Trading psychology is a pretty boring topic and usually very repetetive. People who learn it get bored and wonder why the hell they need to read the same thing 20 times. Then they go and take a position. They lose it. They take another position lose it and then keep on revenge trading until their balance is 0.

What is the funny thing here? Well they kept on reading about how revenge trading is a bad idea and complaining how they got it the first time yet once they started trading they got over confident and did the mistake they said they already were aware of.

See what I'm getting at? Trading psychology may be boring and repetetive but it is so for a reason, a very good reason for that.

But enough with the chit chat. Let me now be the 21st person to tell you about trading psychology and why it is VITAL for you to stand a chance in a competetive financial market like crypto.

Nr. 1 You suck at trading

Now I don't mean this in a condescending or negative way, But in the start you'll suck. I don't care how much paper trading you've done or how many articles you've read. Once you start trading with money, yes real money. You'll be phased and you'll be excited, overconfident and suck at it. All at the same time.

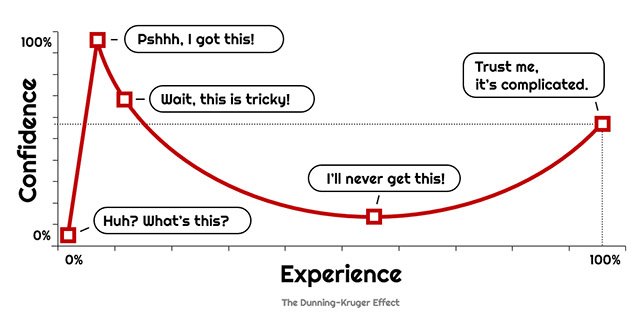

Let me explain a bit more. Or rather let the a Dunning-Kruger chart explain.

I can't stress enough how you should not try and give yourself confidence about trading in the start. Presume that you suck. Don't think just because you got that one lucky trade that you'll now somehow be able to defy all rules of TA and basic principles like order sizing just because it worked once. You will get rekt. Maybe not now but eventually. Remember we're aiming for long term growth not short term moon lambo gains, the latter is not sustainable.

Don't visit mt. stupid stick to the principles and your personal trading rules.

" When you win a trade you will wonder why you didn't do a bigger entry size. But once you lose you'll always wish you would've held a smaller position "

-Some guy I follow on Twitter

Nr. 2 Revenge trading

You knew I would get to this point. So let's just get it out of the way asap.

Revenge trading is emotional trading. In the start you'll be spilling your emotions everywhere.

"Why did I short here, why did I long there"

"Why did I take a counter trend position"

"I should've done x instead of y"

"Why don't I do the opposite now to make back my profit!"

"I gotta make my loses back, i'll make back my loses quick with some trades then leave"

These are thoughts every trader (human ones at least) will have in the start. Remember stay disciplined don't let your emotions take over. A lot of people will also base decisions (trades) upon thoughts like these. Once you do this you can pretty much say good bye to your money as emotions have once again gotten the better of you.

Don't let revenge trading kill you. If you lose 2 trades in a row no matter the size take a 48hr break from crypto. I'm serious. You do not want to jeopardize your money for some dumb emotions. Collect yourself and come back stronger than ever. There will be great opportunities to come don't worry about missing a few along the way.

Nr. 3 FOMO

When trading shitcoins and smaller coins there are two people. The ones who'll capitalize and make the big bucks and the guys who'll lose and not realize their mistakes.

Do you know the main difference between these two? The ones who succeed will find the shitcoin hours or days before the dumb money. Once they've accumulated enough they'll share the coin with their followers and dumb money will come in a buy the shit out of the coin and once it is at a euphoric stage the guy who got in before everyone else then shilled it to others will dump his stack, leaving his followers in the shit.

Do you know why the smart guy had to wait so many days to announce his new high potential shitcoin? That's because he didn't market buy. He placed orders below market price and waited for desperate sellers to sell to him at his prices not the markets. Once the dumb money comes in they'll market buy their coins/tokens and therefore pump price so much.

Now this article is not focused on shitcoins but this principle applies to trading. Placing market orders is for suckers. The people who make huge returns will almost always place limit orders below market and by the time those orders have gotten filled the general public will see what is happening and enter at market.

Sometimes you'll lose some potential wins since your limit order never got filled but remember, there will be opportunities like the one you just missed if not better in the future. Be patient and stick to the rules.

Nr. 4 Greed

Greed. It is a very strong emotion. Greed can cause you to not take profits. Greed can make you increase leverage, remove stop limits and eventually lose you a lot.

Greed was a big thing for me that I had to overcome and it took me a while to be fully honest with you. When I started out I was a BitMex leverage degen. Meaning my leverage was much larger than it should've been. Personally I would recommend max 10-25x leverage at any given time, though I still break this rule myself sometimes. But only on small positions/trades.

There will be a lot of times where you feel that your position can do much better. Sometimes it can. But in a lot of cases it won't and a reversal will start. I've noticed that I get a gut feeling whenever I feel it really has topped out and I've been following this gut feeling very often and has so far worked wonders for me. Ofcourse it all depends person to person, do what works for you. Maybe you can have a rule that if your position has been open x amount of time or in y amount of profit you exit no matter what.

A good rule to prevent greed is once your position goes profitable move up your stoploss(es) so that they're in profit. So even if you get stopped out you will be in profit (remember to take fees into account when doing this.

Greed might take a long time to control, but try to suppress it as much as possible.

Nr. 5 When trading think only about trading, nothing else

When you are trading, do not think about anything other than trading. If you need to think about school, family or anything else take a break and do that. When you are trading the only thing that should be on your mind is what the markets will do next, not what you will eat tonight.

Once you start thinking about external things whilst trading you'll start getting emotional.

I.e: I used to think a lot about I need to trade more so I can buy this and that. This made me overtrade which made me lose money in the start. When you are trading you are in the zone.

When you are in the zone the only thing you focus is on the zone, nothing else. No exceptions.

Nr. 6 Overtrading and overstressing

If you are overtrading you are doing it wrong. Not only will your balance suffer but your mind will also suffer. Overtrading or the feeling that you always have to be in a position will force you to take bad positions with bad R:R (Risk:Reward ratio).

Like in everything else when trading go for quality over quantity.

Overtrading will keep you glued to charts 24/7 and not only drive your balance into the ground but also your mind. When overtrading you'll typically involve tons of emotion which as we know is a recipe for disaster when trading.

What I will do is 1-3 times a day I'll check on some charts see if there are any good setups. If there aren't I'll move onto the next chart. If I find a good setup I'll draw out my key levels, set my orders along with alerts then leave and do something else. This allows me to be as time efficient as possible. The moment my order gets filled I'll get a notification then I'll come back to my computer to set new alerts along with my stop loss(es) to prevent myself from loss.

I do this because I know once I've entered a position there is nothing I can do about it so it is much more beneficial to just set your alerts and let it be and come back once something happens instead of staring at a chart that will keep on moving whether you are watching or not.

Disclaimer: I do not mean leave your position entirely. Set your alerts and orders and whatever else you need to do then be ready in case something happens. do not just leave your position open with no alerts or stop loss(es) and possibly exit(s) set.

So that is it. Hope you enjoyed the article. If you have any questions just contact me on telegram

Congratulations @fr0stayy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @fr0stayy! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit