tl;dr: TillBilly is a terminal that connects to a Point of Sale (POS) terminal enabling shoppers to make payments with the Stellar-native BILL token as well as receive receipts, make us of loyalty/reward programs and promotion tools digitally and directly with a NFC-enabled device of their choice.

You have probably heard of similar projects before (blockchain or not) and very likely seen and/or used similar terminals at your local retailers before, so why should you care? Take a look at TillBilly’s whitepaper (or read this article and take my word for it) and you will see that there are a few things that make this project stand out.

This article will explain what TillBilly, what it’s business proposal is and examine the advantages TillBilly promises as well as the risks that can be associated with it.

But first, let’s start with a little POS 101.

What is a POS and why is it importantIf you know why a POS is extremely important to any retailer, you can very well skip ahead. This will be a very high level breakdown of POS.

Wikipedia states: “The point of sale (POS) [or point of purchase (POP)] is the time and place where a retail transaction is completed.” The POS is where and when money and goods actually change ownership. For most retailers that usually is the register.

However, there is a lot more to the POS (alternatively called Point of Service, Point of Return or the above mentioned POP) than simply the completion of a retail transaction and the POS has increased dramatically in significance for retailers. The rise of sophisticated POS software has led to a variety of ancillary functions that can be performed at a POS: inventory management and warehousing, customer relationship management, bookkeeping, report management, membership and loyalty systems to name just a few.

In addition to that, POS placement and design can have a dramatic influence on a customer’s purchasing decisions:

Traditionally, businesses set up POSs near store exits to increase the rate of impulse purchases as customers leave. >However, varying POS locations can give retailers more opportunities to micro-market specific product categories and >influence consumers at earlier points in the sales funnel.

(https://www.investopedia.com/terms/p/point-of-sale.asp)

Just think of your local supermarket and how they usually place snacks, chocolate bars and other small, delicious items close to the check-out in order to trigger you to make impulse purchases. Or if you have kids, to beg you to make said impulse purchases for them.

Design, implementation and usage of POSs, POS terminal and software has become a major category of marketing and retail business administration. It is a highly competitive market that is in constant change because of influences from a range of factors such as digitization, changes in consumer behavior, technological advances and cost reduction pressure.

Enough POS —why should anyone use TillBilly?Simply put, TillBilly is a little terminal that retailers can add to their existing POS that enables customers to pay for goods and receive receipts through any card, phone or wearable that is able to use NFC technology. It promises to reduce costs for customer and retailer, get rid of paper receipts, improve loyalty/reward systems and offer better promotional experiences.

These are some pretty hefty goals with seemingly no drawbacks. As we know, there cannot only be winners and if the retailer gains and the customer gains, who looses?

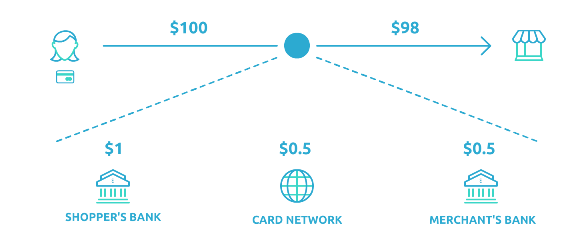

What is TillBilly’s business proposal?TillBilly aims to directly compete with the financial services providers that make up the debit card cashless payment network. A cashless payment usually involves banks (on the customer and the retailer side), a payment system provider and depending on the system, card data acquirers/processors. Simplified it looks a little like figure 1:

Fig.1: Simplified debit card transaction (TillBilly whitepaper)

In this example, a customer pays $100 in a store to buy a good of her choice. Using a 2% transaction fee (in reality, transaction fees are usually around 1.% — 3.5% depending on service and country), the merchant only receives $98, the other $2 are used to pay the service providers. This is where TillBilly comes into play and leveraging the Stellar ecosystem, the goal is to make the transaction look like figure 2:

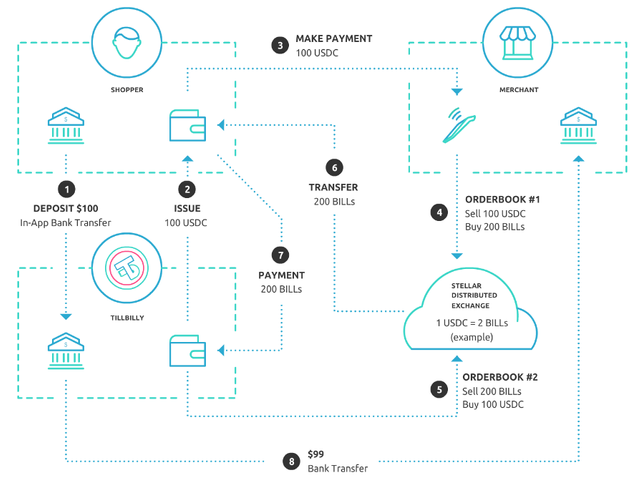

Fig.2: Simplified TillBilly transaction (TillBilly whitepaper)

As you can see, in this example not only does the retailer get to keep $99 instead of $98 (or 1% more), the customer receives credit that can be redeemed within the next transaction. What this picture obscures a little is the fact that of course the banks still exist and participate on both transaction sides.

