STEEM Witness @roadofrich / Blokfield.INC

Background

Since the suspension of SBD trading on Upbit, there has been a lack of accessible and efficient environments for trading SBD. On the STEEM internal market, insufficient liquidity has led to trading losses for some users. Similarly, on HTX Exchange, while there is trading activity, a significant portion is dominated by bot trading, and large order book gaps increase the risk of losses.

Furthermore, users in countries with limited access to HTX Exchange face difficulties in liquidating their STEEM and SBD rewards into cash. To address these issues, we propose building and operating a market-making (MM) bot to enhance the trading environment within the STEEM ecosystem.

Our team has over a year of experience operating MM bots on Upbit and the STEEM internal market, successfully handling over 250,000 SBD in trading volume. Leveraging this expertise, we aim to contribute to the growth and stability of the STEEM ecosystem.

Goals

Primary Goal

Enable STEEMIT users to trade SBD rewards on the STEEM internal market at fair prices, minimizing asset losses.

Secondary Goal

Integrate with centralized exchanges (CEX) where STEEM and SBD are listed to perform arbitrage trading.

Use arbitrage profits to burn STEEM and contribute to the ecosystem's sustainability.

Tertiary Goal

Develop a bot to swap STEEM and SBD into USDT or TRX, creating a system to minimize asset loss during swaps.

Expected Benefits

- Increased Liquidity in the STEEM Internal Market

Improved trading environment with stable liquidity for SBD and STEEM.

- Price Stabilization Across Exchanges

Arbitrage trading will reduce price discrepancies between exchanges.

- STEEM Value Appreciation

Profits from arbitrage trading will be used to burn STEEM, enhancing its value and benefiting the community.

- Enhanced Utility for STEEM and SBD

Establish an ecosystem where STEEM and SBD can easily be exchanged for other cryptocurrencies, such as USDT or TRX.

Proposal Details

- Operational Funding

100 SBD per day: Required for development and operational expenses.

- STEEM Power Allocation

50,000 SP: Necessary to maintain sufficient liquidity and build a robust order book on the STEEM internal market.

- Initial Liquidity Assets

SBD, STEEM, and USDT: Approximately $10,000 worth of assets to begin liquidity provision effectively.

Technical Implementation

Utilize the APIs of the STEEM internal market and HTX Exchange for real-time data collection and automated trading.

Develop a smart bot to optimize arbitrage trading and asset swaps.

Ensure transparency by regularly disclosing all transaction records and operational activities to the community.

Conclusion

This proposal focuses on enhancing the stability, liquidity, and user convenience within the STEEM and SBD ecosystems. Our goal is to maximize the benefits to the STEEM ecosystem by concentrating on service operation and bot development without requesting additional operating fees for the bot itself.

With over a year of experience in building and operating MM bots, we bring the expertise and commitment needed to establish a transparent and efficient liquidity provision system. We are dedicated to working collaboratively with the STEEM community to create a sustainable solution that supports the ecosystem's growth and prosperity.

We look forward to the support and engagement of the STEEM community.

interesting idea, but IMO we need to hear the opinions from the foundation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I would prefer the free market take care of the price and liquidity issues as opposed to creating a system that will require trust (and a cost) to do the same thing. There will be profit potential for those that can arbitrage the HTX and internal market prices and that profit should (may?) be enough motivation to solve the problem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

when it works well, it makes sense.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with @danmaruschak's points. I don't understand how you plan to use SP to maintain liquidity, and 100 SBD per day seems like a lot. Is this proposal going to be submitted into the SPS, or is the word "proposal" here intended more like "suggestion" or "idea"? I don't see a proposal in the SPS yet.

Additionally, what about time frames and deliverables? 100 SBD per day for how long? When would delivery be expected? How much burning do you expect to accomplish via arbitrage?

Also, maybe people who buy SBDs at above $1 should expect to take a loss. It was intended as a stable coin, and I'm not in favor of using SPS funding to support an artificially high price of SBDs.

Lastly, maybe this sort of idea should be coupled with a revamp of the blockchain's liquidity rewards capability? Perhaps that would provide competitive funding for diverse MM implementations, instead of locking the blockchain into a single provider(?).

As a general concept, I'm in favor of providing liquidity and expanding access to STEEM/SBD trading, but I don't fully understand the plan here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I explained above why SP is needed. You can refer to it.

We need to build various MM bots and systems. During the development period, we will need the support of DAO.

I did not submit SPS because it is currently under discussion.

If everything is discussed, we will submit SPS and start voting.

This MM bot is not intended to artificially keep SBD at a high price.

MM bots and strategies are very diverse. We only provide liquidity through MM and react to market price changes.

And it is difficult to create market price changes with 10K USD of liquidity supply.

How much STEEM can be burned will depend on the trading volume and market conditions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A good weekend,

@ wakeupkitty

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! You too, @wakeupkitty.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Arbitraging between exchanges seems like a good idea in general. With what you're talking about here, I'm not really following why you need a lot of SP for this. Can you expand on that? Also, why 100 SBD per day in operational funding to just issue automated trades? What is so expensive about that?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The reason why SP is needed is because Resource Credits are needed to use the STEEM internal exchange.

Since the STEEM internal exchange operates on-chain, it requires a lot of Resource Credits to create order books.

We needed about 15K SP to continuously create about 3 order books for 24 hours.

We estimate that about 50K SP will be needed to add two-way trading and more order books.

Developing an MMbot algorithm requires the efforts of many developers.

There are many parts that need to be developed, such as an MMbot that operates on the HTX exchange, a system that discloses transaction history through API, an MMbot that operates on STEEM, and a strategy to increase the number of STEEM using the MMbot.

Considering planning, website construction, MMbot design development, etc., 100SBD is honestly a very low amount.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I haven't run the numbers, but my general impression is that you'd need to run a huge number of transactions before hitting an RC limit. Why do you need to so many transactions?

Why do you need to create multiple "order books"? Why do you need to do it "continuously"?

Why? That doesn't make sense to me, especially if you've already done it once. What's complex about the algorithm here?

Maybe a broader question here: What is doing this via bot getting you that doing straightforward arbitrage via manual transactions couldn't?

Why do you need to construct a website to issue transactions on a blockchain and the HTX exchange?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The market price keeps fluctuating. We need to keep re-creating the order book to match this change.

The MM bot we operated is a one-way system that buys SBD from the STEEM internal exchange, transfers it to Upbit, and resells it.

And we need to develop it again to match HTX.

Also, the MM we created is a system developed for our own profit, and it is different from the nature of the proposed proposal.

If the above proposal is approved, everyone needs to check how the MM bot works, so additional development is absolutely necessary.

If there is no MM bot, there will be an order book gap in the STEEM internal market, and there will be a lot of losses when buying or selling SBD.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I thought your premise was that there was a systematic distortion where the markets were always out of sync. If there are constant fluctuations that cross whether there's an arbitrage opportunity isn't that an indication that the markets are already naturally close? Right now it looks like the orders on the internal market put the price at between 0.19 and 0.20 SBD/Steem. Coingecko says that on HTX SBD is trading at $1.34 and Steem is trading at $0.2581, so 0.2581 / 1.34 = 0.193 SBD/Steem. Those seem pretty close to me. What transactions would your bot be issuing in an environment like that?

The automated posts kept saying that your Upbit bot was preliminary. Why did it never get to full release? How effective was your bot at closing the price differentials between the internal market and Upbit?

If there are profits to be made by arbitraging between HTX and the internal market, wouldn't it be better and more decentralized to just let the profit motive incentivize whoever wants to take the risk to do buys and sells, and natural economic equilibrium keeps the markets in sync? What is the benefit of a bot that does this and burns the profits?

Why? Historically there has been a gap but that seems likely related to distortions of the highly restricted Upbit market. Isn't HTX much more open?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you have only observed the market for a short time. Your opinion is that if you leave it to the market freely, everything will be resolved.

MM bots are working on all exchanges, but they are working very limitedly on the STEEM internal market. There are several reasons for this, such as development limitations and insufficient trading volume.

We processed more than 250K SBD transactions through Upbit MM bots, and users traded SBD with a difference of 0.x%.

And MM bots are not officially released. (This is not a service that is open to everyone.)

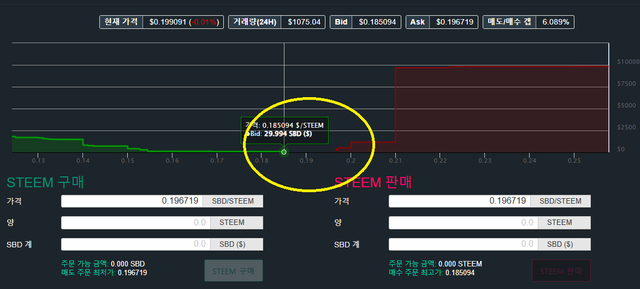

Simply put, if there is no MM bot, there will be a gap in the order book as shown in the picture below.

Users who trade during this gap will suffer losses.

Currently, there is a gap of more than 3% in the order book.

And the reason for making this is to look at it from a long-term perspective.

The current volume of the internal market is very low, so it may not seem like a problem, but what if the volume increases?

This gap increases even more, and more trading losses occur.

This in turn reduces the frequency of using the STEEM internal market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My opinion is that if things don't seem to be resolving to what a standard economic analysis would tell us then there must be some other factor in play. It seems like there was something weird going on with the Upbit exchange. I am skeptical that "not enough trading bots" on the internal market was, is, or will be a problem. How far out of sync have SBD prices historically been with non-Upbit exchanges?

You seem very focused on things like quantity of transactions. How much profit did you make off of your transactions?

Wait. Who are you saying is suffering losses in this situation... Buyers? Sellers? Both? People with access to exchange markets? People without access to exchange markets? Both?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's too hard for me to tell you all the cases.

Most of the trading volume of SBD so far has been on Upbit. And Upbit was only available to Koreans. The problem here is that users who can trade on Upbit traded at 1SBD=$5, but users who can't use Upbit traded at 1SBD=$4.5.

I provided liquidity to the STEEM internal market at around 1SBD=$4.9x$ through MM, so that users who don't use Upbit can trade at close to 1SBD=$5.

Then, users who can't trade at 1SBD=$5 have to sell at about $0.5 cheaper than the market price, which means that they incur relative losses.

If there's a lack of liquidity, it's difficult for many users to trade. This is the key point.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Se que acabo de llegar a este hilo, pero concuerdo mucho con @danmaruschak, sin una estrategia clara es difícil que se llegue a un consenso

No se mucho sobre liquidez y el mercado, pero en lo poco que he leído entiendo que quieren igualar el precio de Upbit con las operaciones creadas con ese fondo que piden, pero considerando la gran cantidad de usuarios que existen, cuando tiempo cree que duraran las transacciones que se programen? pienso que el fondo en algún punto se acabara y volveremos al principio

Además, recuerde que el SBD fue creado para valer 1$ (con esto no estoy diciendo que estoy conforme con ese precio, solo que el mismo Whiterpaper juega en contra de lo que esperamos como comerciantes)

Si el precio estaba siendo manipulado o no en Upbit, no cree que el precio podrá cambiar si dejamos que todas las operaciones comerciales sean trasladadas a HTX? (por lo que veo el precio que esta en HTX solo representa el 0.19% mientras que las operaciones de UPbit son mas de 99%)

El 12 de febrero esta a la vuelta de la esquina, en caso de que su propuesta se apruebe, hay alguna fecha tentativa para su implementación? estaré atenta a todas la opiniones y dudas que se resuelvan

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@roadofrich Hi, I have a same thought about this. Recently, I thought STEEM needs SBD LP pools for better liquidity. If the LP pools automatically distribute exchange fees, the liquidity will skyrocket.

I published this post. What do you think about it?

https://steemit.com/hive-103599/@happycapital/steem-needs-sbd-lp-pools-now-please-read-this-post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Furthermore, I uploaded this issue on X.

Feel free to read it.

https://x.com/Happycapital3/status/1880171428236149155?t=dycZ6wNHNMXpuQv7kocAjQ&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When it comes to bridging STEEM and SBD to other blockchains, I think the most important thing is the 3rd party issue. I hope STEEM or Tron foundation will make the official TRC-20 STEEM and SBD 🙏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is my 2nd post about the issue.

For the sake of scalability for STEEM token economy, STEEM needs LP pools on SunSwap based on Tron blockchain.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I personally do not prefer multichain.

I think it is more efficient to build a STEEM Layer 2 system like STEEM-ENGINE and build our own on-chain DEX.

https://steemit.com/proposal/@roadofrich/proposal-for-steem-ecosystem-developing-a-steem-sbd-liquidity-supply-and-market-making-mm-bot-part-2

If the TRON Foundation builds a bridge and supplies LP, it is definitely positive, but I think it is also necessary to build an internal exchange environment, which is a STEEM on-chain DEX.

From an outsider's perspective, the current STEEM ecosystem environment looks very poor.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think it is good that witnesses like you are beginning to generate proposals to address the situation and achieve stability.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Several witnesses are working to change. :)

This change is a good start.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is important to keep users informed, explain the current situation, consequences, and actions to stabilize Steem / SBD.

I wish you success

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is needed and I hope steemit team supports this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think the 100 SBD per day forever, is much too high. I like the idea of stake holders building things to increase the value of their stake. That being said I do think developers should get paid for the work they do, and in this case I think a one time development fee and then a minimal maintenance fee going forward is much more reasonable.

Also, I think it will be interesting to see how the market responds when HTX is the only exchange in town. There is the ability for profit for users to arbitrage the internal market without having to use DAO funds to set up a liquidity system. I would much prefer the market to fix things than we pay to have someone do it for us.

Also also, I liked your idea of creating a steem exchange (DEX) much more than this proposal. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

SPS can be stopped at any time and the first SPS will probably last for 6 months to a year.

As I said on the Witness channel, we need to update the system in stages.

First, there will be liquidity provision, then DEX, Swap system, etc.

And all of this will probably happen after we successfully carry out SPS.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post is manually rewarded by the

World of Xpilar Community Curation Trail

BottoSTEEM OPERATED AND MAINTAINED BY XPILAR TEAM

BottoSteem

Robust Automations on STEEM Blockchain using the Power of AI

https://steemit.com/~witnesses vote xpilar.witness

"Become successful with @wox-helpfund!"

If you want to know more click on the link

https://steemit.com/@wox-helpfund ❤️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been featured in the latest edition of Steem News...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @roadofrich! You are Splendid!

command: !thumbup is powered by witness @justyy and his contributions are: https://steemyy.com

More commands are coming!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When SBD is below $1, one use the Convert feature to convert SBD to STEEM based on the SBD=1 price. However, this requires 3 days. !thumbup

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Using market making bots, we think it would be a good idea to increase and burn STEEM by providing sufficient liquidity. I understand that the Covert function is ultimately an act of increasing STEEM issuance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit