Is history repeating itself?

Robert Shiller, of the famed Case-Shiller Real Estate Index, feels that is the case. He sees a lot of similarities between now and the last housing bubble from a decade ago.

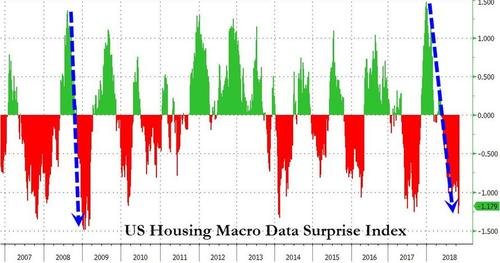

There are a lot of signs of weakness including a slowdown in construction and homes sitting on the market longer. Rising interest rates are pointed to as one of the causes. As the Fed tightens, homes become more expensive putting a wrench in the market.

This on top of a market that many believe was too extended after a 7 year run up due to historically low interest rates.

I’ve got cash for when the market crashes. I’m looking to buy up some rentals!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit