The answers are depending on to whom you asked this question.

But most financial and economic experts agreed that the best indicators to measure recession are – GDP Growth, Inverted Yield-Curve, Unemployment and Stock Market Sell-Off.

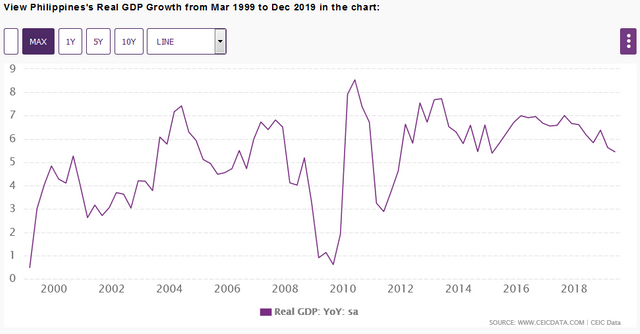

GDP Growth. In 2008-2009, the US experienced a rapid drop in real GDP – with negative economic growth of 4% in 2009. However, the recession in the US was relatively short-lived. In the Philippine GDP Growth rate, though at a decent rate, it was in a continuum declined from 2013 until to date.

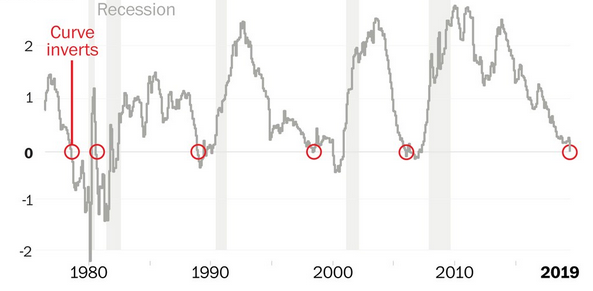

Inverted Yield-Curve. The inverted yield, or more specifically the difference between the yield on 10-year and 2-year government bonds, has signaled recessions reliably over history. Its timing hasn't been perfect, often it's early by a couple of years. However, an inverted yield curve, when the yield on 2-year bonds exceeds that on 10-year bonds, has virtually never been a good sign for the economy. On the chart below, the grey areas are U.S. recessions, you can see that the yield spread has dipped below zero before each one.

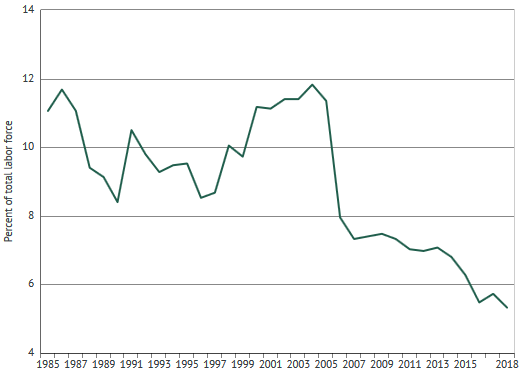

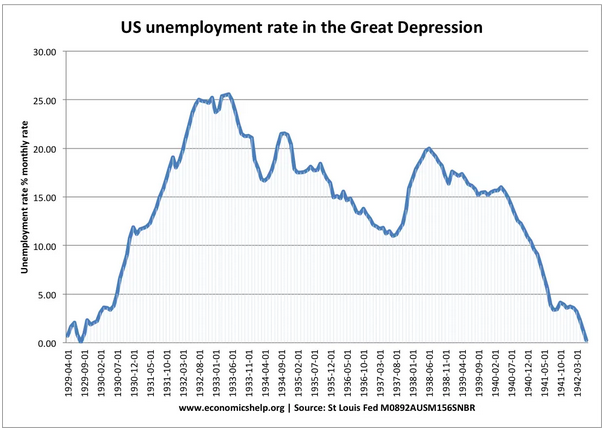

Unemployment. Consumer spending is about two-thirds of the economy, and people predictably spend less when they are unemployed, hurting economic growth. It's perhaps unsurprising then, that recessions are accompanied by rising unemployment. Currently, global unemployment is on a declining trend. However, the potential risk here is that there comes a point when unemployment simply can't go much lower. Some unemployment, called frictional unemployment by economists, is necessary as people transition in and out of the workforce and find jobs. So, unemployment isn't a problem now, but we may be approaching a point where unemployment gets so low that it can't fall much further. At that point, recession becomes more of a risk as unemployment can't stay flat forever. Still, we'd need to see rising unemployment and that's not the case in the most recent report, when the numbers for 2019 showed unemployment continue falling. Below graphs are the Philippines and the United States of America (USA) unemployment rate.

Stock Market Sell-Off. Over history, the stock market has been quite good at calling recessions early. The prospect of recession is keenly watched by the markets, because stock earnings can tank in recessions, leading stock prices to decline. The market does tend to overreact though, and it can fall even when a recession is not coming. Therefore, this can be thought of as a hyperactive indicator, the market will likely fall as a recession approaches, but it can also signal false alarms frequently. Currently, the Dow Jones Industrials was down by 4,000 in just a recent few weeks while S&P 500 has made reasonably steady daily losses for the last 13 current sessions. Today – 9th March, is the anniversary of an 11-year old bull run from the 2008-2009 Great Financial Crisis, and PSEi down 457.77 points or 6.76% was the 2nd biggest 1-day sell-off in Philippine stocks history. The first one was 12.27% happened back on October 27, 2008.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of any securities.

Related Topics:

https://steemit.com/steemph/@php-ph/2019-best-worst-philippine-stocks-performance

https://steemit.com/steemph/@php-ph/2020-my-philippine-stocks-outlook

https://steemit.com/steemph/@php-ph/is-ecomonic-collapse-looming

https://steemit.com/steemph/@php-ph/the-stock-market-doom-and-gloom-of-2020

Please upvote and follow me on https://steemit.com/@php-ph.