Your in a relationship, you've been dating a number of years, you've found "The One", you move in together, shared expenses, now things start to get a bit tricky because in the back of your mind you feel like you're making a larger financial commitment than your other half. Time for a new approach.

Lets get some things clear, I'm talking about a situation where you crazy enough about your other half to prioritise your relationship over something as trivial as money, most couples have 3 different ways of approaching this (feel free to chip in if you have a unique way).

- Both parties in the relationship will keep seperate funds, and each cover a portion of the expenses more or less evening out at the end of the month.

- A joint account will be created where each party would contribute an agreed value which would be enough to cover bills and other joint expenses

- Both incomes will go into one pot (joint account), and any expenses throughout the month would be taken from the pot including personal expenses.

If you approach you relationships finances in 1 of the above ways let me share some of the flaws I've come to realise with each of these approaches.

Having your own private money in your relationship sounds great in theory, I mean you've worked hard for your income each month so you deserve it all, obviously you will cover your end of the expenses, but what tends to happen is once you are both aware of each others income is that there is some inequality built up, we find that when doing things together like going out to a restaurant or a movie an expectation is built up towards the higher earner, this is not necessarily a bad thing at all except that when you do want to treat your other half there's an inherent higher value of "relationship credit" for the lower earner and a lower value of "relationship credit" for the higher earner. This can start to cause a type of friction when the person who always pays begins to feel obliged to rather than bestowing.

This same situation occurs in any of the above approaches as long as the disposable income of the 2 parties are not equal.

Who cares about money? just put everything together and all expenses can be managed from one account, yeah sure this works but from my experience there is a better method, problem with this method is when all your monies are in one big pot together how do birthday presents work? lets say my other half decided to buy me a new 4K HD TV and spends the best part of a grand on this gift, if its coming out of the same account we both manage its going to be very obvious how much she spent and would I even appreciate such an expense from an account even though it was my birthday, technically I paid some of the TV and I felt it as soon as I saw the money leave the account.

The only way any gesture which carries any sort of cost will be appreciated equally from either party are when both parties would have had equal stake and the gesture itself is what pushes the balance.

The way this is done is simple:

- Create a joint account

- Each of you move your entire salary into that joint account

- Create your budget (I used to use excel, but then came accross this wonderful bit of software which allows both of us to input joint expenses into the budget using our phones at any time https://www.youneedabudget.com/)

- From the Joint account, on the 1st of each month pay an equal "salary" to each of your personal accounts ( 6% each is a good start )

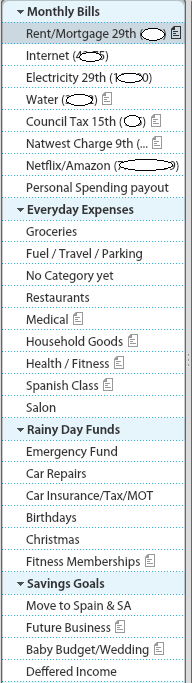

now what you have is a budgeting software application kept up to date which can contain any number of catagories (heres an example)

The rules of budgeting here are to assign every bit of income to a category, even if you dont have a category yet create a Miscellaneous category, you'll soon start separating transactions out into categories that make more sense.

This will give you the peace of mind that your monthly expenses are all allocated already, what you dont spend this month carries over to next month in their respective catagories and most importantly you still have your own money which you can either choose to save, blow on new toys, Buy Crytptocurrencies or spend on your partner, choosing to spend this money on your partner whether it be a treat, a fancy dinner or a surprise gift will carry so much more value as there can no longer be any attached expectation for the higher income earner.

And if you decide that 6% isn't enough, discuss and agree upon a more satisfactory value.

At the end of the day it boils down to trust, if you are both working towards a common goal and a healthy relationship its making sure the little things never build up to big things that might risk bringing any unnecessary additional stress to your relationship in future.

Hopefully I've explained myself well enough to make sense, its my personal experience from being through a number of long term relationships and finally finding something that works really really well and sharing it with your in case you wanted to give it a try for yourself.

Until next time.

I like your idea a lot. Thanks for sharing. I have always been against a joint account and in favor of having two seperate ones and each party paying an amount into the joint one to cover expenses. I never thought of the downside of that. Thanks again.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Happy I could help, I've been in situations in previous relationships where i landed up paying for most things as i was earning more, it was automatic but it did give me some resentment, especially when i looked closer at my finances and realised just how much i was paying, i didnt feel like we both contributed in the same way. When my wife and i moved in together we sat down and had a discussion about the subject of finances, and we came up with this, haven't regretted it yet. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A question: maybe I misunderstood it in the essay! So you both pay your salary into one joint account and then each of you gets x% transfered to their own personal account? Doesnt Person A, that earns more think its unfair that Person B gets the same amount for their own personal leisure usage? How is it different from Person A paying for most things like in your example with your previous relationships, to the solution you suggest, since i suppose Person A ends up paying for more joint expenses and gets out as much into their leisure account as Person B? I hope you understand my questions :) Thanks again.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good Question, and sure there is a risk that person A might feel like they contributing more as they are earning more but what u have in the joint account is managed money, so its a little different than person A having to pay the check each time and person B not realising that it adds up to alot as he/she has no visibility of your personal expenses. You working on a conmon goal and u can watch your net worth grow each month while u save for that house. Also the higher earner doesn't really feel like their salary belongs to them as its the disposable income that really counts. When u see the joint account balance grow each month from good budgeting i promise you that you'll both be smiling. I earn nearly double to what my wife earns and i let her balance the joint account each month to make sure that we've recorded all the joint expenses through the month. Of course she could take it all and run. Lol. But it was never about the money. Happy to answer any more questions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome. Thanks so much for clarifying. If i have more question, i will make sure to drop them here :) Thanks again. This post will help me and my partner a lot in the future :) Have a good day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like this, thanks for sharing will defo come back to this again in the future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit