So You Want to Get into Precious Metals?

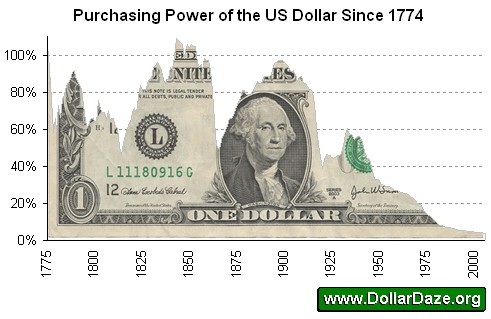

But why? Maybe you're a skeptic when it comes to the economy, maybe things don't look as peachy to you as the media paints them to be; or perhaps you're privy to the great international hoax that is fiat currency. (For those of you that don't know, fiat currency is any currency that relies on faith, as it is not backed by any tangible good.)

Dollars against Gold

Dollars against Gold

Or perhaps you're starting to see the signs of wear and tear from the constant bombardment of quantitative easing and government involvement. There are a multitude of reasons but that could be a post for another day. One thing I'd like to share with you before diving into actually stacking is a graph I found. This pertains to the United States, but it can be applied to any country as all countries in the world have adopted fiat currency.

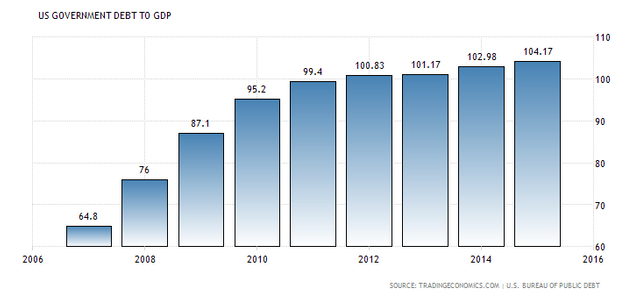

The national debt has crossed the United States entire GDP, and this is not even considering future unfunded liabilities.

So What Can I Do?

Plenty. For one, you can shield yourself against the impending hyperinflation that will occur when the Federal Reserve prints the Dollar down into oblivion. Any real good or commodity that you can think of could be considered a hedge, be it land, cryptocurrency, or even lumber. But historically speaking precious metals have been this tool.

Disclaimer - I am a student in this field and am not claiming expertise by any means, so I welcome any and all feedback as I go along. Thanks in advance for your patience.

Several Terms You Should Know Before Starting:

Spot Price (also referred to as melt price) - This is how much the "market" would charge for an ounce of that particular metal. For example, at the time of this writing Gold's spot price is $1,278.50/troy ounce. Certain items will net you more or less than spot, depending on what it is and the market conditions. More on that later.

Bullion - Gold, silver, or other metals in bulk before coining, or valued by weight. Typically what people would refer to as "bars".

Coins - This one may be a bit confusing, there are metal coins minted in countries that have actual fiat currency value, though they are usually paltry compared to their spot or melt value. For example, here is a picture of one of my 1 oz. American Gold Eagle coins that is "valued" at fifty dollars, though it could actually easily net you $1350 as of this writing.

Rounds - These are metals that are stamped and look like coins, but they have no fiat value attached to them so they're legally called rounds.

Stacker - A person into that participates in metal stacking, I consider myself one. Hopefully you will too!

So Where Do I Start?

What Metals you should focus on depends on your budget and interests. I personally hold Gold, Silver, Platinum, and Rhodium, with a heavy focus on Silver and Platinum. I can get into a detailed why in a later post, but it is recommended to have 10-30% of your liquid assets into Precious Metals, so you can do the math from there to see what you think you should focus on.

JMBullion, APMEX, and Kitco are a few of the many websites you can look at that have updated spot prices and charts for the major metals.

