Summary

-A quick summary of some of this week's more interesting publications from the Fed, FDIC, SEC and other financial regulatory bodies.

-"Does More "Skin in the Game" Mitigate Bank Risk-Taking?"

-The Overnight Bank Funding Rate currently stands at 1.42%.

-Deutsche Bank agrees to reimburse customers the full amount of firm profits earned on any CMBS trades.

-SEC budget request and Share Class Selection Disclosure Initiative (SCSD) to encourage self-reporting.

-Fed issues their weekly report on oil prices.

"Does More "Skin in the Game" Mitigate Bank Risk-Taking?"

This is one of those articles the Federal Reserve releases that has absolutely no application. It's asking if increased capital requirements help banks to reduce the amount of risk they take. The answer is OF COURSE!!!!! Are you kidding me?

This is like asking if someone feels the same if they lose their money or someone else's money. That said, I think this article has more application than the title gives it credit for. Here's a quick excerpt from the article:

Excessive risk-taking by banks has long been a paramount concern of regulators. The basic problem arises in part due to misaligned incentives; under the current limited (single) liability structure, shareholders of a failed bank can lose no more than their initial investment. With this limited skin in the game, bank shareholders’ private incentives may lead them to take more risk than is socially optimal. If, by contrast, shareholders were liable for the entirety of a bank’s losses, their private risk-taking decisions may be more aligned with socially optimal risk‑taking.

So, instead of looking at this as a consideration for banks, let's extend it. This should be a consideration for all stocks. Perhaps the issue with the corporate state is that the shareholders don't have any personal liability. They are limited in the amount they can lose. What if the shareholder had to worry about being liable for legal or environmental issues? What if the shareholder had to worry about being sued for the corporation's irresponsibility? I suppose a lack of earnings equates to a sell-off, which is the ultimate punishment for the corporation.

Final thoughts: This article does nothing but shed light on the fact that we still have an incredible amount of power over the corporate state. Anything that can hurt earnings is a threat to the corporate state, including its own hubris. Couching gambling schemes in terms of limited liability structures doesn't hide what's happening. If anything, it is a concession to the system's vulnerabilities.

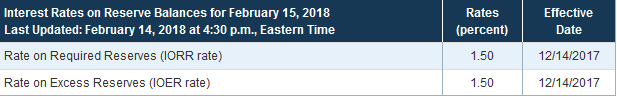

The Overnight Bank Funding Rate currently stands at 1.42%. Do not be confused. This rate is based on the interest rate on excess reserves (IOER rate), which is not the same as the interest rate on required reserves (IORR). Currently, both rates are the same, however (you can view both rates here)

If you're old like me, you remember when the rate was referred to as the fed funds rate. The name was changed when banks were given the ability to charge interest on reserves in 2008. Once this deal was made, the Fed started giving out "reserves" like candy in a scheme referred to as quantitative easing. Today, over $2.2 trillion sits in reserves at the Fed and we (the United States) are paying interest on all those reserves, both at the IOER and the IORR.

The overnight bank funding rate is reported every day. It will never be higher than the rate banks can get from leaving money at the Federal Reserve (IOER or the IORR).

Final thoughts: Every now and then I like to revisit this issue of rates. I hear people wondering if the Fed is going to raise rates and I wonder if they understand what's really going on. Ultimately, the real reason why the Fed is going to raise rates has very little to do with the state of the economy. And, the higher rates go, the more banks get paid. The issue for banks is that inflation is a four letter word. It means lenders will be paid back with less money. If you own $100,000 on your home, and the value of the dollar tanks by 50%, you still owe 100,000 of those dollars, but they're only worth $50,000. Inflation is great for borrowers. So, the game the Fed has to play is -- how do we make sure people still believe in the value of the dollar while raising rates? It has nothing to do with cooling off the economy.

The next article is about Deutsche Bank. The bank will have to pay $3.7 million to customers for misleading them about mortgage backed security prices. What's interesting to me is that this is supposed to be a fair settlement.

To settle the charges, Deutsche Bank agreed to reimburse customers the full amount of firm profits earned on any CMBS trades in which a misrepresentation was made. According to a payment schedule in the order, Deutsche Bank will distribute more than $3.7 million. Deutsche Bank also agreed to pay a $750,000 penalty. Solomon agreed to pay a $165,000 penalty and serve a 12-month suspension from the securities industry.

$3.7 million is nothing in the trading world. We are supposed to believe this is the full amount of the profits made? What's funny is that the SEC apparently believes it. They also think that a 12-month suspension from the securities industry and a $165K penalty is going to stop this kind of activity. The penalty is nothing compared to rewards, even if you do get caught.

Final thoughts: As I've said before, the SEC has been rendered toothless over the years. What's funny is that the very banks that gutted the SEC's power are asking for its protection against Bitcoin. Good luck with that.

As an extension of what's going on at the SEC gutting, I think it's interesting that the SECs budget request is 3.5% higher than it was last year.

In order to keep up with the rapid pace of technology advancement in the areas the SEC regulates, the request seeks a $45 million increase in funding for information technology enhancements to support the agency’s cybersecurity capabilities, risk and data analysis, enforcement and examinations, and automation of business processes. The fiscal year 2019 budget request level is a 3.5 percent increase over the fiscal year 2018 budget request of $1.602 billion.

The total request is for $1.658 billion.

On Monday, the SEC launched the Share Class Selection Disclosure Initiative (SCSD) to encourage self-reporting. The SEC has no way to enforce this really -- how can they enforce fiduciary responsibility when its antithetical to capitalism? So they've created a hotline to encourage self-reporting. This is also funny. Here's an excerpt that sums up the effort:

The Commission has long been focused on the conflicts of interest associated with mutual fund share class selection. Differing share classes facilitate many functions and relationships. However, investment advisers must be mindful of their duties when recommending and selecting share classes for their clients and disclose their conflicts of interest related thereto. In the past several years, the Commission has charged nine firms with failing to disclose these conflicts of interest. These actions included significant penalties against the investment advisers, and collectively returned millions of dollars to clients.

The reason this won't work is because there's no motivation to self-report. Advisers have to pay back all ill-gotten gains and admit to their customers that they mislead them, but the SEC won't impose a civil monetary penalty? C'mon.

Under the SCSD Initiative, the Enforcement Division will recommend standardized, favorable settlement terms to investment advisers that self-report that they failed to disclose conflicts of interest associated with the receipt of 12b-1 fees by the adviser, its affiliates, or its supervised persons for investing advisory clients in a 12b-1 fee paying share class when a lower-cost share class of the same mutual fund was available for the advisory clients. Among other things, for eligible advisers that participate in the SCSD Initiative, the Division will recommend settlements that will require the adviser to disgorge its ill-gotten gains and pay those amounts to harmed clients, but not impose a civil monetary penalty. The Division warns that it expects to recommend stronger sanctions in any future actions against investment advisers that engaged in the misconduct but failed to take advantage of this initiative.

*Final thoughts: Initiatives like this are the reason why the SEC is absolutely ineffective. *

Finally, the Fed issued their weekly report on oil prices. It says that a "large drop in demand expectations decreased oil prices significantly". As a trader of crude oil, I know that the price of crude oil has gone nowhere but up since the middle of last year so I find this pronouncement humorous. Please note that gas prices are a key part of inflation. In fact, the Fed/FOMC credit low inflation with declining oil prices. In other words, the Fed is actively trying to suppress the true price of oil because.

Final thoughts: The Fed's pronouncements are incongruent. The headline is the opposite of the points used to prove the point. The headline reads "Gas prices down", while the bullet points read, "Gas prices headed up." This is a classic case of someone being told what to say when they don't have the data to support the conclusion.