PPT has been specially designed to be used for purchasing invoices and it should be the investment vehicle of choice. This should be a no brainer if you plan to make invoice purchases on the Populous Platform. How do I know? Which is better, fiat or PPT?

Discounting PPT

Many see the collateral rules for investing in PPT as disadvantaging PPT investor as I have highlighted in my earlier blog post “Populous – A Plate of PPT with Plenty of Secret Sauce” as the “Discount Factor”. The intention is to discount the value of PPT used as collateral on the platform to “protect” the Populous/PPT investors from PPT price volatility.

This is a safegaurd Populous need to include because of the price volatility PPT will experience when traded on the exchanges. PPT prices will go up or down depending on demand and applying a discount to the PPT price will ensure to some extent that Populous/PPT investors will not be underwater and especially when the price of PPT goes too high.

The 20% is just an assumed percentage because in reality this will vary and be controlled by the “Price Volatility Oracle” that Populous will deploy.

The Fight of the Century – Fiat vs PPT

This will be bigger than the recent Floyd Mayweather vs Connor McGregor fight. This will truly be a fight to remember, a fight to end all fights and there can only be one winner.

Will it be Fiat or PPT?

Let the Fight Begin

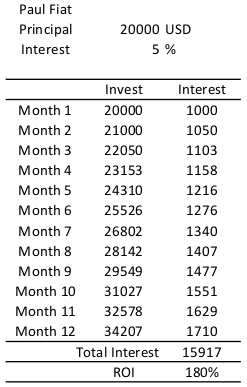

Warming up their bouts, Paul Fiat and Peter PPT are both prepped to invest $20,000 of their hard earned savings.

Paul Fiat decides to invest his fiat in Populous using $20,000 for a monthly return of (say) 5%. At least it is better than parking it in a bank earning near 0% interest.

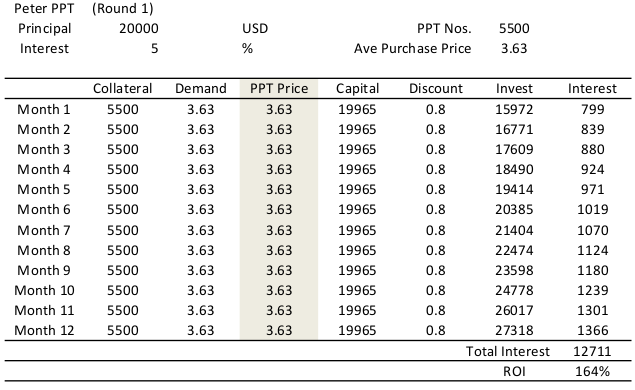

Peter PPT buys PPT instead of using fiat to invest on the Populous platform. He buys PPT tokens on EtherDelta accumulating 5,500 PPT at an average price of $3.63. He too is looking for a monthly return of 5%.

Fight!

Ding! Ding! - Round 1

On his first month, Paul Fiat invests $20,000 at interest of 5% gaining a return of $1000. Assuming his average interest per month is 5% and compounding his returns monthly his $20,000 will have turned into $35,917, a ROI of 180% in one year.

Peter PPT invests his PPT on Populous and as a result have to adhere to all the complicated collateral rules. Peter PPT is already disadvantaged even before the match has started with a discount of 20% applied to his collateral.

PPT price has been sluggish and has not moved in price, there is no-one to cheer him on because EtherDelta is down. PPT price is fixed at $3.63.

The return from Peter PPT’s investment at 5% interest rate and with compounding is only $12,711 with ROI of 164%. Clearly Paul Fiat is the winner of Round 1.

