterprise, Small and Medium Enterprise (SME).

- The large enterprise segment dominated the market in 2020 accounting for a revenue share of over 58%. The segment growth is credited to the high demand for customized POS software across large-scale retail stores, restaurants, and entertainment segments that need a system to manage their cash flows and business operations.

- The customized software for a large enterprise helps manage an array of business operations while improving customer engagement. Rising demand for advanced features, such as employee management analytics, inventory tracking, sales monitoring, customer data management, and reporting, is expected to boost product adoption across various industries.

- The market for the SME segment is expected to grow at the highest CAGR over the forecast period. The growth is credited to the quick adoption of cloud-deployed mobile POS software solutions by SMEs due to their affordability & scalability and the need to improve business during the COVID-19 pandemic.

Based on the End-user Insights, the market is segmented into Restaurants, Hospitality, Healthcare, Retail, Warehouse, Entertainment, Others.

- The retail segment emerged as the dominant end-user segment with a revenue share of 35.01% in 2020. The vast retail sector includes clothing, accessories, grocery, packaged product, electronics, and much more that require POS software as per the nature of the business function. The retail industry gradually shifted from brick-and-mortar stores to multi-channel (social media) and e-commerce retailing.

- This shift in business channels augmented the need for additional features in POS software to manage both online and in-store sales. Businesses that installed POS software supporting both sales channels were able to manage operation and profit, while other businesses suffered during the COVID-19 pandemic.

- The product demand in the restaurant segment is poised to grow significantly at a CAGR of more than 9.0% over the forecast period. It is another most lucrative segment targeted by POS vendors. The online food delivery system has become popular among the younger generation and thus, the restaurants require new features in their POS software to track food delivery and take new orders and payments.

Point Of Sale Software Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The vendors are focused on offering differentiated solutions for industry-specific operations at affordable prices. The niche players in the market are also strongly competing in the local market to capture the underlying opportunity across end-users.

Some prominent players in the global point of sale software market include

- Clover Network, Inc.

- H&L POS

- IdealPOS

- Lightspeed

- NCR Corporation

- Oracle Micros

- Revel Systems

- SwiftPOS

- Square Inc.

- TouchBistro

- Toast Inc.

Order a free sample PDF of the Point Of Sale Software Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research Helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.