Hello, this is Editor P of Team Protocon.

In the last session, we learned about Uniswap, the epitome of Defi. If you haven't seen the last episode, please check out Automated Convenience Store in Virtual Asset World - Uniswap!

Today, we're going to talk about the second of the DeFi project series, the Sushiswap derived from Uniswap, which has more than $3.99 billion in liquidity and more than $69.32 billion in trading volume.

The birth story of Sushiswap

Image credit: Binance Academy

The Sushiswap began in August 2020 in a tweet by Larry Cermak, research director at the block. His idea was the same as Uniswap, but it was a service that issued tokens directly and distributed to liquidity providers (LP), and on August 27, 2020, an anonymous developer named chef nomi actually implemented it. This service is called Sushiswap. In other words, Sushiswap is simply Uniswap which issues and distributes its own token called SUSHI.

The difference between Sushiswap and Uniswap

Image credit: Uniswap (UNI) vs Sushiswap (SUSHI), Exodus blog

As mentioned earlier, Sushiswap is very similar to Uniswap.

Then, what is the difference from the existing Uniswap?

Uniswap pays a 0.3% commission to liquidity providers (LP). On the other hand, Sushiswap pays 0.25% as a fee, and the remaining 0.05% is compensated to all of those who staked SUSHI tokens. In other words, you can also receive fees for pools that you didn't provide liquidity to. Sushiswap considered the role of liquidity providers important and adopted this method to reward them in proportion to their contributions.

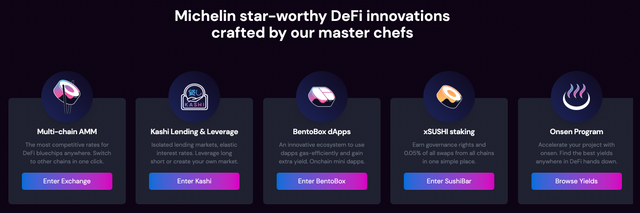

The 5 services Sushiswap provides

Image Credit: Sushiswap homepage (sushi.com)

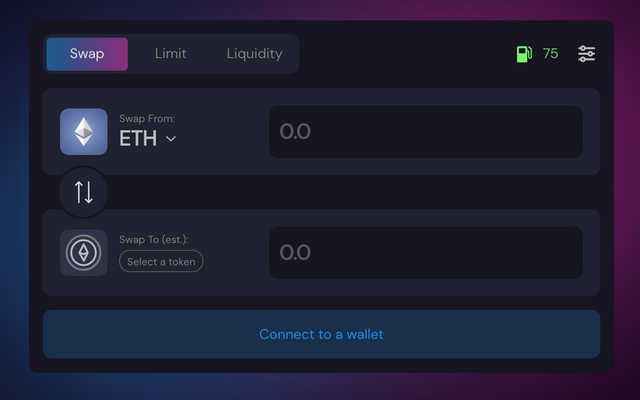

- Swap

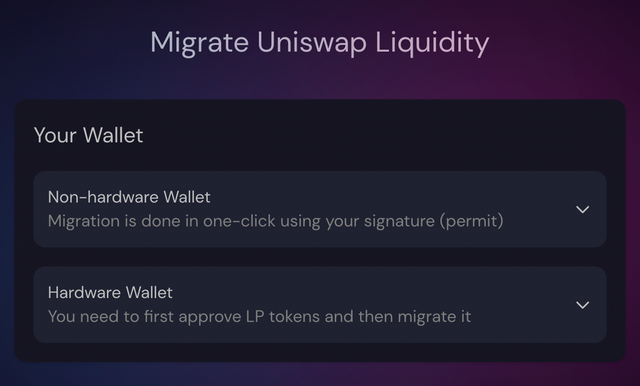

As the name "Sushiswap" suggests, Sushiswap provides multi-chain AMM-based token swaps and migration capabilities.

Token Swap: The operation of 'exchanging' ERC-20 tokens issued on your current Ethereum network with other ERC-20 tokens.

Token Migration: The operation of swapping from Ethereum network-based ERC-20 tokens to tokens on a completely different network.

To put it simply by analogy, if coin swaps are only moving lakes in the same building, migration can be seen as leaving the neighborhood and moving to another place.

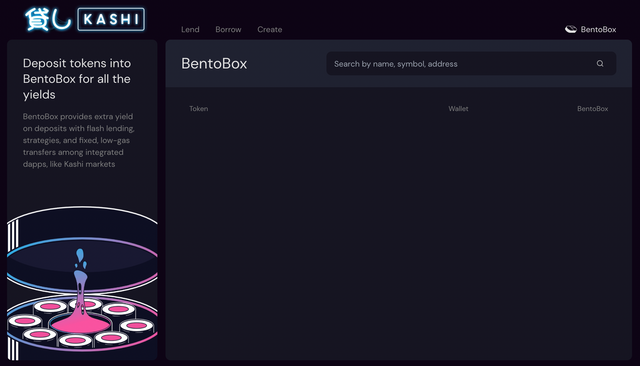

- BentoBox dApps

BentoBox is a special smart contract that acts as a vault for a specific token. In short, this safe refers to a pool of funds available in bento-enabled applications in the Sushi ecosystem, and users who deposit funds into BentoBox vault can earn additional profits from tokens. The vault can generate profits in many ways, for example, by lending assets in the vault and charging participants who used flash loan service which is later paid to liquidity providers as a fee.

In addition, different applications operating in the same vault can use the BentoBox architecture. This structure is efficient because it reduces gas spending as there are fewer steps to go through than otherwise. Currently, the only bento-enabled application is Kashi, a rental platform, but the Sushi team is trying to introduce more applications into BentoBox in the future.

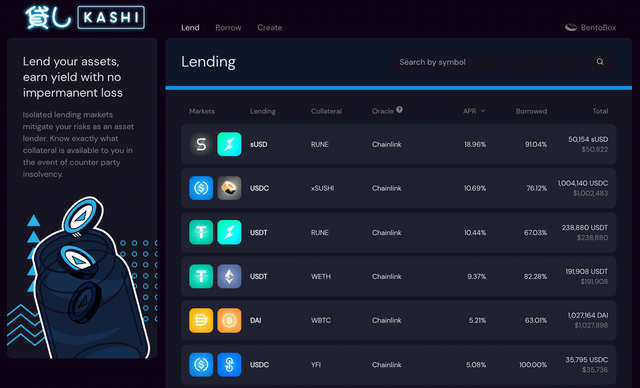

- Kashi Lending & Leverage

Kashi means 'rent' in Japanese and is a lending and margin trading platform based on BentoBox. It is a service for lending assets deposited in Bentobox to users, and a cryptocurrency deposit and loan service that supports users to trade with the borrowed assets. At Kashi, anyone can create a gas-efficient, customized lending and borrowing market. In contrast to other popular DeFi money markets such as Aave and Compound, Kasi operates each market separately. This means users can create markets for high-risk, high-return assets without affecting other markets.

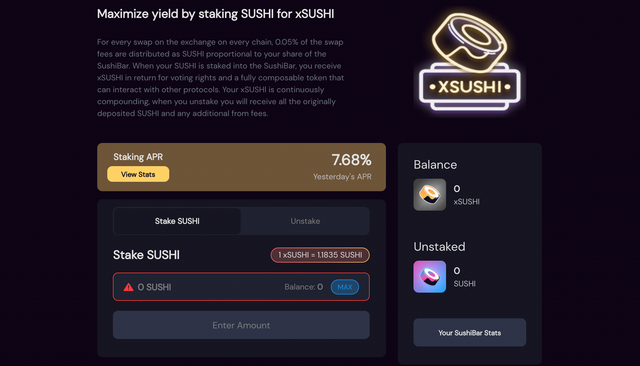

- xSUSHI staking

xSUSHI is an incentive token of Sushi Swap, where users can receive xSUSHI by staking SUSHI on the platform for a certain period. For every swap that occurs on all exchanges on the chain, a fee of 0.05% is distributed to SUSHI according to the individual's stake in SushiBar. By staking SUSHI on SushiBar, you can interact with multiple protocols and receive xSUSHI, which represents your voting rights. xSUSHI continuously generates compound interest, and when staking is released, the principal SUSHI and fee interest are returned together.

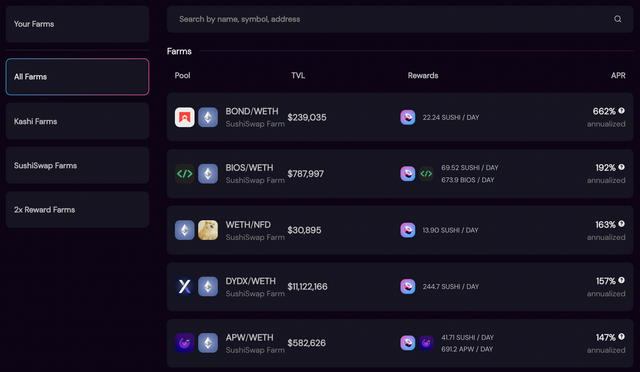

- Farm

Based on the SLP (Sushi Liquidity Provider) tokens staked on the farm, a reward (interest) can be provided whenever a new block is created. However, 2/3 of the reward is designated as a lock-up period for 6 months from the time of earning, and some of the tokens rewarded with interest cannot be withdrawn for 6 months. For example, assuming that you are receiving a total of 3 SUSHI as interest, if you have just harvested 1 SUSHI, you will be able to harvest the remaining 2 SUSHI exactly 6 months after this point.

Following the last research, the second protagonist of the DeFi project series, chef nomi's Michelin 5-star restaurant Sushi Swap, learned about each function. Was it useful? Sushi Swap, which appeared as a latecomer on August 27, 2020, went through several ups and downs, including the betrayal of developer chef nomi. However, after recovering the sushi swap development fund from chef nomi, it is currently in third place in the overall DEX market and is operating stably. Protocon will also provide a staking service through the Protocon wallet in the future, so please look forward to it. We will come back with a Klayswap in the next episode!

That’s it for Editor P 😊

Official Protocon Links

Telegram

Twitter

Facebook

Youtube

Medium

Reddit

Github