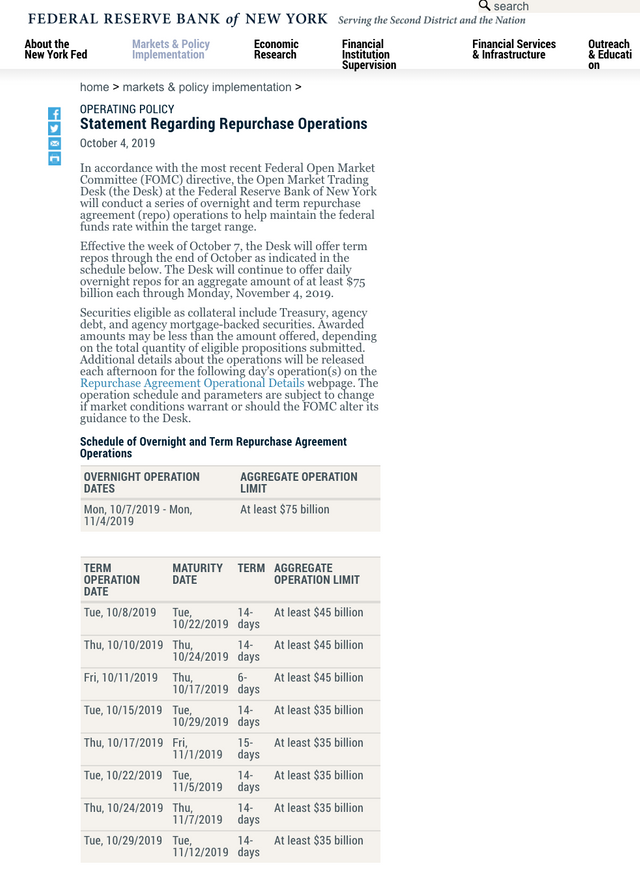

The big banks won’t lend to each because they don’t trust that they would get paid back even 24 hours later, so the Federal Reserve has had to start supplying cash up to 75 Billion (with a B) to keep the US banks afloat. It looks like the financial system will require such extreme measures at least until mid November.

Just in case you missed this EMERGENCY situation, which has been happening since the last two weeks of September after the overnight lending rate between banks hit 10% in the USA. Something like this has happened before at the start of the last GFC back In 2008, just a few days after Lehman Brothers went bankrupt, there was this same sort of intra-bank credit freeze.

It also happened in 2013 in China, when their rates jumped to 20% overnight probably due to bank failure, but the Central Bank of China was able to contain the situation and it did not spread to other countries and the rest of the world.

Here is a copy of the Federal Reserve’s latest announcement:

Reference

https://www.newyorkfed.org/markets/opolicy/operating_policy_191004

https://kenburridge.com/federal-reserve-usa-bank-bailout-begins/