Introduction

The projects we will explore and refer to today are closely related to platforms that support locking tokens into pools to receive rewards from liquidating, in short, the DeFi project. Liquidity is an exchange nowadays.

This project is called Yearn Finance Platinum - a premium version of high-performance finance, the name sounds good, but seems to be purposely synonymous with project finance misses.

This project has no reviews or ratings, what interests me is the reputation of Little Rabbit's Bounty manager.

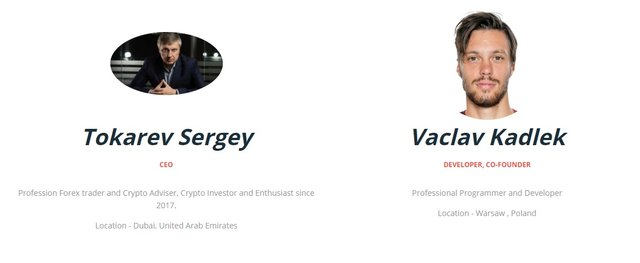

The project has team information, but this doesn't give it much credibility. You will see what I wrote is very similar to the YFLTD project, because they share the same idea, the general manager of Bounty, even the YFLTD twitter account also shared the YFPL post

What is Yearn Finance Platinum

Yearn Finance Platinum is Revolutionizing DeFi By Combining the Benefits of Yearn Finance and Governance. Decentralized people group drove DeFi convention underscores on Staking, Yield Farming, and Locked liquidity with limited supply 3,333 YFPL tokens. Network Driven Governance Feature.

PROBLEM SOLVING IN WHICH YFPL WANT CURRENT MARKET Defi

- The need to participate in liquid DeFi projects with attractive APIs is very high, but the number of prestigious and reliable projects is very low;

- Most liquidity pool projects do not have a secondary reserve strategy to serve user needs;

- I wanted to write more, but it's true that without a project document, nobody would dare to cut the wind or draw a lot of weird features that might not show up in YFPL.

SOME OF THE SOLUTIONS PROPOSED BY YFPL

- Publish 1 platform for everyone to have the opportunity to participate in the liquidity pool on the decentralized exchange, get high profit from trading activities using liquidity from the pool;

- Token holders have additional options to make more profits such as betting or voting that determines the operation and future of the platform;

- Platform users can borrow & lend via the platform, which is considered the safest direction for DeFi projects;

- Register and create liquidity pools at UniSSwap & MoonSwap, listing on major exchanges such as Hotbit, Probit, Binance DEX.

Marketing and Promotion

- Social network developments

- BitcoinTalk and Discords thread creation

- 5 AMA sessions

- Youtube promotion

EXCHANGE LISTING

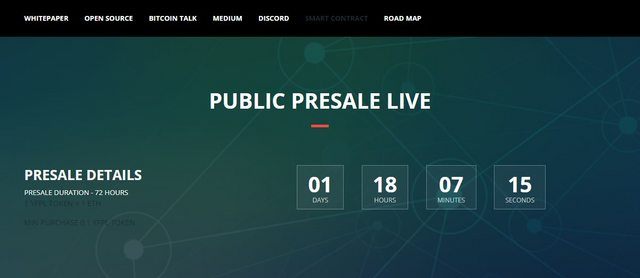

- Public presale at Bounce.Finance Platform

- Uniswap and Moonswap Liquidity Pools

- Hotbit Exchange, Probit Exchange

- Binance DEX

STAKING AND GOVERNANCE

- FERRUM NETWORK PLATFORM

- OWN STAKING AND GOVERNANCE PALTFORM

- APY 333 %

Yearn Finance Platinum

Tokenomics

YFPL DETAILS:

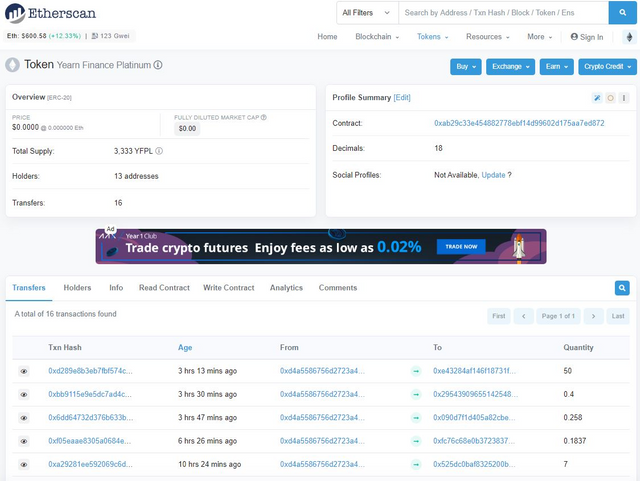

- Token Name: YFPL Token

- Code: YFPL

- Platform: Ethereum flows: utility, liquidity

- Total supply: 3333 YFPL

- Token-Sale:?

- Token price: 1 YFPL = 1 ETH

- Soft cap:?

- Hard hat:?

TOKEN DISTRIBUTION:

- 50 tokens - open private sale

- 100 tokens - public sale

- 200 tokens - DEX

- 100 tokens - Hobit

- 50 tokens - marketing

- 500 tokens -

don't stake the token on the development team.

All unused tokens will be locked for 36 months

Roadmap

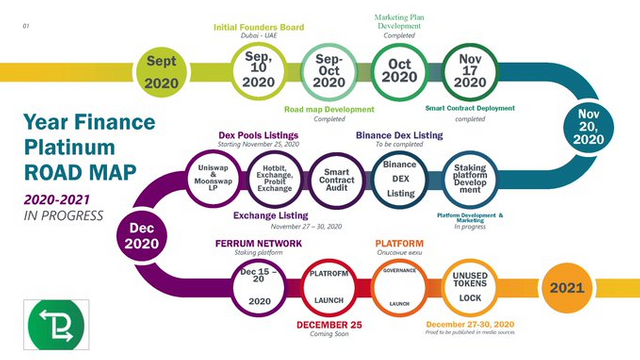

09.2020

- Form a team of project co-founders

09-10.2020 Roadmap

- development

10.2020

- Developing a marketing plan 11 /

17,2020

- Implement smart contracts

2020/11/20

- lurking development platform

- Binance DEX Smart listings

- Audit contract

- Hotbit exchange listings

- Create liquidity pools at UniSwap & MoonSwap

12,2020

- The foundation is staked on the Ferrum Network

- Launch the official platform

Yearn Finance Platinum Team

To get more accurate information, please visit the link below:

- Website: https://yfplat.finance/

- Twitter: https://twitter.com/YearnPlatinum

- Facebook: https://www.facebook.com/Yearn-Finance-Platinum-108724841057266

- Telegram: https://t.me/yfplann

- Bitcointalk Bounty: https://bitcointalk.org/index.php?topic=5292546.

AUTHOR

Bitcointalk Username: NYONYGMY

Telegram Username: @Mey_nyonyg75

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=2750675

Wallet address (eth): 0x269327ae1b712bfd6C3C5C604e926304A1244f85