After figuring out what you like to stack, you should head over to a reputable local coin shop / precious metals exchange and introduce yourself. You will do this for 2 main reasons:

If they're reputable, they've been around for a long time. They are a wealth of knowledge, and from my experience, they are generally decent people that want you to succeed.

They can test any coins or metals that you may come across outside their shop for authenticity, which they'll gladly perform if you've done business with them before.

(The second step saved me almost $5,000 cause I quickly identified some fake bars I purchased from eBay. )

Looks real enough, but it's just a gold colored paper weight.

The approach I used when I got into the shop was pretty straightforward, I introduced myself and told them that I was new. I then had a conversation with them, attempting to pick their brain and got a feel for what kind of philosophy they had towards stacking (everyone has their own).

I then spent a little money at the shop, just to show them I was genuine. How much you spend depends entirely on your budget, but I would say anything over 100 USD would be probably suffice. Think of it as your initial investment on this journey.

Next, I would study the spot price charts and figure out what price points you'd be comfortable at getting in. You can see the dips and highs from past years and it will give you a decent picture of how the metals move.

Some other things to consider:

This is Wealth Preservation, first and foremost - This is a long term investment. Though you may not see the sort of short term returns that cryptocurrency or the stock market brings, this investment you make in metals will never go to zero and does not rely on electricity or the internet. However, I suspect the investment will probably pay off big within the next few years or so depending on when you buy. And now is a good time to get in.

Avoid Collector coins - As a newcomer I would avoid anything that is a "collector" coin. You'll know when you see them, they typically carry a very high premium over spot. Unless you have a deep knowledge for coins I would steer clear. Your focus right now should be to be able to buy as close to spot as possible.

Smaller denominations generally have higher premiums - As with most things in life, buying in bulk will save you money. Try to avoid buying anything that carries a hefty premium, which tends to be smaller denominations of metals (typically less than 1oz.)

Think ahead for storage - As your stack grows you may need to consider where and how you store your stack, security from theft and fire should be your main concerns. If security is a concern try not to publicize this new hobby of yours ( I know, I'm a hypocrite).

Enjoy your stack! - It may sound superficial, but don't be afraid to buy things that appeal aesthetically to you (keeping cost in mind as well). For example this Platinum Swedish Helvetian Matterhorn is one of my favorite pieces, sometimes I like to just look at it after a long day's work.

I love you too, Helvetia.

I hope this was helpful, please feel free to comment or ask questions and I will do my best to answer. If you found value in this and would like more posts about this topic please feel free to upvote.

Thanks for your time,

O.T.

TL;DR version - Buy metals (allocate about 10-30% of your liquid assets), fiat currencies are going down the drain.

An interesting post @otraza. Thanks for the introduction to stacking. Investing in metals is something I have been considering for sometime. Whats your opinion on buying online from the bullion type websites?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate your feedback!

As far as buying online, unless you are buying large quantities, you're better off buying elsewhere for better deals due shipping, price/unit, and the fact that they prefer you to pay using bank wire transfers.

In fact, most of the bullion exchanges have stores on eBay and the prices off of eBay are usually better in my opinion than on their websites. Buying from eBay gives you purchase protection, free shipping, and the flexibility in payment types. I have bought from most of the major bullion exchanges using this method and have not had a problem so far.

Hope this helps, if you have any other questions please feel free to ask!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for that. I didn't know you could buy from eBay! Might just check it out and give it a go. Thanks again.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

meep

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Right back at you pal 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

meep

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No problem at all, I'd just advise you to stick with the reputable dealers on eBay in the very beginning at least. If you have any other questions please let me know.

-O.T.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Have you any recommendations?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Liberty coin, bullion exchanges, apmex, bay precious metals, and pinehurst coins are all dealers that I've purchased from with no problems as of yet, though this list is far from comprehensive.

I still do check everything they send, but they have countless positive feedback and I doubt they would risk dealing in counterfeits.

-O.T.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for all the information @otraza I'll go and check some of these out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @otraza! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit