This Week’s Property Market Highlights:

- Auction volume was lower across the country.

- Home prices were mostly flat in Sydney but jumped higher in Melbourne.

- A Morgan Stanley economist says overseas Chinese property investment could fall 84 percent this year.

- A Big Four Aussie bank stress tests a 30 percent crash in house prices.

- UBS economists actually believe the RBA can raise rates.

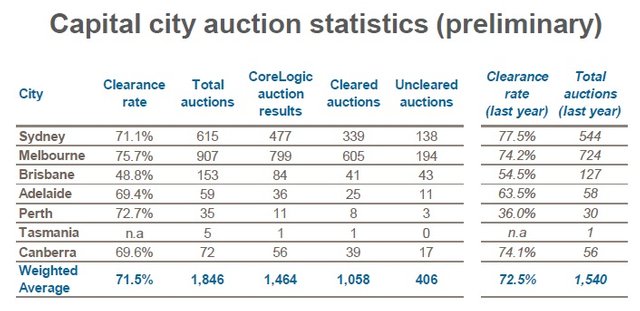

The Latest Preliminary Auction Activity

Sellers brought fewer homes to auction this week, with total auction volume across the capital cities coming in at 1,846, down from 1,987 last week. The preliminary clearance rate was higher, which is to be expected when buyers have less choice.

New South Wales had a bank holiday long weekend, but that didn’t stop Sydney’s preliminary clearance rate lifting back above 70 percent. Melbourne’s market was the hottest in the country again this week. Sales at Auction in Adelaide, Perth, and Canberra were robust, but less than half of Brisbane auctions found a buyer.

source

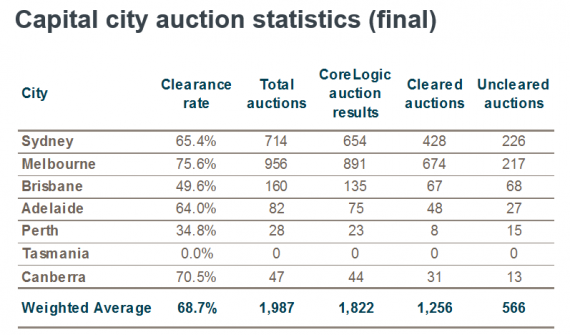

Last Week’s Final Auction Results

Only Melbourne and Canberra sellers cleared over 70 percent after the final count was in last week. Demand in both Sydney and Adelaide was moderate, with clearance rates in the mid-60s.

Here are all the final capital city results for last week:

source

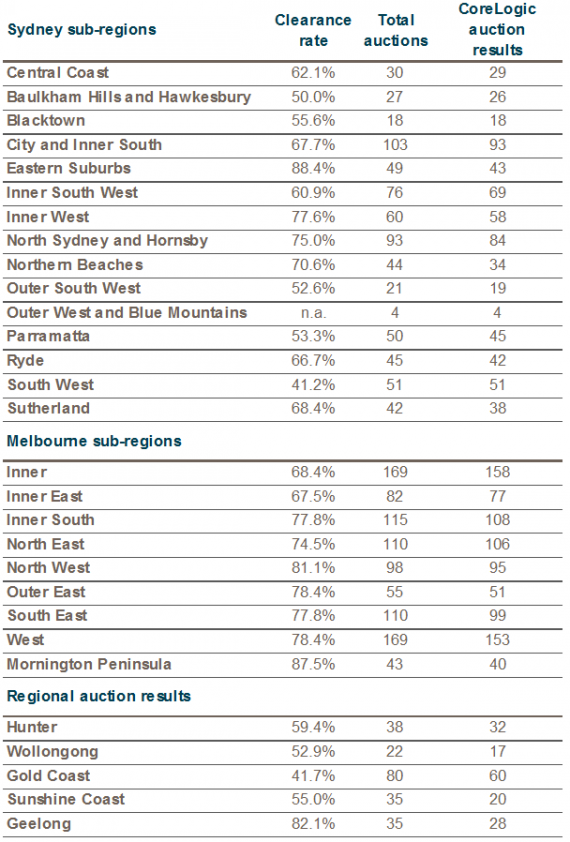

Demand remains strongest in the Eastern Suburbs of Sydney where 88.4 percent of auctions found a buyer. Sellers in the South West continue to struggle finding bids. In the Melbourne suburbs, the Morning Peninsula took out the top spot.