Ding! Ding! - Round 2

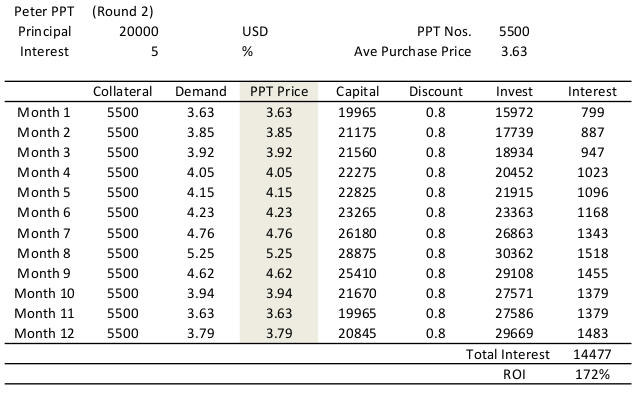

Sensing an easy win Paul Fiat comes out of his corner raring to do battle. Again his principal of $20,000 have made a ROI of 180%.

Peter PPT is showing signs of life now that EtherDelta is back on line the crowd is starting to cheer him on. Even with the crowd behind him Peter PPT’s ROI was just 172%.

Clearly EtherdDelta did not give that boost when it was required. Paul Fiat wins Round 2.

Ding! Ding! - Round 3

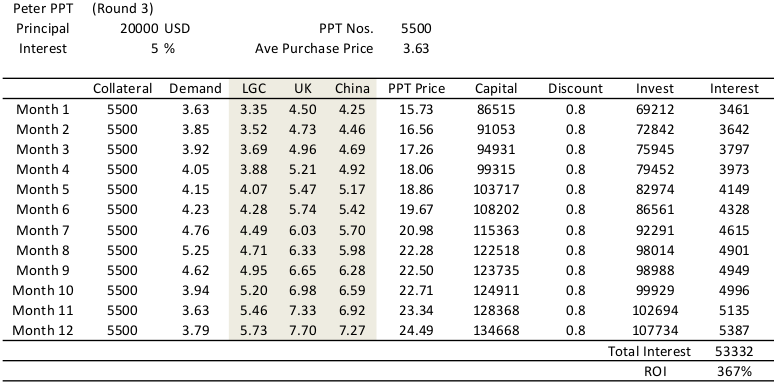

Paul Fiat comes charging out of his corner and again he has shown consistency with another performance of 180% ROI.

The splash of water was what Peter PPT needed, he is now rejuvenated. LGC, UK and China were now backing him and PPT price soared.

Peter PPT put up a pretty good fight to come out on top with a ROI of 367%. The tide has clearly turned in favour of Peter PPT but the fight was not yet over.

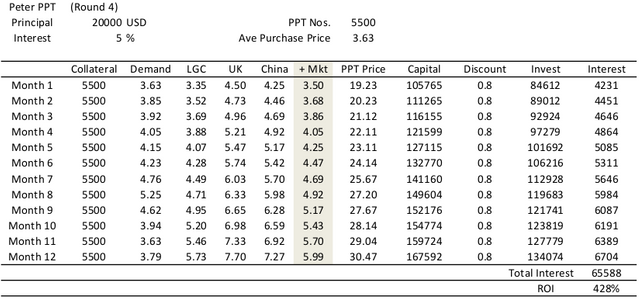

Ding! Ding! - Round 4

After losing Round 3, Paul Fiat was not dejected and he still had fight in him left. Always consistent Paul Fiat was still able to garner a ROI of 180% again.

Peter PPT was energized after winning the previous Round and came out with his fist swinging. A head shot, a body blow and Paul Fiat was on the ropes. Peter PPT got another boost when Populous expanded and another market gave him backing. Come on Peter PPT, finish him off, but Paul Fiat is saved by the bell!

Peter PPT finished the round with a 428% ROI, an impressive round by Peter PPT indeed!

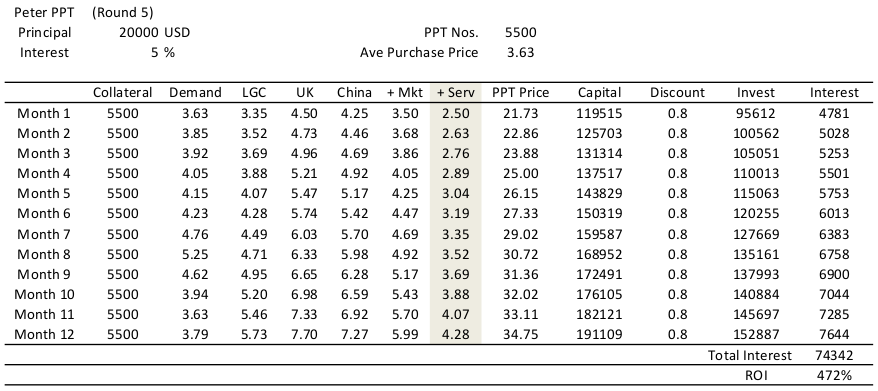

Ding! Ding! - Round 5

Exhausted from the last two rounds, Paul Fiat mustered all his strength to put on a show ending the round with a solid ROI of 180% as usual.

