1.Orb is a Software Foundation That Aims to Solve the Problems of Our Current Economic System

Problems in Our Current Economic System

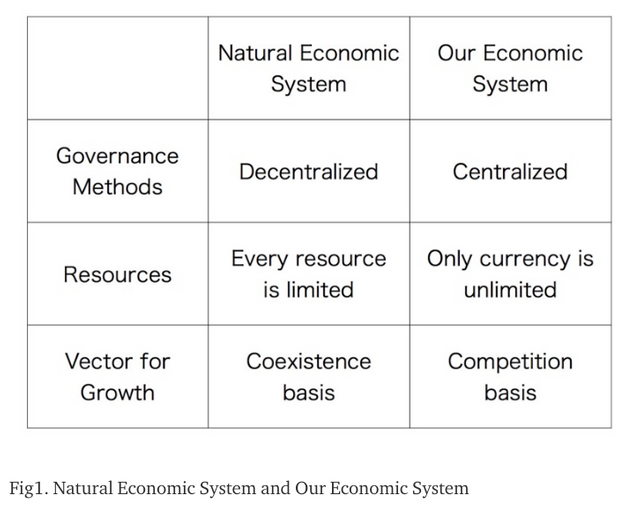

First of all, as a society we are majorly involved with two types of economic systems. First is our — humanity’s — own economic system, which we’ve developed since the prehistoric age as a life-support system including food, clothing and housing. Thousands of years ago, this economic system was quite a primitive one, based on hunting and gathering. Today, the system is highly specialized and driven by various types of technologies. The second system is a natural economic system: Earth’s environment itself. We are running our own economic system by utilizing various type of resources generated and regenerated inside of the natural economic system, such as food, fuel, and mineral. In other words, we design and operate our civilization through investigating the natural economic system, systematizing the knowledge we acquire, and putting it to use. For this reason, if we don’t understand the rules of the natural economic system enough or hold a false perception towards the system, our economic system will be in conflict with the natural economic system — earth’s environment — and thus, our economic system will be on the edge of its sustainability.

From the perspective of evolutionary biology, we think of our economic system as formed based on the Theory of Evolution by Natural Selection as advocated by Charles Darwin (1) An economic system adhering to such a theory fosters harsh competitive mechanisms in a market economy. Thus, while society experiences rapid growth of our economic system, the mechanism by which this happens tends to produce too much competition in the market economy. As a result, we formed central governance systems such as nations and governments, and from there, produced currencies with infinite proliferative capacity, and the notion of GDP/GNP, a growth index based on competition principle. By necessity, each economic zone competing with each other will face various conflicts and disputes. We cannot deny the fact that such disharmony will eventually cause four major problems in human beings — environmental destruction, population explosion, economic discrepancy, and war. Therefore, we at Orb question an economic system based on the theory of natural selection while we place much value and high potential on an economic system based on the theory of habitat isolation(2) advocated by Kinji Imanishi, which considers coexistence as a key element for evolution. We aim to actualize such an economic system.

(1) The theory of natural selection is a theory for evolutionary biology. It sets prerequisite that competition for survival in same species are inevitable because the fertility of all species always exceeds the capacity of our environment — the maximum number who can survive in Earth’s environment. From there, the evolution for all species comes from competition mechanism that the offsprings of individual who has higher survivability will be the standard while the offsprings of individual who has lower survivability will decrease or become extinct. Charles Darwin (1809–1882 ) , the advocate of this theory, was allegedly inspired by Thomas Malthus (1766–1834) , the author of the Principle of Population. Darwin thought that not only humans, but all species, have to fight over limited natural resources, and all species face discrepancy in their survivability and fertility for each, as all humans do, strive for mastery each other.

(2) The theory of habitat isolation by Kinji Imanishi (1902–1992 ) mentioned about the possibility of evolutions without natural selection. All species will gain acquired characteristics and evolve by adopting themselves niche domains to sustain their species. This habitat isolation mechanism produces diversity of species and the diversity brings in homeostasis (the stability of systems) on natural economic system.