To pick up the thought from the previous paragraph, talking strictly of the monetary perspective now, the retailer gains in the form of lower transaction fees and the customer gains from ultimately paying less because of a cashback system. The market players that lose are the traditional payment system participants.

How does TillBilly work?The simple answer: magical blockchain technology. Generally speaking, this was more or less the original motivation behind Bitcoin and blockchain as a whole: to enable a transaction between to two entities without a trusted third party involved. Now you will correctly say: wait a minute, TillBilly IS a third party and they ARE taking money out of the transaction. That is 100% true. Their proposal is not to get rid of financial transaction systems but to use blockchain technology to create a cheaper, better system.

Figure 3 shows us how our $100 example purchase would be processed through TillBilly:

Fig.3: TillBilly transaction process (TillBilly whitepaper)

In order to be able to use TillBilly, the future customer (let’s call her Allison, I am tired of Alice doing all the fun things) needs to first top up her account through the TillBilly app that is linked to her bank account. This is where blockchain technology comes in.

Opening a TillBilly account opens a twin TillBilly Stellar account. TillBilly decided to build it’s transaction system on a two asset model, meaning that there are actually two cryptocurrencies (this time in the literal sense) in play.

First, there a token called a fixed value credit asset, which will be used for TillBilly operations. Fixed value means that it will always have the same the same exchange rate (e.g. $1 = 1 USDC). Credit asset stems from the Stellar concept of trustlines which states that “when you hold assets in Stellar, you’re actually holding credit from a particular issuer”. Basically, you trust TillBilly to redeem 1 USDC credit asset for $1 and vice versa. In our example that means that Allison tops up her TillBilly account with $100 and receives 100 USDC.

The second asset is the aptly named BILL token. BILL is the currency that the transaction will ultimately be settled in. Allison decides to make a purchase using a TillBilly terminal for $100 USD and the behind-the-scenes transaction process gets into gear.

Through the retailers terminal, Allison’s purchase has triggered a sell order for 100 USDC on the Stellar own decentralized exchange buying the an amount of BILLS (in our example the exchange rate is 2:1, ergo Allison receives 200 BILLs). Simultaneously, a buy order for 100 USDC is triggered in behalf of TillBilly, effectively selling Allison the 200 BILLs required. Allison receives the BILLs onto her TillBilly account which are transferred back to TillBilly, thereby settling the transaction. At a decided upon point during the day, the retailer’s bank account is settled with the USD equivalent from TillBilly.

Similar to the traditional transaction system, the retailer will NOT receive the full $100 that Allison is paying. TillBilly keeps $1 (or 1%) of the transaction as a fee, the retailer will receive $99 of Allison’s $100 and Allison will receive $0.5 worth of USDC back from TillBilly. That credit can then be used for her next purchase.

To stay in out example, Allison puts the good(s) on the counter, the clerk scans the item(s) and tells her that she needs to pay a sum of $100. Allison takes out her device, holds it close to the TillBilly terminal (which will probably light up green for confirmation) and that’s it. Allison receives her receipt on her phone and has just made a purchase using cryptocurrency.

This sounds complicated — why does TillBilly need two token?With the explained two token model, TillBilly tries to address two central issues regarding cryptocurrencies as a method of payment: FIAT conversion and price volatility.

Even if you already have an account from a FIAT gateway, acquiring cryptocurrency is a lengthy process that can be complicated for non-technically inclined users (at least in May 2018). There are always instant purchasing option e.g. through credit cards but these options are usually plagued by high fees/bad rates.

Regarding price volatility, the by now famous story of Laszlo Hanyecz buying 2 pizzas for 10,000 BTC back in 2010 (which celebrates it’s anniversary at the time of writing) is a widely know cautionary tale of how today’s pizza can be tomorrow’s mansion.

TillBilly cannot take away the bank participation (most of us do have a bank account after all, which we use for the majority of our transactions) in order to receive cryptocurrency. However, since Allison has linked her bank account with the TillBilly app, all it takes is a literal tap of a button. In addition to that she knows (trusts) that 1$ will always be worth 1 USDC, i.e. that the $1 she has topped up her account with will always keep it’s 1$ purchasing power.

Furthermore, TillBilly is the only market participant that can buy or sell USDC which are exchanged for BILLs when a transaction is actually happening. That means there is no price volatility is using BILLs because they are only bought to be instantaneously used as a transaction settlement. No HODLing involved. (unless you really want to, TillBilly has a crypto-pro mode which enables users to buy and sell BILLs as they please).

So I can pay using my phone — what else does TillBilly offer?As initially stated, TillBilly enables retailers and customers alike to enjoy a few additional functions. I will not go into a lot of detail here but want to quickly mention them because they paint a holistic shopping experience picture. To fully understand what TillBilly has to offer we need to look at those functions from the customer’s and the retailer’s perspective. Said function are digital receipts, digital loyalty/reward programs and digital promotions (see a pattern here?).

Customer perspectiveDigital receipts are virtually indestructible, always accessible (given you have your device on you) and do not take up physical space. No more frantic searching various pockets when you are asked “do you have the receipt?” when trying to return an item. TillBilly enables automated categorization in order to get a structured overview of spending and supposedly enables integration with accounting platform in order speed up filling your taxes.

Digital loyalty/reward programs are virtually indestructible, always accessible (given you have your device on you) and do not take up physical space. No more frantic searching various pockets when you are asked “do you have your loyalty card” when shopping.

Digital promotions can reach you based on your location, time of day, past purchases, etc. and ideally should only be presented to you when you could (and actually want to) use them.

Retailer perspective(These point are additional to the “traditional” advantages of POS software)

Digital receipts do not need to be printed therefore a retailer will simply save money. Potentially there are fewer unsatisfied customers who had had a service be declined because of missing receipts.

Digital loyalty/reward programs have very little setup costs and have a higher rate of adoption/usage because the customer will have the loyalty “card” with them at all times.

Digital promotions are data-driven and personalized thereby promising higher conversion rates as well as a better shopping experience for the customer.

Additionally, not printing receipts has one very positive external effect: sustainability. The paper for receipts does not need to be produced in the first place and receipt waste is reduced.

So where is the catch?Every product needs to make trade offs between a variety of factors and TillBilly is no exception. There are a few things that need to be considered potential drawbacks and risks, most of them for retailers and customers alike.

TillBilly is a trusted third party handling your transactions and therefore is just as vulnerable to fraud, manipulation and hacking as other third parties. It uses hardware security modules (a dedicated crypto processor designed for the protection of a crypto key lifecycle), Stellar’s multisignature mechanism and a multi-factor authentication. That is a high standard of security but nothing is every fully secure. However, that is mitigated by the fact that users are topping up credit and only using the credit to pay.

You need to trust TillBilly that $1 = 1 USDC will always be true. This can easily stop being true for such trivial reasons as TillBilly going bankrupt. When this happens, you will either loose money using TillBilly ($0< 1 USDC < $1) or your credit will be completely worthless ($0 = USDC).

You need to trust TillBilly to handle your transaction data safely and in your best interest. There is a very thin line to walk here because there is a huge incentive to use customers transaction data to provide the above mentioned ancillary functions for retailers (or downright sell the data). TillBilly needs to find a middle way between data protection and data exploitation.

The utility of TillBilly is directly correlated with network size. If you can only pay for healthy cabbage snacks at one store in the shady part of your town, adoption will probably not spread. The best payment system in the world is useless if nobody uses it.

Customers need to top up their account WELL BEFORE they go shopping. Depending on bank and country topping up can take a few days. Therefore, should you have no credit left on your account and you really want those cool 90s shades from the mall, you are stuck with “traditional” payment methods.

There is no mention of a recovery process in the whitepaper. What happens if your device gets stolen/lost? There probably is a process but as the old saying goes: don’t trust, verify.

TillBilly has a token constraint mechanism that is designed “to constrain the supply of tokens, thus avoiding oversupply of tokens into a network where they cannot be used, and as as consequence severely devaluing the token itself”. The mechanism sounds reasonable and sound but as with many mechanisms and assumptions in crypto it is hard to verify until a certain scale has been reached.

ConclussionTillBilly offers a deal that no retailer or customer can decline for long: pay less for doing (mostly) the same as you have always done. Cashless, device-driven payments are increasingly adopted and will continue to do so in the foreseeable future.

TillBilly significantly lowers the entry barriers to cryptocurrencies, if not even downright takes cryptocurrency out of the visible equation for every day financial transactions between retailers and customers, trying to only leave the positive aspects alive. Additionally, it tries to be more than just a payment method by offering customer relationship functions that seem like a perfect natural fit.

Naturally, there are a few risks involved as well including a high amount of trust needed in TillBilly and a significant change in customer behavior by having to top up credit well before the actual transaction takes place.

Blockchain based POSs are here to stay because at the end of the day they lower costs for a heavily cost-driven industry. TillBilly is making strong arguments to be a big player in disrupting the POS market.

— — — — — — — — — — — — — — — — — — — — — — — — — — — —

I am not affiliated with TillBilly.

You can find find the whitepaper and more information here: https://tillbilly.com/

This article was first posted on medium by myself: https://medium.com/@D_N_Weiss/tillbilly-bringing-the-blockchain-to-points-of-sale-9e9f803726db

✅ @akingultra, I gave you an upvote on your first post! Please give me a follow and I will give you a follow in return!

Please also take a moment to read this post regarding bad behavior on Steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @akingultra! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit