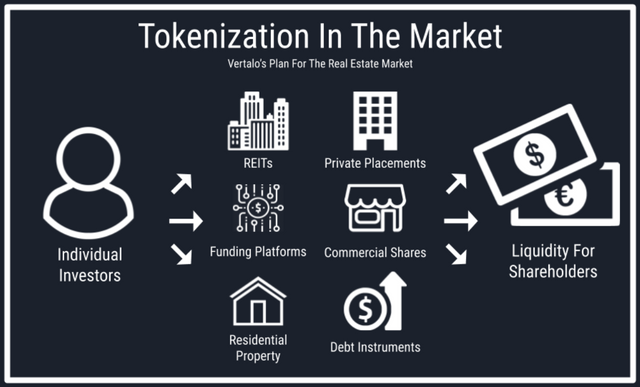

Digital real estate is an investment trend of the last few years. If you are considering this new market, this article is for you. Here we have collected a maximum of statistics and examples. Dry facts and nothing more. You draw your own conclusions.

Tokenized Real Estate Data

Let's move on straight to the numbers. Here are the main statistics about the tokenized real estate market from various sources.

- The tokenization of real estate assets is anticipated to reach $1 trillion by 2030, according to a Deloitte analysis. The Asia Pacific region is anticipated to lead the real estate tokenization industry, according to the report, mostly as a result of the growing uptake of blockchain technology in nations like China, Japan, and Singapore.

- The overall value of real estate that has been tokenized in 2020 was predicted to be $128 million, according to a SpringerOpen research.

- Real estate tokens experienced the fastest growth of the $16.4 billion market capitalization of the nascent tokenization industry from June 2021 to May 2022.

- The tokenized real estate market is currently worth over $200 million. The worldwide real estate market is estimated to be worth $317 trillion at present, thus a 0.5% share. However, there is huge potential for growth here.

- By 2025, the worldwide real estate tokenization market is expected to grow to a value of $1.5 billion, according to a report by ResearchAndMarkets.

Examples Of Tokenized Real Estate

Here are some examples of apartments and commercial properties that have been successfully tokenized.

- St. Regis Aspen Resort. In 2018, blockchain technology was used to tokenize a luxury hotel and condominium complex in Colorado, USA, allowing investors to purchase fractional ownership in the form of security tokens.

- Dallas Apartment Complex. In Dallas, a 250-unit multifamily apartment building has offered tokenized options to investors. For this $47 million project, the development business raised $6.5 million from investors.

- Salt Lake City Townhome Community. A multifamily townhome complex in Ogden, Utah, was tokenized with a $1,000 minimum investment and a target internal rate of return (IRR) of 16.8%.

- Hotel in Sapporo city. Kenedix, a Japanese real estate corporation, has announced the launch of its fifth digital security token, which is backed by a hotel in Sapporo City. So far, Yen 33 billion ($240 million) has been raised among the five buildings. According to Kenedix, the real estate security token industry will be worth Yen 2.5 trillion ($18 billion) by 2030.

How Profitable Can Tokenized Real Estate Be

The best way to answer this question is to give an example. The Home Key project promises up to 73% per annum for investments in real estate (depending on the term and package). This is significantly higher than the standard return on investment in real estate, which rarely exceeds 7-10%.

Additional benefits include diversification (the ability to buy shares in different objects instead of one object) and liquidity (it is much easier to sell digital assets than real ones).