Orb is a Software Foundation That Aims to Build Natural Economic Systems in Our Society

We at Orb are performing R&D and solution development towards a software foundation that moves our economic system closer to natural economic system. In other words, by building Orb’s software technology into humanity’s economic system, we aim, for example, to decentralize our economic system, to popularize digital currency and a settlements system based on a natural depreciation model, and to create a new growth index based on coexistence. From there, our economic system will become close to the natural economic system.

Our initial goal is to decentralize our economic system and to develop the software foundation to actualize the decentralization. With our decentralized technology, we aim to support various economic zones to run their system without central governance model.

2. Problems in Our Economic System

In this section, we firstly explain our understanding for historical background of the three major characteristics in our economic systems — central government, currencies with infinite proliferative capacity, and GDP/GNP, a growth index. Secondly, we explain our understanding for causal correlation between those three characteristics and four major problems in human beings — environmental destruction, population explosion, economic discrepancy, and war.

Historical Background of Generating and Developing Central Government, Currencies with Infinite Proliferative Capacity, and GDP/GNP

The Raise of Central Government and Its Overblown

In very early days of our civilization, without doubt, it’s very risky for a human to maintain self-sufficient economy alone because our technology to run such lifestyle was quite primitive. Thus, as many species raise their survivability with bands, humans also formed huddles. Humans also increased their productivity with specializations inside of the huddles to raise the huddle’s survivability. An unit which organizes the above self-sufficient economy based on the specialization with a group of people is an economic zone.

In the process of specialization inside of a specific economic zone, exchange economy spontaneously came into being there — Ex. barter trading between a person specialized in wheat cropping and a person specialized in hunting and gathering. Here, it’s a clear fact that we don’t have to set rules when each in this trading behaves altruistically because mechanism of service effectively works. However, in the case of that one of each or both of each behaves in a self-interested manner, those people face with trading troubles. Therefore, we realized the necessity of setting rules. This rule is the origin of law. From there, we also recognized the necessity of a role to set and run those rules, we formed a central authority — Ex: central governance model by deans in the case of village-size level economic zone.

There after, the size of our economic zone enlarged from family size to village, town, nation, and federation of nations in over a period of thousands of years. As the size grows, we organized larger and more centralized governing systems.

Historical Background in The Raise and Development of Currencies with Infinite Proliferative Capacity

In its origin, a currency was made as a common exchange medium defined by a central government with the necessity to operate an exchange economy more efficiently . In the early stage, the central government employed natural objects, such as shells or acorns, which were considered as common valuable natural objects inside of the economy zone. However, in the exchange economy between one and the other economic zone, people had to apply a common valuable objects which both of each can accept as exchange media. In most cases, people used golds as exchange media.

Although gold was very useful object from the perspective of credibility, workability, and durability, the portability was not highly enough. Thus, new demand for the alternative exchange media better than gold raised with long-distance exchange economy, so-called economic globalization. Some people started a new business, keeping gold from the holders and issuing bills and securities made by a peace of woods and papers. Once we deposit some gold to them, they issued a security for us, and we could use the security to purchase goods and services at the member stores far away from our home land. Those people who run such issuing business charged account management fee or issuing fee for their main revenue sources in the beginning. Later, some of them started lending business based on pooled gold from their customers. From there, our currencies not merely functions as exchange media, but also newly functions as “capitals”. It is considered that this is the raise of capitalism. As such interest rate based financing business models were developed, accounting methods on balance sheets were raised. From there, currencies gained infinite proliferative capacity.

The Historical Background of GDP/GNP

In middle age and modern times, central governments placed values on physiocracy and mercantilism for their growth policies. But, as currencies started to function as capitals, central government considered the accumulation of capitals as the growth index of their economic zone. This is the origin of GDP (Gross Domestic Product) and GNP (Gross National Product). Without doubt, GNP inevitably motivates each economic zone to invade each other because the growth index counts the capitals accumulated by those people belonging to one economic zone who lives in the other economic zone — ex. Japanese lives in US. Such dynamism in market economy based on GDP/GNP is considered to be a key factor to stimulate the globalization in our economy.

The Core-relation Between Three Major Characteristics in Our Economic System and Four Major Problems in Our Civilization

The Core-Relation Between The Mechanism of Babble Burst Economy and Wars

Currencies in our economic system never depreciate, and permanently increase with interest rates. This characteristic naturally causes excess of money supply against actual economy. High growth economy, for example — Japanese economy in 1960s-1980s after WW2 or BRICs economy in 1990s, never cause such excess of money supply against their actual economies since the buying power of goods and services in their actual economy is so strong because of material scarcity in their household economy that people are reluctant to invest their money on stocks or any other financial products. However, once most of households economy fulfills their material scarcity, then, the majority of their buying power shifted from fresh purchasing to repurchasing demands, and the total purchase demands of their actual economy seriously decreases. From there, the excess of money supply raises in household economy, and the majority of them start investing on financial assets by the excess. This causes bubble economy. Because most of stocks are heavily overvalued, exercise of caution on financial markets naturally raises with price soaring, some investors sell their stocks, stock prices drastically clash, and bubble economy bursts. As the stock price clash seriously worsen the companies balance sheets, the companies have to sell or close some of their business and layoff their employee. Depression starts.

In past history, the decline of GDP/GNP with depressions frequently motivated the central government to engage in warfare with other countries (economic zones) in order to overcome the economic difficulty. The size of war naturally enlarges as each economic zone expands from family size to villages, nations, and federation of nations. The worst example is WW2 which was caused by World Depression in 1929. We experienced ultimate sacrifice of over 85 million lives lost in the global warfare.

Economic Discrepancy and North-South Problems by Capitalism

People who lives in an economic zone which holds currency system with infinite capacity can gain advantage of living with larger capitals. For example, suppose 1% annual interest rate in banking. Those people who will or can deposit $100M in a bank receives $1M per a year while other people who will or can only deposit $10K receives $100 per a year. Here is $99M difference in each capital gain. This will chronically cause economic discrepancy. Every time bubble economy bursts, the economic discrepancy will increase between those people with poor capitals who lose their jobs or face with serious income decrease and other people who holds enough capitals to overcome such economic difficulty. This tendency also happens between nations with large capitals and other nations with poor capitals. Stronger economic zones which holds competitive industries in global to accumulate capitals, Weaker other economic zones which only holds poor industries to compete them. From there, North-South problem raises. The same problem alike North-South issue also occurs in Euro and Japan. In Euro, for example, while German achieved no issue of government bonds in 2014 since 1969, Greek has been facing with financial collapse since they joined Euro in 2001. Likewise, Tokyo keeps the healthiest financial strength over decades while Yubari city, a local city in northern Japan holding many marginal villages, lapsed into financial default in 2006. Local economies in Japan seriously have been weakened over decades. Thus, it is crystal clear that the idea of building universal currency and economic globalization with claiming the necessity to streamline global market economy will cause more serious economic discrepancy in global.

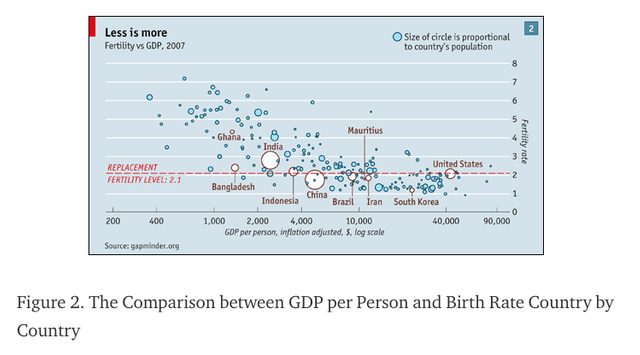

Population Explosion and Environmental Destruction by Economic Discrepancy

While population in developed countries such as Japan and Northern Europe decreases, our total population in global has been chronically increased. Now in 2015, the total number reached over 7 billions. For the major factor of this problem, we recognize the higher birth rate in areas or countries with poor capitals — ex. Africa, South Asian area. This means since people who lives in such poor capitals economic zones cannot expect well-developed social welfare programs because of lack of capital caring pension funds after retirement and unemployment allowance, those people consider their children as valuable labor force to take care of them after retirement or in unemployment. Thus, such circumstance convinces them to have more children, and the dramatic decrease of fatality rate by progress of medical technology saves those children lives from death and spurs population explosion.

As population explosion naturally boots up our consumption of natural resources, we will face with a difficulty that our consumption power surpasses reproduction power in natural economic system. Such difficulty will cause environmental destruction. WWF (World Wide Fund for Nature) published “Living Planet Report” in May 2015. This report clarified that in the case of all human beings try to achieve the same level of living as those in developed countries like Japan, we unquestionably need more than two Earth in 2030 to maintain such massive consumption economy in global. Stated another way, we can recognize that human explosion affects on environmental destruction.

3. Our Approach and Its Validity

As discussed above, Orb is a software foundation in order to achieve to make our economic system close to natural economic system. That is, we aim to redefine our economic system base on the fundamental rules incompatible with natural economic system — central governance systems such as nations and governments, currencies with infinite proliferative capacity, and GDP/GNP, a growth index based on competition principle. In this section, we discuss about our approach and its validity to redefine the above three elements in our economic system.

The Necessity of Downsizing Economic Zones and Its Decentralization

We now operate our economic system in a situation with a mix of those people who behave altruistically and those people who behave selfishly. As a conclusion, control by central governors forces our daily life to be more cramped and inconvenient. From there, people even behave more in a selfish way. Eventually, we’ve been facing with a negative spiral that central governors tighten their control to people more seriously. The direction of such negative spiral will reach to the world controlled by gigantic over sight government described in “1984” by George Orwell.

A key concept in our solutions for the above problem is “Formulation of Goodwill As a System” harnessing free trading mechanisms in market economy and mutual trustworthy relationship in our society without relying on serious control by central governors. This means we aim to build-in a new mechanism — evil or malicious people naturally behave with goodwill — into our economic system.

We already recognize such macro trend in Sharing Economy like AirBNB and Uber. For example, in AirBNB, room owners can expect to raise their room charge and to gain more guests with their activities based on goodwill, such as keeping their room clean and tidy, because of their higher reputation scores. Guests also can more easily rent those rooms with their higher reputation scores. In another case, Bitcoin allows unspecified users to validate payment transaction instead of relying on central banking system as a third trusted body for validation. In this model, the third party, so-called “miners”, can gain appropriate rewards for validation. This reward system is designed to decrease the motivation of malicious activities by the third parties. We can also apply this type of mechanism to other use cases which require validation by third trusted parties — ex. payment validation on fiat currencies, clearing services on security trading, registration of real estate, and tradition of automobile ownerships. The growth of these applications will be enable us to minimize the needs for central governance and to achieve small government based on small economic zones.

The necessity for local digital currency with natural depreciation model

Even if we achieve small government and economic zones, we cannot get rid of the possibility for babble and burst economy and wars without building-in a new mechanism or rule to our economic system which will eliminate motivation to enlarge economic zones and excessive competition by globalism.