source

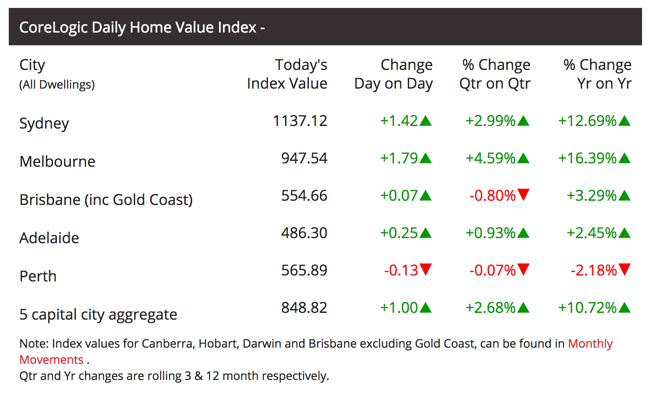

Recent Changes in House Prices

Home prices rebounded this week, thanks to a fall in auction volume. In Sydney, the median house price growth was nominal at 0.17 percent. In Melbourne, home prices surged 0.50 percent week-on-week. Brisbane, Adelaide, and Perth remained relatively flat.

source

Market Analysis

Changes in home prices in Sydney and Melbourne this week continued to highlight the impact of supply on changes in home prices. Auction volume increased over the previous week, and prices went lower as buyers had more choice. This week, supply decreased, increasing competition between buyers, and prices rose.

Clearance rates are lower in Sydney than in Melbourne, which is an indication that supply is moderating in the New South Wales capital, evidenced also by slower house price growth. Demand is softening because investors are struggling to qualify for stricter lending standards. APRA’s tougher capital controls on banks are having the greatest impact on the Sydney market because home prices are already higher there.

CoreLogic didn’t report on the upcoming auction numbers for next weekend, so we won’t know until tomorrow what volume will look like. If there are fewer sellers again, assuming demand remains consistent with previous weeks, expect more competition amongst buyers and another uptick in home prices.

In the short to medium term, home price growth should remain relatively flat, but expect the Melbourne market to continue to outperform Sydney. If Melbourne’s clearance rate remains in the 70s, home prices will likely continue to grow in the range of 0.50 to 1 percent per month. Prices in Sydney aren’t expected to fall until the auction clearance rate moves below 60 percent for a sustained period.

This Week’s News

Commonwealth Bank Stress Tests a Property Market Crash

source

There are no micro-economic indicators yet of an impending housing market collapse, but maybe the CBA sees something others don’t. In their latest investor discussion pack, the bank laid out a pretty dark scenario, although perhaps not as bad as things could get.

Their scenario assumes that over a three year period…

- home prices collapse 31 percent,

- unemployment surges to 11 percent, and

- the RBA cuts the cash rate to 0.50 percent.

Here’s what they came up with: They’d need to write off about $4 billion in bad loans, although after getting paid from mortgage insurers, total losses would amount to $2.9 billion. The CBA’s total profit last year was over $9 billion, so a 30 percent price drop wouldn’t be a SHTF scenario for the banks, but shareholders would no doubt be feeling some pain.

source

Of course, investors wouldn’t fare nearly so well if home prices were to fall 30 percent. They’d be the ones facing foreclosure, and that after months of some very painful cash flow challenges.

Chinese Investment in Aussie Real Estate is Falling Fast

source

Tougher capital restrictions in China is a big risk for Australian real estate. Chinese investors have made up a significant portion of demand for Aussie homes, especially new builds. If investors can’t get their money out of China, they can’t buy properties overseas.

One Morgan Stanley economist suggests Chinese overseas direct property investment will plummet by 84 percent this year and then fall by another 15 percent by the end of 2018. Only time will tell what that means for the Aussie property market.

Delusional UBS Economists are Forecasting RBA Rate Hikes

source

Economists at Swiss financial services company UBS have pulled forward their projections of an interest rate hike by the RBA. They expect the Australian economy to grow at 3.5 percent per annum beyond 2019 and suggest the RBA will step in to slow our economy down.

Once again, we have delusional Keynesians buying in to the notion that central banks can actually increase wage growth through lower interest rates.

We currently have a floor under Australian home prices thanks to the RBA’s record low cash rate. Plenty of homebuyers can still afford to pay the interest on very expensive properties. The RBA wants to keep it that way, because without household debt growth, bank profits are screwed.

The last thing any of our regulators want is falling home prices. They want wage prices to rise to wipe out inflation in house prices, so if the economy is growing at 3.5 percent per year, they’ll be celebrating.

Unfortunately for them, interest rates are already at a record low and the economy hasn’t started growing yet. Furthermore, the Aussie dollar has strengthened on a softening US dollar as traders are starting to reject the notion of higher interest rates in the USA.

The RBA wants the Aussie dollar below 70 US cents. Once the Fed starts cutting rates again, we may not see a voluntary rate rise by the RBA until the bond market collapses and drives borrowing costs up independent of the RBA.

Sorry UBS. I just can’t see it.

Where do you see the Fed and the RBA taking interest rates?

Should Aussie banks be stress-testing a fall in home prices greater than 30 percent?

Jason Staggers

We here at Community News reckon CBA were doing more than Property Market Stress Tests this week JasonStaggers.

Right... time to go finish the laundry, then it is off to bed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

devaluation is not the permanent solution of the problem (as you mentioned RBA wants AD to 70 cents on the dollar) because devaluation these days does not remain normal devaluation but competitive one and that creates problem for both in long term as macro economic scene changes and more countries will join the trade league..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's the race to the bottom. The only real solution is to let the market determine borrowing costs, which would certainly lead to higher interest rates, a stronger currency, and exporters going out of business. As they say, pay me now or pay me later. Unfortunately, the later option will be more painful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes I agree with you on this but I don't think interest rate gonna be decided by free markets as there are whole breed of keynesian policy makers around the world (active intervention- actually too much active intervention). And yes your second last sentence of the comment is holy true- cash flow is the king, but people expect too much free lunches from government and that's really bad thing for same people. Major fiscal imbalances are due to this mentality (expecting free lunches).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As always an excellent professional report. Highly appreciated Jason. Perth housing down 2% YoY, do you think we can use that as an Australian forecasting indicator?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Lucky. To the degree that it reveals that home price growth over time always re-aligns with consumer price inflation (and wage growth) then yes, I think we can.

There's much more demand for housing in Sydney and Melbourne due to the concentration of jobs and immigration growth in those areas, but eventually, either home prices must fall or wages must rise. And like I said in the post, I'm not convinced the RBA has the power to lift wages in the current world economic landscape.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the comment. I had initially mentioned the 2% decline as a reflection of true Australian industry since we have a lot of commodities orientated business going on here. However now you have pointed out some true "industry" - immigration. It seems to me a lot of immigration is in the education tourism sector. I know a couple here, now they are driving Uber. Headshake, according to my reviews Uber pays too little, therefore car depreciation cannot be compensated. I haven't told them yet, don't want to mess up their day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, good point. Eventually, the end of the mining/commodity boom will impact all of Australia. Unfortunately, we keep spending like the iron ore price is $180.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amazing analysis. #Hope to see more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. You can check back this time next week :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Reesteemed!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good post, I will be supporting you, upvote? it would help :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit