Most of us are stuck in a zone where we make hardly any money.

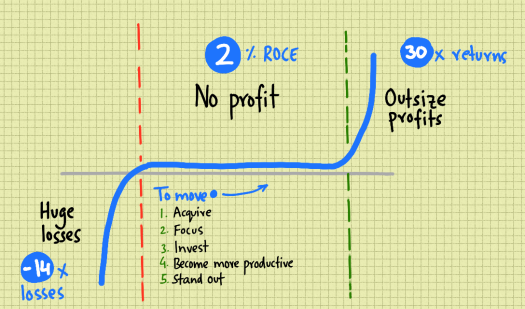

It turns out that the profits made by organisations fall along a power curve.

This means that most fall into a zone where their returns on capital employed are tiny.

They make net returns of less than 2% on invested capital, making 10% gross and paying out 8% to lenders.

Chris Bradley, Martin Hirt and Sven Smit from McKinsey explain how in this article, showing that companies at the top make around 30 times as much as the ones in the middle.

The ones at the bottom make losses of over 14 times.

This works out to around $50m in the middle, nearly $1,500m at the top and losses of just under $700m at the bottom.

They found that around half of where we sit on the curve depends on the industry we're in - Tobacco is at the top, paper is languishing in the middle.

As the saying goes - before you climb the ladder, make sure it's leaning against the right wall.

It's better to be average in a great industry than great in a poor one.

This has echoes of Warren Buffett who wrote when a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.

As this McKinsey article shows, returns are highest in pharmaceuticals, household personal goods and software, and lowest in utilities, telecommunications and transport.

So what's the answer?

It turns out that to move up the curve, we need to do the basics plus a bit.

The authors come up with five points.

The first is to have a disciplined acquisition process. We need to evaluate and buy businesses that are a good fit for us.

The other four are basic good business practice.

We should focus on the areas that are doing best, moving more resources to them.

We need to invest in our capability, putting capital into the business so that we have the technology and resources to respond to the market.

Becoming more productive goes without saying - doing more with less.

We need to stand out - differentiate ourselves by innovating and creating new business models.

Interestingly, this power curve could be used to describe individuals and their careers just as much as organisations.

A few make a lot of money, the vast majority get by and some lose a lot.

The question that we need to answer is what moves we're going to make next.

The authors argue that these need to be big ones - just doing what everyone else is doing isn't enough.

We need to do more and go further if we want to break out of where we are and move towards a more profitable position.

Doing nothing is a bad idea.