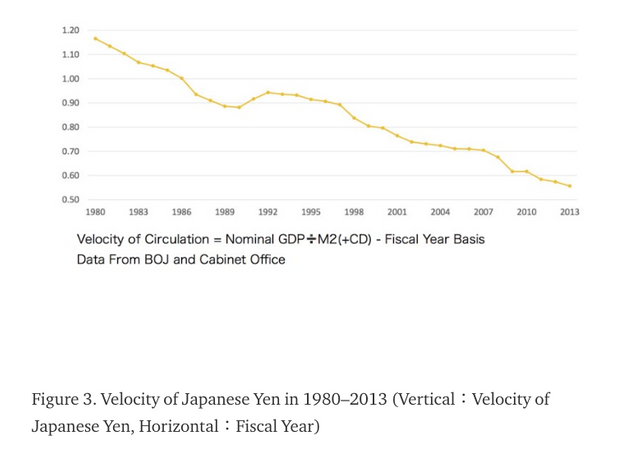

Our fundamental solution for this problem is to apply natural depreciation model to our currency system as same as limited resources with reproduction process in our natural economic system and our industrial products made by those natural resources. The idea of natural depreciated currency system was proposed by Silvio Gesell (1862–1930) around hundred year ago, and the economic effect now has been proved with some actual cases all over the world. We can also theoretically recognize the positive effect of natural depreciated currency system toward our economic system. Take “Equation of Exchange” by Irving Fisher (1867–1947), Novel Prize Economist to explain its effectiveness.

- MV = PT

- M (Money Supply)

- V (Velocity of Circulation)

- P (Price of Goods and Services)

- T (Transaction Volumes)

Based on this precondition, take a look at the following graph (Figure 3)- V of Japanese Yen after Bubble Economy in 1980’s.

The above Figure 3 indicated that V of Japanese Yen tended to decrease from 1.18 in 1980 to 0.57 in 2013 inversely proportional to the increase of M. Thus, we can recognize that the oversupply of M never stimulates our real economy.

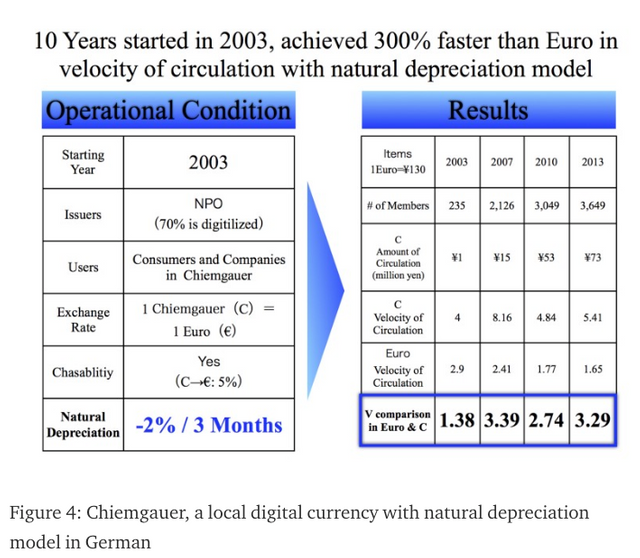

On the other hand, Chiemgauer, a local digital currency with natural depreciation model in German, achieved 300% faster V than Euro on average. See Figure 4. This is a clear indication for us to realize that we can revive our economic climate without permanent increase of money supply.

The Necessity of New Growth Index Along With The Reproduction Power of Natural Resources on Earth.

GDP/GNP, a growth index based on “amount of capital”, will cause not only economic discrepancy and wars, but also force humans to demand radical economic growth surpassing the reproduction capacity of resources in natural economic system. Here is possibility that we will face with serious difficulty of keeping to surviving on Earth because such growth index will raise more rapid population explosion which pull out critical environmental destruction. For this potential risk, we recognize the necessity of introducing a new growth index far away from “amount of capital”. For example, a growth index which quantifies the efficiency of energy consumption per person will be one of our options. This growth index will enable us to operate our economic system based on the reproduction capacity and capability of resources in natural economic system. The higher efficiency shows clearer trend to coexist with natural economic system on Earth. To formulate this new index, we have to cooperate and discuss beyond stakes over companies and nations.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@mrmasa/a-blueprint-for-post-capitalism-c3ebcac31ce1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, the content is also written by me :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit