While Satoshi entrusts all his trust to Bitcoin transactions, centralized private key management methods have brought confidence to the crypto market.

However, storing vulnerable keys in a database, and also as offline storage in hardware or paper, has led to not only billions of dollars in security breaches, but also to independent liquidity and market fragmentation; assets are locked and cannot be easily deployed in the DeFi ecosystem, access and control are sacrificed for the sake of limited security.

QREDO WILL CHANGE ALL OF THAT.

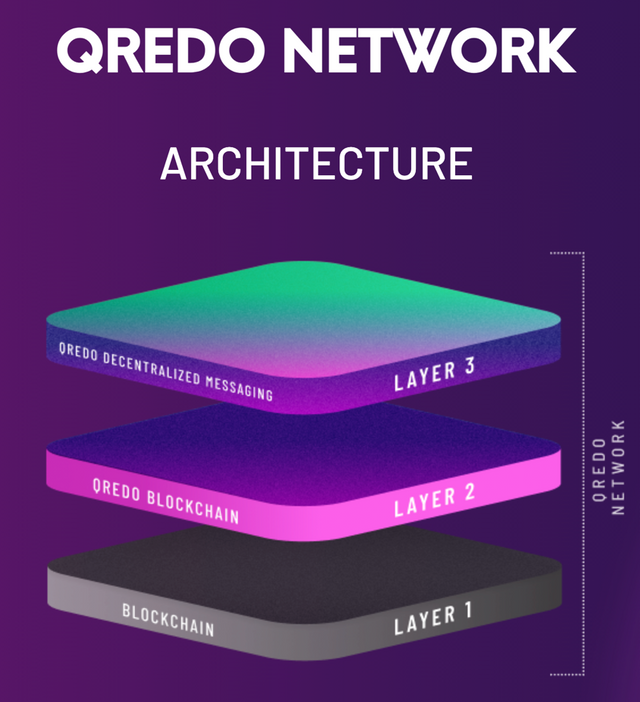

This radical new blockchain infrastructure eliminates the need for private keys to manage digital asset ownership. Instead, the unreliable implementation of multi-party computation (MPC – I'll cover that) provides a flexible way to conclude transactions that meet the needs of institutional governance and security. This is combined with an interoperable Layer 2 network that acts as an immutable asset registry, allowing for instant cross-chain settlement between previously individual blockchains and platforms. On top of that, the Layer 3 decentralized communication network supports encrypted trade negotiations and allows information to be attached to transactions.

CUSTOMERS? WHAT PROJECTS AND CASE CAN BE THE BEST USE OF QREDO INFRASTRUCTURE?

With the explosion of DeFi protocols, organizations have realized that storing portable decentralized assets in a walled garden of centralized custodians keeps them safe and makes them safe. effectively hibernated inert property.

Now we can freely interact with DeFi protocols through Wallets while financial institutions investing in Cryptocurrencies are bound by more binding regulations. They are stripped of their ability to borrow, lend, and staking in DeFi, and are quickly prevented from making sensitive transactions. This forces many asset managers to adopt a passive buy and hold strategy instead of taking advantage of volatility and profit opportunities.

Qredo connects DeFi with financial institutions, providing asset managers – from corporate funds to professional crypto hedge funds and private banks – with responsive infrastructure institutional standards.

For example, a corporate treasury team could use Qredo to internally manage digital assets. They can distribute signing power between company departments and designated supervisors to meet organizational requirements and implement automated workflows as required for operational tasks such as mediation and settlement between brokers, exchanges and other connected partners on the network.

RISKS AND CHALLENGES

DeFi offers institutional investors a great opportunity to pour money in by deploying them on different protocols. However, this can pose important risks and challenges:

- Governance is not scalable: Digital asset wallet infrastructures are typically designed for individuals. Not organizations, which cannot allocate signing and access rights to fit the corporate governance structure.

- Qredo allows organizations to perform on-demand governance; Specify an unlimited number of signers and decentralization to match custom monitoring policies.

- Limited liquidity. The liquidity of crypto assets is limited across chains and protocols, making it difficult for major players to get in and out of the market without slippage.

- Qredo acts as interoperable middleware, reliably interacting with different chains to extend the most efficient transaction routes across multiple DeFi protocols.

- cumbersome asset management. Managing funds between multiple protocols on different chains means combining different interfaces, paying high gas fees to move funds, and relying on cumbersome token bridges. This presents a challenging user experience for traders and makes it difficult to provide complete records of transactions for accounting and compliance purposes.

- Qredo allows organizations to manage assets deployed on various decentralized protocols from a single dashboard. Organizations can track balances in real time to make better business decisions and instantly export an audit trail for easy accounting.

- Layer 1 asset managers like Bitcoin, Ethereum and Polkadot want Layer 2 because:

- Layer 2 can provide much-needed scalability; help asset managers bypass slow confirmation times, high fees.

- The rapid execution offered by Qredo on Layer 2 enables instant transactions between users, platforms, and protocols on the Network, allowing organizations to instantly take advantage of sensitive trading opportunities.

As a Layer 2 decentralized custodian protocol designed to act as middleware for capital markets, Qredo does not want to compete directly with other Layer 1 or Layer 2. Qredo will be the factor that adds value to all. However, it can be distinguished from existing Layer 2 as follows:

As a Layer 2 decentralized custodian protocol designed to act as middleware for capital markets, Qredo does not want to compete directly with other Layer 1 or Layer 2. Qredo will be the factor that adds value to all. However, it can be distinguished from existing Layer 2 as follows:

Registry function. Qredo's Layer 2 network acts as an immutable asset registry, turning the blockchain itself into a secure vault.

- Administration. Layer 2 is not currently viewed as the architecture and technology for the governance requirements of capital markets clients. Qredo provides users with the ability to assign multiple connected supervisors to perform administrative responsibilities, with an immutable audit log detailing what actions were taken by which actors and who monitors. who has approved these actions in relation to customers' digital assets.

- Cross-chain interoperability. Current Layer 2 usually focuses on a specific sequence. Moving money between separate Layer 2 is forced to go back to the original Layer 1 primary partition, and then make another hop to the final destination via a cumbersome bridge. As a cross-chain Layer 2 network, Qredo acts as an interoperable middleware – enabling seamless transactions and atomic swaps of assets between different chains.

- Tokenomics is user-centric. Up until now, the Layer2 Token models have been based on Layer 1 on-chain validator rewards. Qredo takes a new approach to tokenomics, incentivizing all network participants with a multipurpose token model. . This provides a sustainable model for creating lasting network value.

- Immutable test traces. All actions performed on the Qredo Network, including transactions, administration changes, and wallet creation, are recorded on the Layer 2 chain. This forms an immutable record that can be exported instantly. for accounting and compliance purposes. Sender and recipient identities can be attached to easily comply with the Travel Rules.

ROADMAP

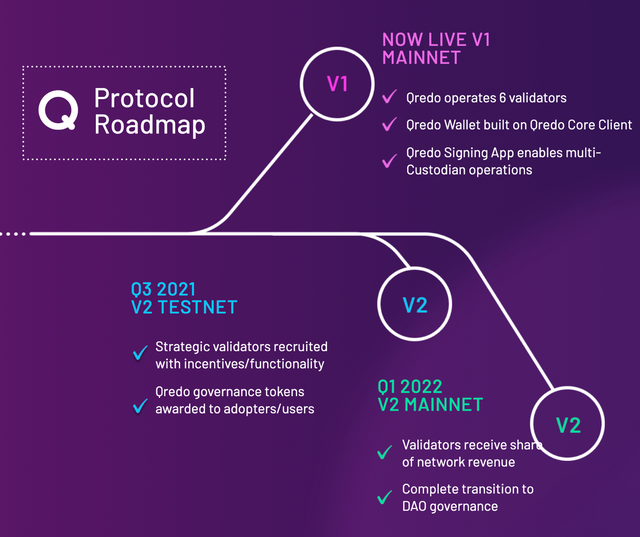

Mainnet version 1 (v1) launched at the end of October, just as DeFi was starting to grow from beta into a global phenomenon.

As organizations continue to adopt DeFi, Qredo's focus is on developing a comprehensive network to drive innovations in the DeFi space while significantly reducing risk and operating costs.

With mainnet 2.0, we (Qredo) expect to release open source Qredo Client (node) and some integration libraries, in Fall 2021. This will allow developers access to transaction types are implemented on the blockchain. Qredo is also developing a One-To-One account wallet implementation to keep track of Layer 1 storage addresses. Most importantly, we will decentralize the network so that users have full control over it by allowing any anyone set up an authentication button.

TOKEN VALUE AND HOW TO USE TOKEN QREDO (QRDO)

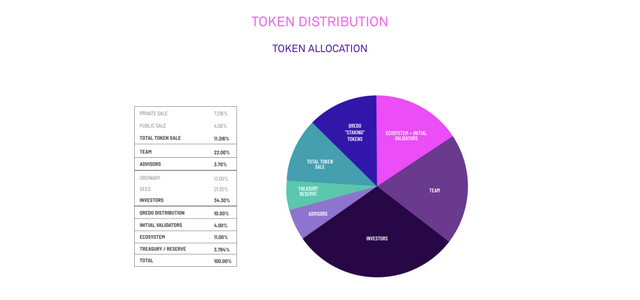

The Qredo Token (QRDO) combines the features of Utility Tokens and Governance Tokens to create a user-centric model that incentivizes not only validators but all network participants.

There are four types of network participants, and they are rewarded through a combination of two mechanisms: fee-based compensation and inflation-based compensation.

Market Makers continuously provide quotes for a certain digital asset. They are incentivized to provide bars from QRDO Tokens via inflation-based compensation and earn additional income from Layer 1 assets as an additional bonus from fee-based compensation.

Validators take turns validating, recommending, and voting on the transaction to be included in the next block. 80% of Layer 1 fees are converted into QRDO Tokens (by market makers) and transferred to Validators as Fee-based compensation for validating, network security and availability transactions high.

Traders swap digital assets on the network. They pay a fee, which is calculated as a small percentage of the transferred or traded Layer 1 asset. These fees are refundable up to 100% in QRDO Tokens (must be deposited with validator for a minimum period of time).

User custodians store digital assets on the Qredo Network. They are rewarded based on the value of their assets through an epochal approach to semi-variable inflation.

QREDO will be the DeFi trend in the next 12-24 months!

Traditional institutional investors are slowly experimenting with the opportunities offered in Defi. Good liquidity makes it possible to legitimize the market, helping to create a more efficient and inclusive financial infrastructure for all users. We are at the dawn of the Multichain future. Multichain support for assets and protocols has become one of the biggest stories of the past year, as the country barriers that have prevented the industry are being torn down. As the development, demand and utility of these asset protocols increase, it will be easier to exchange. In the near future, we will see the transition between traditional and decentralized.

Qredo is an intermediary solution that will disrupt interoperability and liquidity, bringing together other platforms that compete to accumulate value.

WEBSITE: https://www.qredo.com/

TWITTER: https://twitter.com/QredoNetwork

LINKEDIN: https://www.linkedin.com/company/qredo

TELEGRAM: https://t.me/qredonetwork

DISCORD: https://discord.gg/bgVPvf6

GUTHUB: https://github.com/qredo

Author:

Telegram: @rewithoutu

Email Qredo: [email protected]