After putting in a winning performance in the last two rounds Peter PPT felt on top of the world and came out with a swagger. Peter PPT just got another boost by addition of another financing option to its service. Peter PPT took aim and Peter Fiat went down.

Paul Fiat was down but not out and yet again was saved by the bell but Peter PPT put in a stunning display with a ROI of 472%!

And The Winner Is!

The tension could be felt in the air whilst the scores were being tallied. A delay, a commotion at the judges desk! The results are out!

Round 1 and 2 - “No Contest!” A loud and might uproar erupted from Paul Fiat’s camp. Paul Fiat had clearly won the rounds with the higher ROI but the judges’ decision was final.

The match now rest on the outcome of the 3 remaining rounds.

Round 3 - 367% vs 180%

Round 4 - 428% vs 180%

Round 5 - 472% vs 180%

Peter PPT wins by an overwhelming majority!

Obligatory After Fight Analysis

Here is the obligatory after fight analysis which recounts each round blow by blow.

Round 1 – PPT was disadvantaged by the volatility rule required to be applied to the collateral. Fiat investment does not have this rule so 100% of the fiat was invested and the interest compounded.

Round 2 – Again the PPT investment was disadvantaged because of the volatility rule. Even though there was fluctuation in the price of PPT due to trading on exchanges and in general the PPT was higher than the initial purchase price Fiat investing still came out ahead. However if the PPT price went even higher then PPT investing would be more advantageous.

Round 3 – Now the game play is a lot different and the dynamics slightly more complex. The LGC, UK and China market liquidity pool was put into play which reflected on the PPT price and increased the price significantly. Even though a 20% discount was applied to the collaterised PPT, PPT investing still came out ahead over fiat. This is where you see the Secret Sauce in action. As PPT price increases the investment also increase.

What’s more the compounding effect also had an impact on the overall PPT price. As interest was made on each month, the interest was recycled back into the liquidity pool thus pushing up the price even further each proceeding month. The increasing PPT price allowable PPT holders to steadily increase their monthly investment each month.

The demand component remained the same and reflects the trading action of the PPT on exchanges. Any trade on exchanges does not add to the liquidity pool however do increase the number of PPT held or the number of PPT holders. Desirability of PPT will be measured by this component of the PPT price.

Round 4 – The game play is exact as in Round 3, but the PPT price got a further boost by the addition of a new market. Thus every market Populous expand to, the price of PPT will go up because new liquidity would be added. The next markets may well be France, Germany, Italy, Japan, Taiwan or even South Korea and expansion into anyone of these markets will boost the PPT price.

Round 5 – Similarly, Round 5 is a combination of Rounds 3 and 4 but in this round Populous opted to add additional services. This could be more financing options or even as discussed in my previous post, Populous may generate revenue from integration of the Forecasting Oracle with the accounting software.

Price Assumptions

Demand – The demand component of the overall PPT could be considered as the premium you pay to acquire PPT. Since there is demand people will pay to acquire it and based on market forces the current premium is assumed around $3.63. Peter PPT was assumed to have acquired his PPT for this average price.

LGC – The assumed starting value of $3.35 is based on the forecast made in the post “Populous – PPT Price Updated Forecast, My Take!”

UK – Since LGC was forecasted a price of around $3.35, it would be unreasonable for the whole the UK market to at least achieve $4.50 greater than LGC. At the point in time it is believed that this is a conservative estimate.

China – According to the latest trade factoring figures the world factoring market has reduced from $3 Trillion in 2013 to $2.4 Trillion in 2016. China has also lost its place as the biggest factoring market in the world ceding first place to the UK. An assumed value of $4.25 was therefore assigned to the China market. Nevertheless, still considered a conservative estimate.

+ Mkt – This value represent markets other than UK and China in which Populous will expand. In the example one additional market was assumed and since the new market would be smaller in size as compared to the UK and China a value of $3.50 was assumed.

+ Serv – This value represents the additional contribution from added services Populous would introduce. This could be additional other factoring financing options or value added services like integration of Populous in accounting software. A value of $2.5 is assumed.

NOTE: The + Mkt and + Serv will not be part of the starting lineup when Populous go live but will start to contribute in the months and years to come. Round 3 would probably be the “passive income” you can generate in the first year. + Mkt and + Serv serves to demonstrates the boost in price you can expect when Populous have all their ducks in a row.

In Conclusion

Why was Round 1 and 2 declared “no contest”? Simple, Populous was not live so no-one made a return. Populous will launch the beta sometime between now and end of November and when it does it will launch with the LGC deal, UK market and (probably) the China market in place. Demand from exchange will remain because PPT will still be available on EtherDelta or maybe one of the other major crypto exchanges.

Although the returns from PPT is more superior compared to investing with fiat on the Populous platform, it does not mean that you must use PPT. Investing fiat on Populous is at the least much more profitable than keeping your fiat in the bank. Although individual fiat investments will not enlarge the liquidity pool so it will not help boost the price of PPT.

A KO is not considered because PPT and Fiat investing on Populous still beats keeping fiat in the bank by a long shot. It is only a KO if you have fiat and are not investing on Populous!

As PPT prices climb the magic of the Secret Sauce diminishes, until such time that PPT is bought to hold for yearly appreciation from buy back and burn. There may still be benefit from using PPT if bought at a high price but you will need the PPT price to appreciate further before PPT investing can be said to be more advantageous than fiat investing. Round 1 and 2 demonstrates this principle.

PPT investors not only benefits from the effects of an enlarging liquidity pool but will also benefit from appreciation of the PPT price if and when PPT holders decide to take some profit by selling PPT. I scratch my head! Why would you do that when you can withdraw some of your returns/interest on a monthly basis instead.

Unless investors lose confidence in Populous and starts pulling their investment out, the price of PPT will be stable. Everything that Populous achieves according to their business plan will be beneficial for price appreciation. The PPT price is made up of many small elements and each of those will add value to PPT.

Investing in PPT tokens is for the long term because PPT growth is on the cards. In the meantime you can enjoy the short term gains from the interest derived from buying invoices on a monthly basis. PPT has very long legs indeed and Clif definitely hit the bulls-eye with Populous!

PPT’s potential “To Da Moon” for interstellar space flight is very real.

Other Populous Posts

My other posts can be read by clicking the links below.

Populous – Counting Beans!

https://steemit.com/populous/@marcusxman/populous-counting-beans

Populous – Size Does Matters!

https://steemit.com/populous/@marcusxman/populous-size-does-matters

Populous – PPT Price Updated Forecast, My Take!

https://steemit.com/populous/@marcusxman/populous-ppt-price-updated-forecast-my-take

Populous – Breaking “NOT OFFICIAL” News!

https://steemit.com/populous/@marcusxman/populous-breaking-not-official-news

Populous – Full Steam Ahead on the Spur Line?

https://steemit.com/populous/@marcusxman/populous-full-steam-on-the-spur-line

There are more posts on Populous and you can find them here.

Should you have any questions concerning Populous you can approach Populous through their Slack Channel, Bitcointalk forum or Twitter Account for answers and clarifications.

This is NOT Financial Advice

In my humble opinion, the risks to the downside are small compared to the potential upside rewards. This should not be construed as financial advice but an opinion only. As usual do not invest more than you can afford to lose as these investments can go to zero and always do your own due diligence. If you seek financial advice then see a certified financial advisor.

Feel free to comment as you see fit below.

Very well done my friend! That image was hilarious btw! :) Long live Populous!

-moxie

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@moxi trying to make it more interesting to read!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@driva has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@minnowpondblue has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit