Hello. This is Editor K of Team Protocon.

After a one-week break, we resume our weekly research.

Currently, the hottest thing in the blockchain market is 🔥 DeFi, but at the same time, even the word is still unfamiliar among the public. What if a famous company develops a blockchain project and enters the DeFi market? The project can be seen as starting the project from a relatively advantageous position. As a result, world-famous large companies are entering the DeFi industry, but not everyone is satisfied.

Today, I would like to talk about Klaytn's KLAYswap, which is steadily building the foundation of the DeFi ecosystem. Klaytn, developed by Ground X, a subsidiary of Kakao Co., Ltd., which is famous for mobile messenger in Korea, was explained earlier in Token Staking Slice I - Klay Station. Please refer to Klaystation Research for basic information. Today, we will take a look at the various functions and methods provided by KLAYSwap.

KLAYswap

Image Credit: KLAYswap medium

Like Uniswap, KLAYswap is a decentralized exchange (DEX) that utilizes an Automated Market Maker* mechanism. By introducing this mechanism, KLAYswap increased the efficiency of the exchange by stably maintaining the fees incurred when making transactions.

*A method in which a liquidity pool is created and automatically exchanged with two or more types of cryptocurrencies, away from the existing 1:1 transaction between buyers and sellers.

In KLAYswap, users can supply liquidity to various pools and as a reward, they are rewarded with KSP Governance Tokens that maintain the KLAYswap ecosystem according to their stake in the liquidity pool. According to the KLAYswap, KSP can be utilized as follows.

- Acquiring KSP mining rewards by depositing KSP and other assets together in the pool.

- Acquiring KSP mining rewards by participating in KSP staking.

- Participate in voting to determine the KSP distribution rate of the KSP reward pool

- Participate in governance voting related to the protocol’s agenda

- It is used as the cost of creating a new pool (pair) (the cost of creating a pool is incinerated)

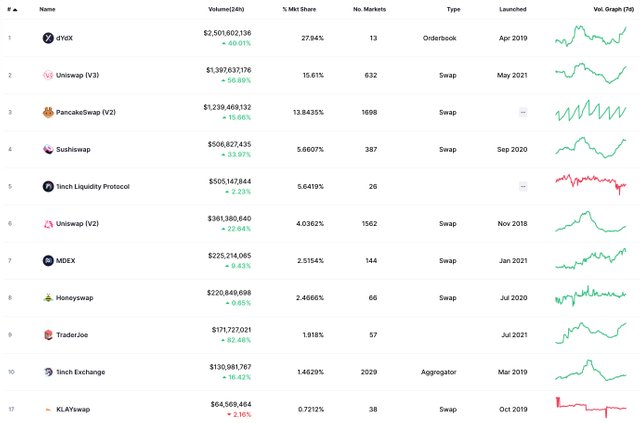

Image Credit: CoinMarketCap

According to CoinMarketCap, KLAYswap, which appeared in the second half of 2019, currently (as of October 12, 2021) has a market share of 0.7212%, ranking 17th among DEXs. Until the first half of this year, KLAYswap remained at the bottom. Although it is not yet very high ranking, the top three exchanges monopolize the market with about 57.3935% of the market share, so if you compare it with other DEX only, it seems that the performance is not bad. The 24-hour trading volume is $64,569,464, indicating that about 77.2 billion won is being traded.

Advantages of KLAYswap

- Scalability

In KLAYswap, the concept of Inter-Blockchain Communication (IBC) protocol*, which was previously described in Cosmos Research, appears. Ozys, Klaytn's governance council and DeFi service provider, has developed its own Orbit Chain using interoperability technology between blockchains.

The biggest feature of KLAYswap is that it can trade various assets. This is because KLAYswap is designed to be able to swap K-Bridge assets (KCT, Klaytn Compatible Token) together using the Orbit Bridge based on the Orbit Chain. Currently, KLAYswap is linked with Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) through an interchain protocol.

*The role of connecting and working interconnected so that multiple independent blockchains can communicate with each other.

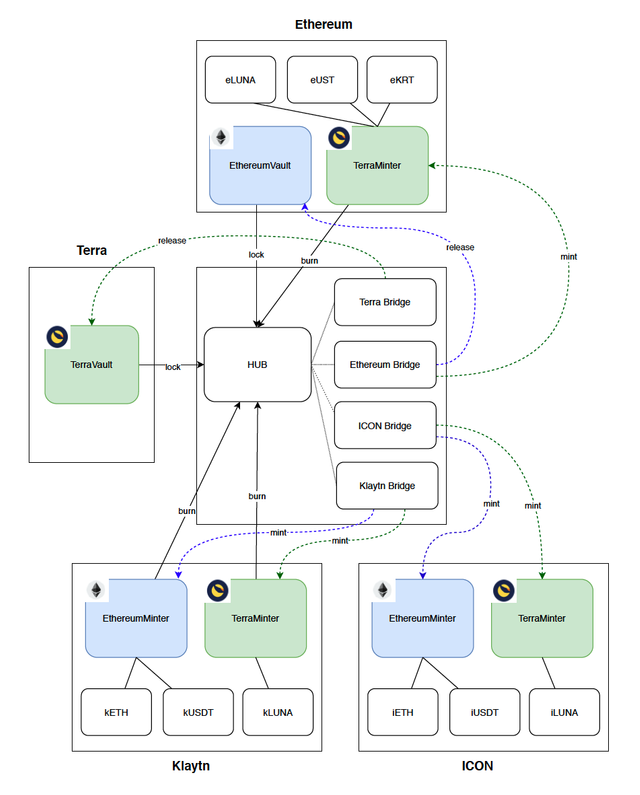

Image Credit: Orbit Chain

Assuming that the Ethereum asset 'ABC' is transferred to the Klaytn network, tokens will be issued with the following procedure.

(1) ‘ABC’ assets are transferred to Ethereum’s Locking contract

(2) When confirmation is completed, it is transferred to the Minting contract of Klaytn Blockchain.

(3) A new 'ABC' token based on KCT is issued

- Sustainability

sKLAY refers to a rights token and a securitization token issued by smart contracts for staked Klay. In addition to providing additional liquidity that is currently lacking in the Klaytn ecosystem, holders of sKLAY can participate in various profit opportunities provided by the DeFi protocol running on Klaytn while maintaining their staking positions.

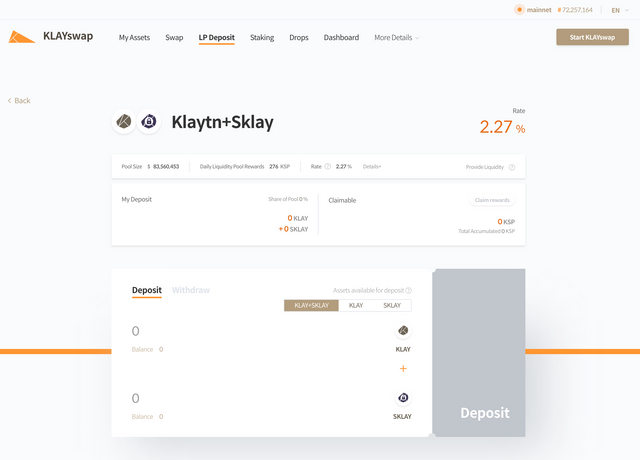

Image Credit: KLAYswap

Since sKLAY is an asset bonded to a staked KLAY, a structure is formed in which the demand to "discount" to avoid the seven-day unstocking period and the demand to purchase KLAY at a lower price than the market price.

If you contribute to the SKLAY-KLAY pool, you can

(1) Acquire KSP mining token.

(2) Acquire KLAY for transaction fees incurred in KLAYswap.

(3) If you have sKLAY, you will get KLAY as a staking reward for KLAY.

KLATswap wanted to induce more value creation and solve the sustainability problems of existing DeFi by ensuring the revenue of (3) item.

Stability

CertiK is a U.S. blockchain and cryptocurrency security company that supports the verification of cryptocurrencies listed in strategic partnerships with global cryptocurrency exchanges such as Binance and Huobi Global. KLAYswap, which performs all operations with various smart contracts, is said to be undergoing security authentication with increased stability through blockchain smart contract verification platform Certik.Convenient usability

Image Credit: KLAYswap

Although it is not a No. 1 advantage of KLAYswap, the fact that it is easy to link digital wallets with Kakao Talk that is attractive enough for domestic users. KALYswap supports Kalikas, Metamask, and Klip, which can be linked to KakaoTalk. KakaoTalk is a national messenger with a simple design and simple system used by more than 90% of Koreans. The built-in wallet for managing digital assets in KakaoTalk is very good in terms of DeFi accessibility.

How to operate KLAYswap

The AMM mechanism of KLAYswap is based on the formula x*y=k [x=KLAY, y=KCT Token, k=Constant Function] and the corresponding token price range is formed according to the quantity of each token when creating a liquidity pool. It works on the same principle as Uniswap Research explained. For example, as the liquidity supply of x(KLAY) increases, the y(KCT token) decreases to maintain the constant function k. In this way, the supply volume per token changes in the liquidity pool and is designed to form prices.

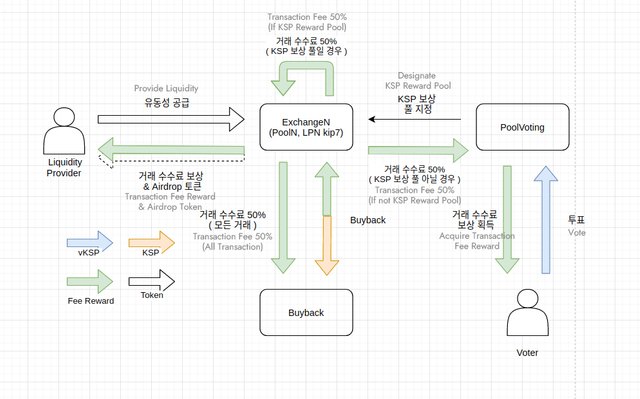

Image Credit: KLAYswap

The above is a schematic diagram of the swap process of KLAYswap. If you trade tokens through a pool of KLAYswap, you will incur a 0.3% transaction fee. Half of all transaction fees incurred at this time are used as funds for KSP buyback* and incineration. The other half is distributed to the pool voter for the KSP Reward Pool and to the Liquidity Provider for the general pool who deposited assets.

*A financial management technique in which a company buys its shares in the market with its own funds. In general, treasury stock purchases are made to increase stock prices by reducing the number of shares distributed in the market when their stock prices are unstable or fall. (Doosan encyclopedia)

KlayFi

Image Credit: KlayFi

KlayFi Lab, a global DPI service developer, launched a KlayFi service in July this year designed to maximize the return on investment assets of KLAYswap users and enhance convenience. KlayFi has strengthened its investment effectiveness by providing welfare functions to users who deposited assets in KLAYswap and at the same time providing additional KFI, a KlayFi governance token. KlayFi was released with the goal of implementing a virtuous cycle in which its ecosystem and governance tokens continue to grow by linking Klayswap's unique governance model and token economy. It surpassed 50 billion won in deposit assets a day after its official launch, and in a week, its total deposit assets exceeded 90 billion won (about 80 million dollars), drawing attention.

Today, we looked at Klaytn's KLAYswap, which is constantly challenging the DeFi market. Klayswap is gradually expanding its awareness of the DeFi market, which is not familiar to the public, through KakaoTalk messengers. In addition, it is releasing a new service, so it can look forward to the future. In the next study, we will learn about Pancake Swap, one of the DEX top rankings.

This has been Editor K.

Official Protocon Links

Telegram

Twitter

Facebook

Youtube

Medium

Reddit

Github