When seen from a global perspective, there are obvious property price differences between countries such as Nepal and Canada – or on a national level, between cities such as Detroit and New York City. Considering these differences, should it be considered good fiscal policy that a housing crash in one market should collapse other, unrelated markets? On a smaller scale, should the failure of a large property development down the street spoil the success of other developments which are selling their units successfully and contributing to the local community?

A common sense answer should be a resounding "no" yet the current drive to use token economics to fractionalize real estate is creating the same environment that led to the 2008 housing crisis, and could be creating something even worse.

At least during the housing crisis, which collapsed world markets and let to what experts have since called the "Great Recession," there were some barriers in place, due to the use of separate sovereign fiat currencies, such as the US Dollar and the Euro. Now, at the tail end of 2018, however, we've seen the birth of something which should be beautiful and transformative turn into what could potentially be a nightmare if left unchecked.

Tokenized real estate once offered the promise of allowing everyone to invest in small fractions of real estate as if it were publicly traded stock. Any member of a given community could then become a stakeholder to the businesses in one's own neighborhood and there could begin to form a virtuous circle by which everyone benefits from the proper stewardship of the land we live upon.

However, real estate tokenization projects began to (perhaps unsurprisingly) focus on how to make a quick buck. So-called blockchain innovators popped up and began using a single token to offer up fractionalized real estate investing, via a singular token, throughout the entire world. One token to rule them all!

The problem with this, however, is that when the next bubble bursts somewhere in the world, if there are a large number of properties using the same currency as a measure of value, the results could be catastrophic. If a bubble bursts in New York, London, or Shanghai, and real property in heavily tokenized throughout the world, it could bring down property prices on a global scale, sending markets spiraling downward at rates worse than the wildest crypto roller coasters of today.

Nonetheless, Golden Land has devised a way to avoid such a nightmarish result, and a method which could avoid smaller cases of collateral damage just as well. The answer is actually quite simple when taken at face value: don't create a singular token to fractionalize real estate throughout the world, but create a new standard – an entirely new ERC20-esque model whereby Golden Land enables a family of verified real-world assets to be provided their own coins upon our blockchain.

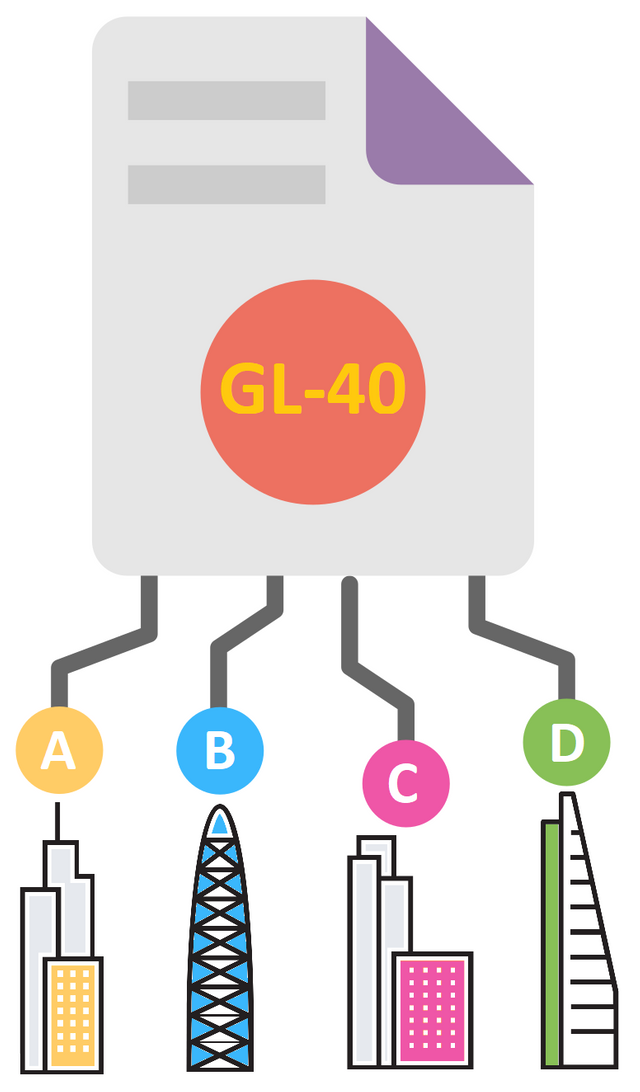

This is the beauty of what we've called the GL-40 standard, a system for verifying real property (via a type of DApp we've christened the "VApp", to be discussed in subsequent posts), and subsequently providing it a unique token upon our blockchain.

This enables an environment where not only are tokenized properties insulated from the collapse of a global token, but the price of Token A would be insulated from the collapse of Token B next door. Each token will instead reflect the dynamics of that given property, as if it were a market onto itself.

This is in fact what any large-scale property development is, if one takes the time to reconsider their preconceived notions of real estate. Imagine the building down the street from me, on New York's Roosevelt Island; it has a restaurant, a pharmacy, a synagogue, and a day care center on the ground floor, with the rest of the floors occupied by residential units. It is nothing short of an economy onto itself.

Any economy should have a currency pegged to the economic activity which takes place within its borders, and multiple layers of governance simply means that there might be multiple currencies to value different levels of economies, from global to hyper-local. A currency built upon the GL-40 chain will accurately measure the economic output within a particular building's walls, without any extraneous variables, which is what a hyper-local real estate token should do.

If you'd like to learn more about how real estate should be tokenized, and how we're building the foundations of the "tokenization of things" era, stay tuned for more.

By Ken Chester and The Golden Land Team