Hey Jessirealtors

If there's one thing I have an issue with is our ability to take a concept and repeat it to death and turn it into truth and everyone just goes along with it. One of the biggest lies and debt traps the world has ever known, probably even a Ponzi scheme is the idea of homeownership.

I've always been told by the older generation and plenty of people who don't understand the math that buying a home is an investment and the best one you can make, after looking at the path, it would be better for me to buy an apartment on at least a 10th story or higher and jump out the window just so I can get away from the level of stupidity being proliferated to the next generation.

Seriously the level of ignorance when it comes to real estate is so staggeringly high that I'm sure banks literally laugh every time an idiot walks in to apply for a home loan thinking how long will this sucker train last, I'm sure even they are impressed by how deep this propaganda has been driven into peoples heads.

Nominal vs inflation pricing

The common misconception among homeowners or prospective homeowners is the idea that your home goes up in value over time. Many real estate investors and those who have a vested interest in the sector perpetuate this myth.

Yes, the price goes up in nominal terms but that's a combination of the market funded by the greater fool and more lax banking regulations to keep a steady stream coming into the market and accessing debt as well as the level of inflation as the currency is debased each year.

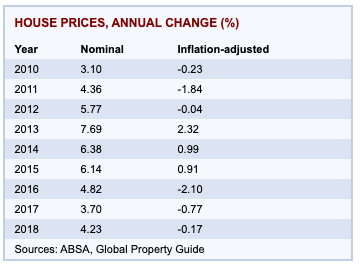

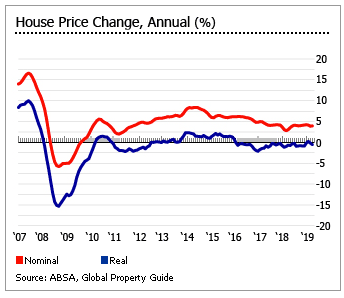

So while the absolute number of your home is worth more on paper, the measurement in which you measure your home does not hold its value. If we look at the stats for my country in South Africa if you compared nominal rates to inflation you can see that the value of a home purchasing power has, in fact, decreased for most of the years since 2010.

Image sources: - globalpropertyguide.com

So while you're paying off this home with your wages and trying to cover the interest and eat into the principal amount as your wages remain flat and your currency inflates, the item you bought is actually losing value/purchasing power.

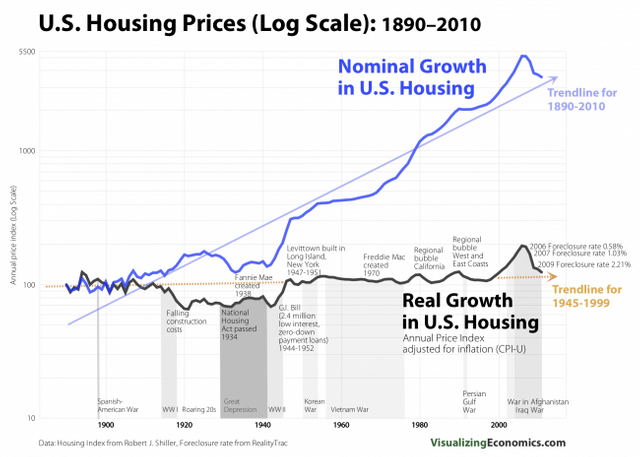

Image source: - visualizingeconomics.com

The same thing is happening in developed markets like the US and I'm pretty sure its the same around the world as they all follow the same playbook of property profiteering instead of production value. So we can see that home prices are mostly made up of inflation and not actual value and purchasing power.

The kicker here is your house may be valued at a certain price it doesn't mean you're going to get it once you try to sell it into the market, in addition, all the fees you pay to sell your home and in some cases have to fund to purchase the new one you're moving to will only leave you further in the hole.

Rent to value ratio

When looking to buy a home a good measurement is the RV value or rent to value ratio. This is the amount of rent you can collect per month for that property vs the value of the home.

When factoring in the home you want to purchase, the ideal RV ratio is 0.7 percent or higher, with 0.5 percent the bottom acceptable point.

To calculate an RV value lets look at an example.

A $200,000 property renting for

- $600, the RV ratio comes in at a dismal 0.3 percent.

- Increase the rent to $1000 and the ratio improves to the minimal 0.5 percent.

- Rent of $1400 yields an RV return of 0.7 percent

That sweet spot for a good return. That means the value of the home is in line with a level income you can use to compare to what you would pay for a mortgage (hopefully a fixed-rate one) and you can see if you're getting a good deal.

Source: jasonhartman.com

Make it a home, not a prison

Yes, I know people need a roof over their heads but it doesn't mean they need to hold a shotgun to their heads when buying one. It's a basic human need to have shelter I agree, but it doesn't mean you should sacrifice your entire life and future opportunities to own it, only to enrich a mortgage broker and some real estate developer.

As long as there is a steady supply of greater fools willing to sign 20 - 30 years of wages away, the Ponzi can keep going and until the market says this is a dumb deal and we're going to stop it won't. The moment people actually wake up and say no to the deal the quicker the Ponzi has to unravel and prices have to revert.

People have the power, they just chose to be uneducated and give it away rather than use it.

Have your say

What do you good people of STEEM think? Have you met or known a millionaire that has lost it all?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler

| Buy & sell STEEM | Donate LikeCoin For Free | Earn Interest On Crypto |

|---|---|---|

|

Do you know Where to exchange steem or steem $? I’ve been doing it on blocktrades but they took steem & steem $ down from there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure you can use Bittrex, Binance, Poloniex or Houbi and sell it there for BTC and then do what you want from there! Blocktrades was blocked by the witnesses in the lastest soft fork

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It doesn’t even let me make an account on Binance , I don’t know why.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is weird, but these exchanges are all dodgy as shit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Binance doesn’t even have steem on the list 😑

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Huobi doesnt have unites states on the list lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Where do you exchange steem?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have a Binance and Bittrex account and I've had it for ages! But if you're really stuck I'd say an easy option is to login to either

and sell it for BTC and send it to a wallet to cash out, just check that there are enough buy orders to fill yours

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It seems to me that you are absolutely right in your judgment that financial illiteracy in terms of investing is at an insanely high level. This is what prevents people from earning a lot of money, as it is simply necessary. They need to clearly understand and structure information about how to invest money correctly. After all, this is a very important ability - to be able to multiply your earned money. and not just leave them dead weight in bank accounts. Thanks to the 1031 real estate exchange service, I can competently invest in real estate and have passive income.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your scheme will work for someone confident in their finances. I sympathize with people who foolishly evaluate their ability to pay for real estate, but at the same time, I feel sorry for them. For some of them, such a stupid step seems like the last opportunity to get property. After all, maybe you can't know what will happen to your workplace tomorrow. At least that's how it was for me. It took me a long time to choose an affordable house and lot for myself, and I took the same long time with the purchase because I could lose my job due to Covid. I could no longer live with my parents, it was terrible. I was lucky with creditors and a new job, but not everyone is as lucky as me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit